CHICAGO (AP) — Luis Robert Jr. drove in three runs in his return to the lineup, and the Chicago White Sox beat the Kansas City Royals 7-2 on Friday night.

Mike Tauchman homered to help the last-place White Sox to their third win in four games. Davis Martin struck out seven while pitching six innings of two-run ball.

Click to Gallery

Chicago White Sox catcher Kyle Teel (8), left, and first baseman Tim Elko (30) celebrate their team's win over the Kansas City Royals in a baseball game Friday, June 6, 2025, in Chicago. (AP Photo/Erin Hooley)

Kansas City Royals starting pitcher Seth Lugo (67) throws against the Chicago White Sox during the first inning of a baseball game, Friday, June 6, 2025, in Chicago. (AP Photo/Erin Hooley)

Kansas City Royals' Maikel Garcia (11) celebrates his home run during the third inning of a baseball game against the Chicago White Sox, Friday, June 6, 2025, in Chicago. (AP Photo/Erin Hooley)

Chicago White Sox catcher Kyle Teel (8), left, celebrates with pitcher Jordan Leasure (49) after catching a pop out from Kansas City Royals' Salvador Perez (13) during the eighth inning of a baseball game Friday, June 6, 2025, in Chicago. (AP Photo/Erin Hooley)

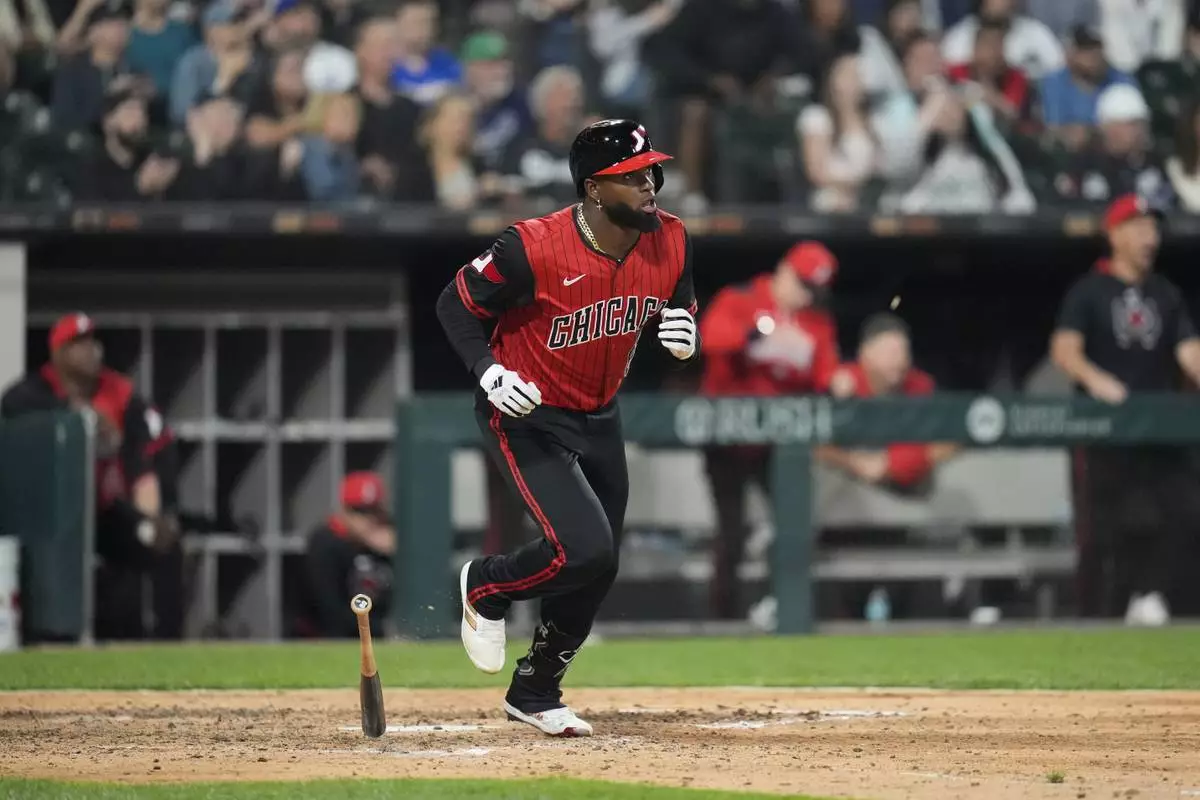

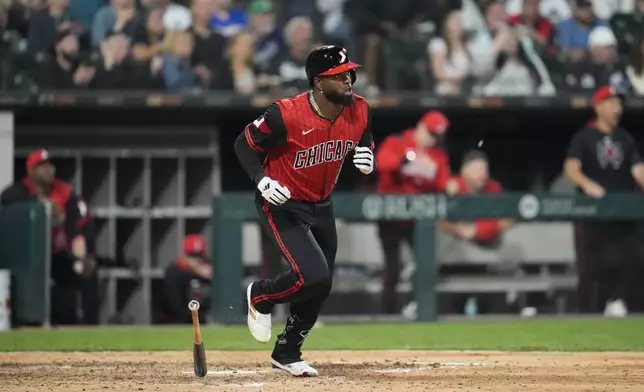

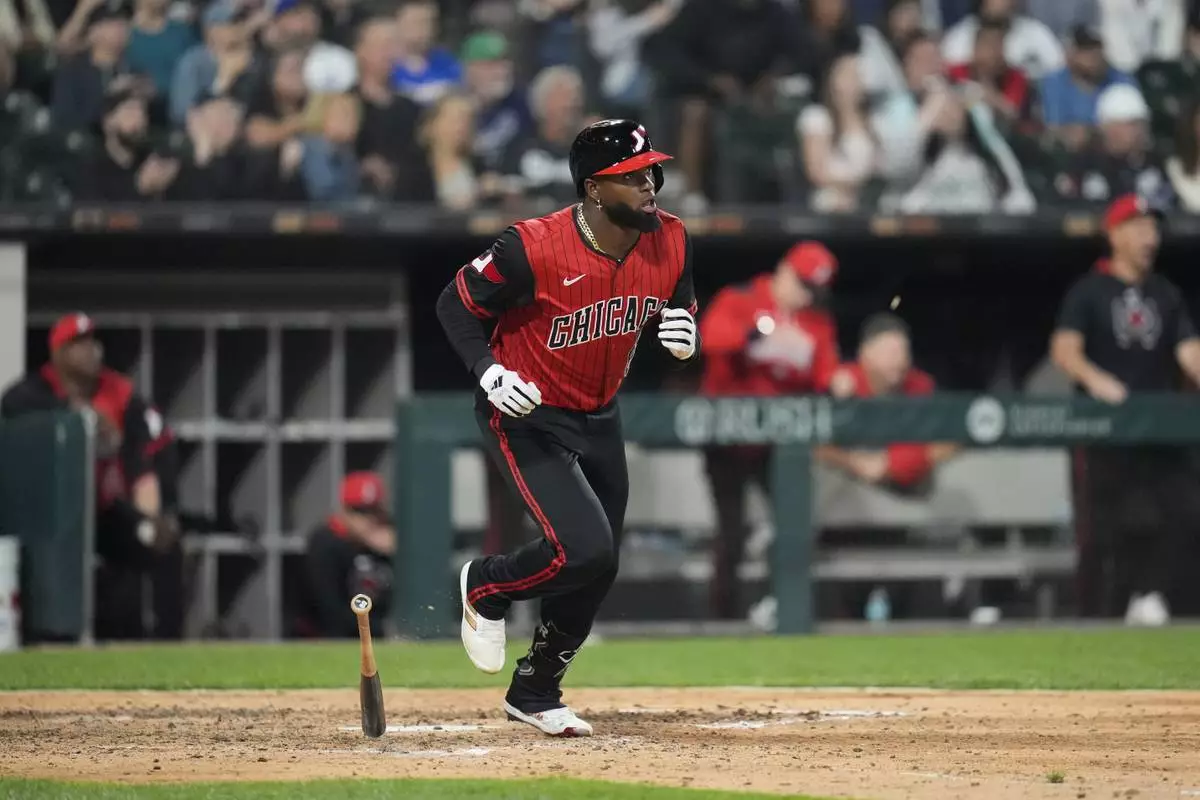

Chicago White Sox's Luis Robert Jr. (88) hits a two-run single during the eighth inning of a baseball game against the Kansas City Royals, Friday, June 6, 2025, in Chicago. (AP Photo/Erin Hooley)

White Sox catcher Kyle Teel, one of baseball's top prospects, went 1 for 2 with two walks and scored a run in his major league debut.

