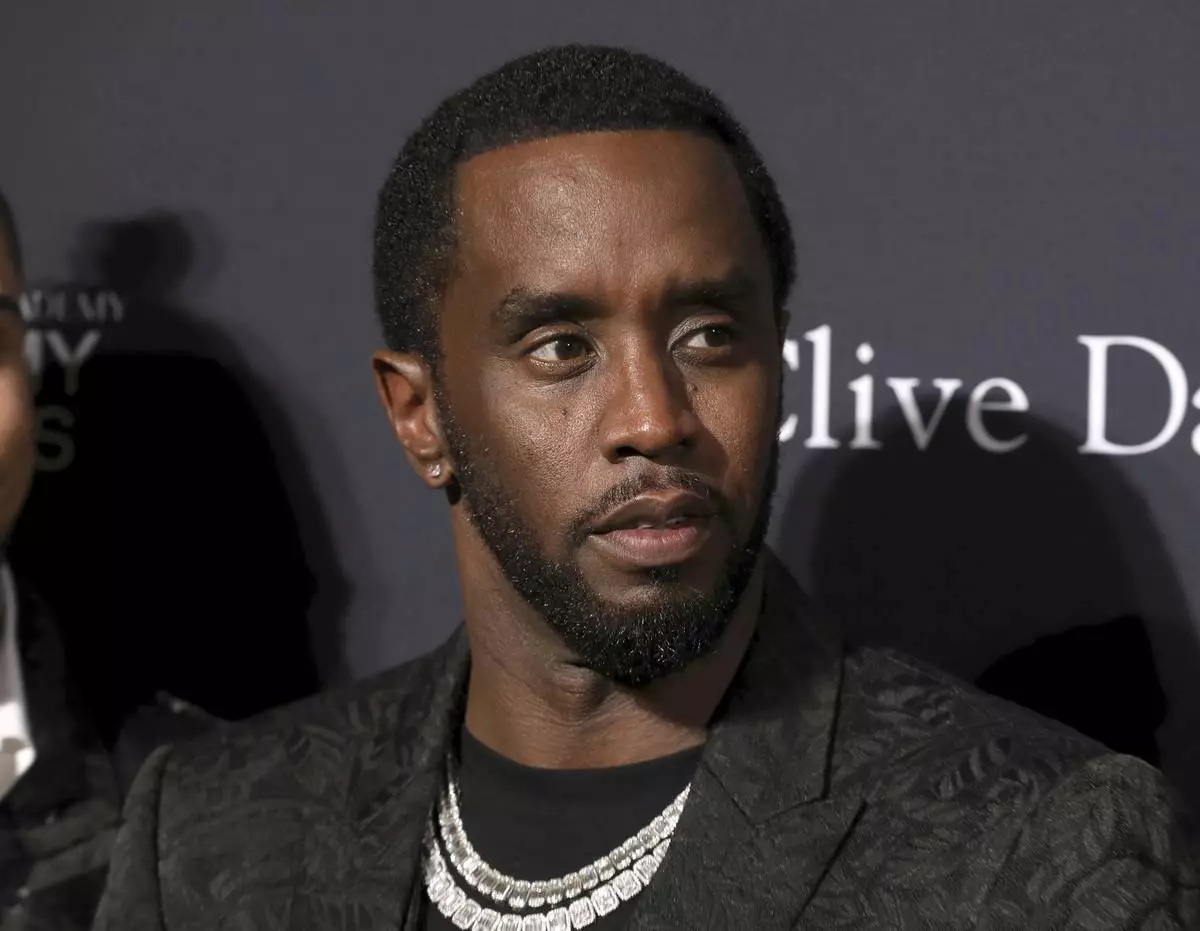

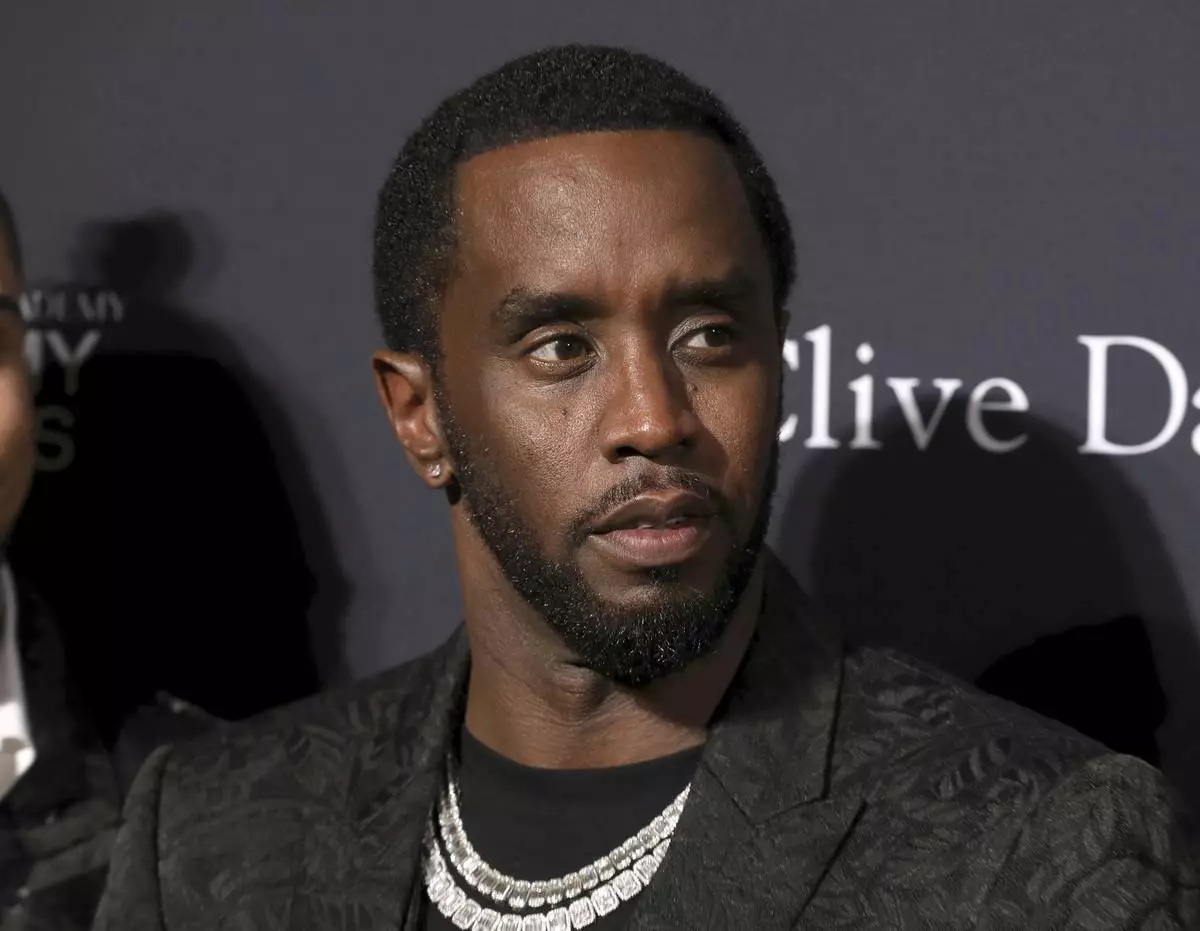

NEW YORK (AP) — Attorneys for hip-hop producer Sean “Diddy” Combs asked a federal judge in New York on Wednesday to delay his May 5 sex-trafficking trial by two months so they can better prepare a defense.

The lawyers said in a letter to Judge Arun Subramanian that prosecutors have been slow to turn over some potential evidence for review, making it difficult to be ready in three weeks.

Prosecutors oppose the request, the lawyers said. A spokesperson for prosecutors declined comment.

Subramanian wrote in an order responding to the delayed-trial request that he will address the issue during a hearing scheduled for Friday.

Pending the conference, the judge wrote, both sides should proceed as if the early May trial remains in place.

Combs, 55, has been held without bail since his September arrest. He has pleaded not guilty to multiple crimes that prosecutors say occurred over a two-decade period.

In their letter, defense lawyers cited a failure by prosecutors to turn over potential trial evidence in a timely matter, including materials relating to a superseding indictment returned by a grand jury earlier this month.

For instance, the lawyers wrote, prosecutors have said they will not meet a Wednesday deadline to turn over exhibits and a witness list.

Some evidence yet to be turned over includes materials related to a count in the indictment that carries a 15-year mandatory minimum prison sentence if a conviction is secured, the lawyers said.

As a result, they wrote: “We cannot, in good conscience, go to trial on the scheduled date.”

