TOPEKA, Kan.--(BUSINESS WIRE)--Jun 10, 2025--

Security Benefit today announced the addition of index accounts based on three new indices to its flagship fixed index annuity (FIA), Foundations Annuity. The new indices represent international, technology, and small cap segments, as well as a simple Trigger Rate strategy benchmarked against the S&P 500 ®. With these new options, Foundations now features 15 different index-linked accounts featuring equities, bonds, commodities, and Treasury asset classes that allow advisors to align with their economic and market outlook.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250610638044/en/

“More asset classes means more ways to mirror your managed money strategies within the safety of an FIA,” said Toby Leonard, AVP, Product Development at Security Benefit. “Diversification is key to a client’s long-term asset mix. With Foundations, advisors can derisk portfolios by taking market loss off the table, allow for tax-deferred accumulation, and prepare for multiple scenarios with a protection-based product.”

The global economic environment appears stable, though near-term risks remain. However, current trends could drive accelerated growth in markets over time: artificial intelligence, data center build-outs, reshoring of manufacturing, pharmaceutical development, space programs, and more. To tap into this long-term potential, Security Benefit added index accounts based on three well-known indices, each featuring an Annual Point to Point Index Account with a Cap:

MSCI EAFE

The MSCI EAFE Index is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the US and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

Nasdaq-100®

The Nasdaq-100 Index (NDX®) represents 100 of the largest, most dynamic non-financial companies listed on the Nasdaq Stock Market and some of the most innovative companies in the world. These companies are selected based on market capitalization and are renowned for their innovation, market leadership, and growth potential. NDX includes major players across various sectors such as technology, healthcare, consumer goods, and industrials, making it a comprehensive benchmark for growth-focused investors.

Russell 2000® Small Cap

The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 7% of the total market capitalization of that index, as of the most recent reconstitution. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