Robert hit a tiebreaking two-run single in Chicago's five-run eighth inning. He also had a run-scoring single in the second.

It was Robert's first game since Monday. The slumping slugger has been working on some adjustments at the plate, and he got an extra day after he was struck on his head by a ball in the batting cage.

The White Sox beat the Royals for the second time in the last 20 matchups.

Maikel Garcia and Vinnie Pasquantino hit back-to-back homers for Kansas City with two out in the third inning. It was the seventh of the season for Garcia, and No. 9 for Pasquantino.

Tauchman tied it at 2 when he connected against Seth Lugo in the fifth.

The White Sox loaded the bases with one out in the eighth, and Robert drove in pinch-runner Michael A. Taylor and Austin Slater with a bloop single to right against Jonathan Bowlan (1-1).

Teel scored on Taylor Clarke’s wild pitch, and errors on third baseman Garcia and Clarke brought home two more runs.

Jordan Leasure (1-4) pitched an inning for the win.

Royals rookie Jac Caglianone went 0 for 4. He is 1 for 17 in his first four games.

Leasure walked Jonathan India and Bobby Witt Jr. singled as Kansas City put the first two on in the eighth. Teel pounced on a bunt by Garcia and got the first out at third. Witt took third on a fielder’s choice before Salvador Perez fouled out, ending the inning.

The Royals swept a four-game home series with the White Sox from May 5-8 and outscored them 19-4. Chicago leads the all-time series 440-434.

Royals right-hander Michael Wacha (3-4, 2.88 ERA) starts Saturday against White Sox right-hander Adrian Houser (1-1, 1.47 ERA).

AP MLB: https://apnews.com/hub/mlb

Chicago White Sox catcher Kyle Teel (8), left, and first baseman Tim Elko (30) celebrate their team's win over the Kansas City Royals in a baseball game Friday, June 6, 2025, in Chicago. (AP Photo/Erin Hooley)

Kansas City Royals starting pitcher Seth Lugo (67) throws against the Chicago White Sox during the first inning of a baseball game, Friday, June 6, 2025, in Chicago. (AP Photo/Erin Hooley)

Kansas City Royals' Maikel Garcia (11) celebrates his home run during the third inning of a baseball game against the Chicago White Sox, Friday, June 6, 2025, in Chicago. (AP Photo/Erin Hooley)

Chicago White Sox catcher Kyle Teel (8), left, celebrates with pitcher Jordan Leasure (49) after catching a pop out from Kansas City Royals' Salvador Perez (13) during the eighth inning of a baseball game Friday, June 6, 2025, in Chicago. (AP Photo/Erin Hooley)

Chicago White Sox's Luis Robert Jr. (88) hits a two-run single during the eighth inning of a baseball game against the Kansas City Royals, Friday, June 6, 2025, in Chicago. (AP Photo/Erin Hooley)

NEW YORK (AP) — Reviving a campaign pledge, President Donald Trump wants a one-year, 10% cap on credit card interest rates, a move that could save Americans tens of billions of dollars but drew immediate opposition from an industry that has been in his corner.

Trump was not clear in his social media post Friday night whether a cap might take effect through executive action or legislation, though one Republican senator said he had spoken with the president and would work on a bill with his “full support.” Trump said he hoped it would be in place Jan. 20, one year after he took office.

Strong opposition is certain from Wall Street in addition to the credit card companies, which donated heavily to his 2024 campaign and have supported Trump's second-term agenda. Banks are making the argument that such a plan would most hurt poor people, at a time of economic concern, by curtailing or eliminating credit lines, driving them to high-cost alternatives like payday loans or pawnshops.

“We will no longer let the American Public be ripped off by Credit Card Companies that are charging Interest Rates of 20 to 30%,” Trump wrote on his Truth Social platform.

Researchers who studied Trump’s campaign pledge after it was first announced found that Americans would save roughly $100 billion in interest a year if credit card rates were capped at 10%. The same researchers found that while the credit card industry would take a major hit, it would still be profitable, although credit card rewards and other perks might be scaled back.