They added: “This is a problem that the government has created, yet it opposes our reasonable request.”

Prosecutors say Combs coerced and abused women for years as he used his “power and prestige” as a music star to enlist a network of associates and employees to help him while he silenced victims through blackmail and violence, including kidnapping, arson and physical beatings.

FILE - Sean Combs arrives at the Pre-Grammy Gala And Salute To Industry Icons at the Beverly Hilton Hotel on Saturday, Jan. 25, 2020, in Beverly Hills, Calif. (Photo by Mark Von Holden/Invision/AP, File)

NEW YORK (AP) — Wall Street closed higher and reached more records Wednesday on a holiday-shortened trading day.

The S&P 500 index rose 22.26 points, or 0.3%, to 6,932.05. The Dow Jones Industrial Average added 288.75, or 0.6%, to close at 48,731.16, and the Nasdaq composite added 51.46, or 0.2%, to 23,613.31

Trading was extremely light as markets closed early for Christmas Eve and will be closed for Christmas Thursday. Roughly 1.8 billion shares traded on the New York Stock Exchange on Wednesday, which is roughly a third of the average trading day.

Markets will reopen for a full day of trading on Friday; however volumes are expected to remain light this week with most investors having closed out their positions for the year.

The S&P 500 is up more than 17% this year, as investors have embraced the deregulatory policies of the Trump administration and been optimistic about the future of artificial intelligence in helping boost profits for not only technology companies but also for Corporate America. Some of the strongest performers this year include Nvidia and Micron Technologies, both companies that make chips or other components that power the proliferation of data centers across the country.

Much of the focus for investors for the next few weeks will be on where the U.S. economy is heading and where the Federal Reserve will move interest rates. Investors are betting the Fed will hold steady on interest rates at its January meeting.

The U.S. economy grew at a surprisingly strong 4.3% annual rate in the third quarter, the most rapid expansion in two years, driven by consumers who continue to spend in the face of ongoing inflation. There have also been recent reports showing shaky confidence among consumers worried about high prices. The labor market has been slowing and retail sales have weakened.

The number of Americans applying for unemployment benefits fell last week and remain at historically healthy levels despite some signs that the labor market is weakening.

U.S. applications for jobless claims for the week ending Dec. 20 fell by 10,000 to 214,000 from the previous week’s 224,000, the Labor Department reported Wednesday. That’s below the 232,000 new applications forecast of analysts surveyed by the data firm FactSet.

Dynavax Technologies soared 38.2% after Sanofi said it was acquiring the California-based vaccine maker in a deal worth $2.2 billion. The French drugmaker will add Dynavax’s hepatitis B vaccines to its portfolio, as well as a shingles vaccine that is still in development.

Novo Nordisk's shares rose 1.8% after the weight-loss drug company got approval from U.S. regulators for a pill version of its blockbuster drug Wegovy. However, Novo Nordisk shares are still down almost 40% this year as the company has faced increased competition for weight-loss medications, particularly from Eli Lilly. Shares of Eli Lilly are up 40% this year.

European markets moved between slight gains and losses. Asian markets were also quiet, with Hong Kong moving up 0.2% while Japan’s Nikkei 225 fell 0.1%

Gold prices were flat at $4,502 an ounce, and silver rose 0.8% to $71.69. U.S. crude oil was flat at $58.38 a barrel.

Derek Orth works on the floor at the New York Stock Exchange in New York, Wednesday, Dec. 10, 2025. (AP Photo/Seth Wenig)

A board above the trading floor of the New York Stock Exchange displays the closing number for the Dow Jones industrial average, Thursday, Dec. 11, 2025. (AP Photo/Richard Drew)

Anthony Matesic works on the floor at the New York Stock Exchange in New York, Wednesday, Dec. 10, 2025. (AP Photo/Seth Wenig)

A person stands in front of an electronic stock board showing Japan's Nikkei index at a securities firm Monday, Dec. 22, 2025, in Tokyo. (AP Photo/Eugene Hoshiko)

FILE - A screen displays financial news as traders work on the floor at the New York Stock Exchange in New York, Thursday, April 3, 2025. (AP Photo/Seth Wenig, File)

A person walks in front of a chart showing Japan's Nikkei index at a securities firm Friday, Dec. 19, 2025, in Tokyo. (AP Photo/Eugene Hoshiko)