About 195 million people in the United States had credit cards in 2024 and were assessed $160 billion in interest charges, the Consumer Financial Protection Bureau says. Americans are now carrying more credit card debt than ever, to the tune of about $1.23 trillion, according to figures from the New York Federal Reserve for the third quarter last year.

Further, Americans are paying, on average, between 19.65% and 21.5% in interest on credit cards according to the Federal Reserve and other industry tracking sources. That has come down in the past year as the central bank lowered benchmark rates, but is near the highs since federal regulators started tracking credit card rates in the mid-1990s. That’s significantly higher than a decade ago, when the average credit card interest rate was roughly 12%.

The Republican administration has proved particularly friendly until now to the credit card industry.

Capital One got little resistance from the White House when it finalized its purchase and merger with Discover Financial in early 2025, a deal that created the nation’s largest credit card company. The Consumer Financial Protection Bureau, which is largely tasked with going after credit card companies for alleged wrongdoing, has been largely nonfunctional since Trump took office.

In a joint statement, the banking industry was opposed to Trump's proposal.

“If enacted, this cap would only drive consumers toward less regulated, more costly alternatives," the American Bankers Association and allied groups said.

Bank lobbyists have long argued that lowering interest rates on their credit card products would require the banks to lend less to high-risk borrowers. When Congress enacted a cap on the fee that stores pay large banks when customers use a debit card, banks responded by removing all rewards and perks from those cards. Debit card rewards only recently have trickled back into consumers' hands. For example, United Airlines now has a debit card that gives miles with purchases.

The U.S. already places interest rate caps on some financial products and for some demographics. The Military Lending Act makes it illegal to charge active-duty service members more than 36% for any financial product. The national regulator for credit unions has capped interest rates on credit union credit cards at 18%.

Credit card companies earn three streams of revenue from their products: fees charged to merchants, fees charged to customers and the interest charged on balances. The argument from some researchers and left-leaning policymakers is that the banks earn enough revenue from merchants to keep them profitable if interest rates were capped.

"A 10% credit card interest cap would save Americans $100 billion a year without causing massive account closures, as banks claim. That’s because the few large banks that dominate the credit card market are making absolutely massive profits on customers at all income levels," said Brian Shearer, director of competition and regulatory policy at the Vanderbilt Policy Accelerator, who wrote the research on the industry's impact of Trump's proposal last year.

There are some historic examples that interest rate caps do cut off the less creditworthy to financial products because banks are not able to price risk correctly. Arkansas has a strictly enforced interest rate cap of 17% and evidence points to the poor and less creditworthy being cut out of consumer credit markets in the state. Shearer's research showed that an interest rate cap of 10% would likely result in banks lending less to those with credit scores below 600.

The White House did not respond to questions about how the president seeks to cap the rate or whether he has spoken with credit card companies about the idea.

Sen. Roger Marshall, R-Kan., who said he talked with Trump on Friday night, said the effort is meant to “lower costs for American families and to reign in greedy credit card companies who have been ripping off hardworking Americans for too long."

Legislation in both the House and the Senate would do what Trump is seeking.

Sens. Bernie Sanders, I-Vt., and Josh Hawley, R-Mo., released a plan in February that would immediately cap interest rates at 10% for five years, hoping to use Trump’s campaign promise to build momentum for their measure.

Hours before Trump's post, Sanders said that the president, rather than working to cap interest rates, had taken steps to deregulate big banks that allowed them to charge much higher credit card fees.

Reps. Alexandria Ocasio-Cortez, D-N.Y., and Anna Paulina Luna, R-Fla., have proposed similar legislation. Ocasio-Cortez is a frequent political target of Trump, while Luna is a close ally of the president.

Seung Min Kim reported from West Palm Beach, Fla.

President Donald Trump arrives on Air Force One at Palm Beach International Airport, Friday, Jan. 9, 2025, in West Palm Beach, Fla. (AP Photo/Julia Demaree Nikhinson)

FILE - Visa and Mastercard credit cards are shown in Buffalo Grove, Ill., Feb. 8, 2024. (AP Photo/Nam Y. Huh, File)