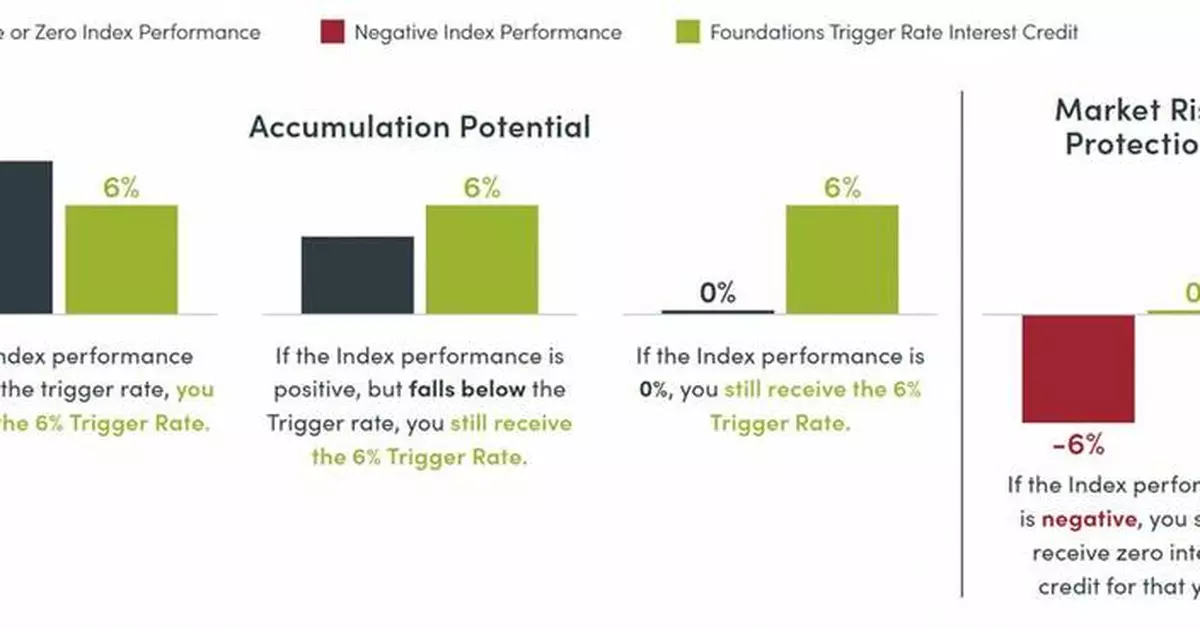

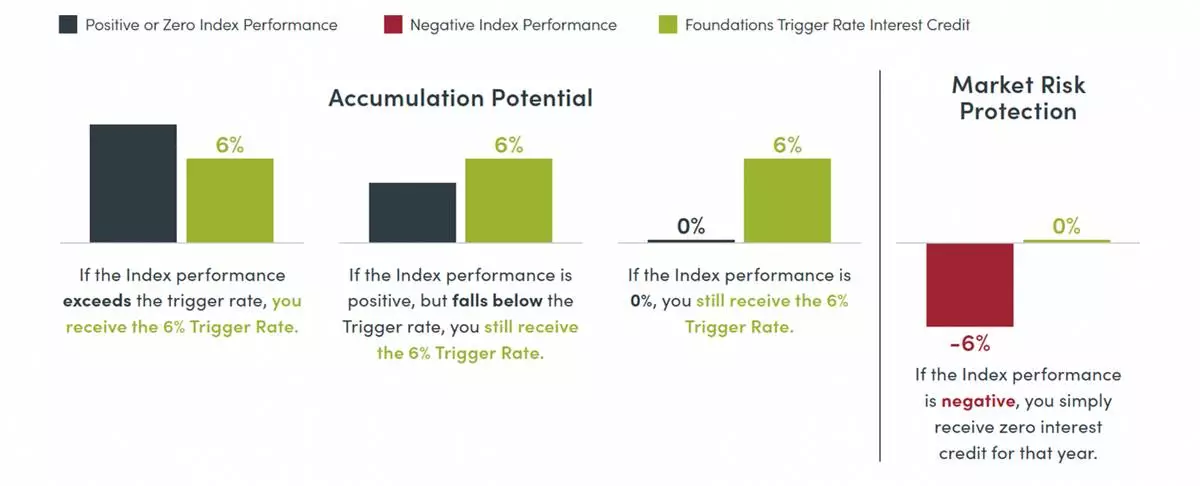

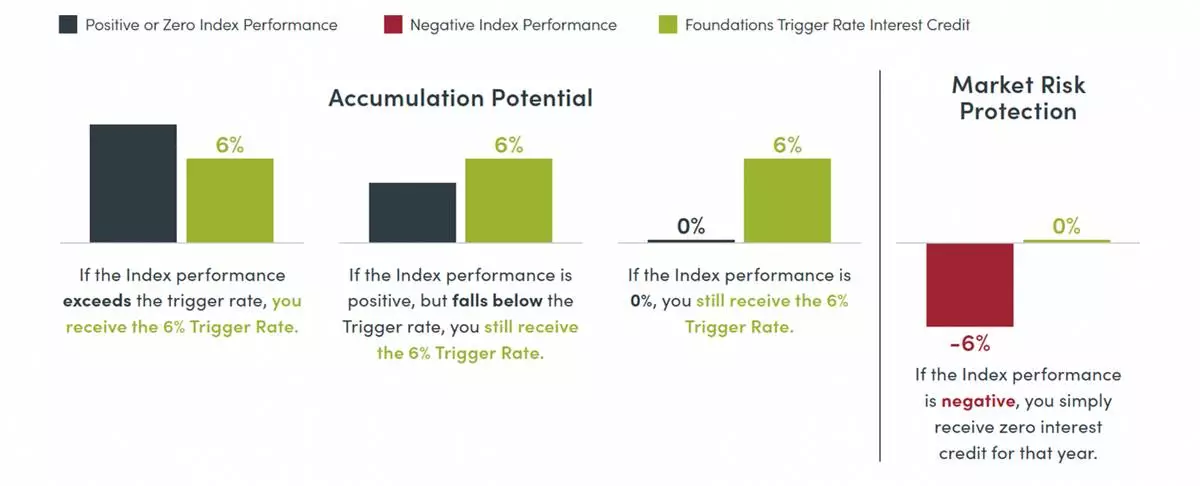

Trigger Rate Strategy*

Additionally, Security Benefit has added a straightforward crediting strategy for clients benchmarked against the S&P 500. With the new Annual Point to Point Trigger Rate strategy, a Trigger Rate is established at term (6% is used as an example in the graph), and Index performance of 0% or higher credits the stated Trigger rate.

“Now, with the addition of these four new strategies, advisors have more asset classes from which to diversify clients’ allocations within Foundations, with none of the associated market risk,” added Leonard.

For more information: SecurityBenefit.com/Diversify

About Security Benefit

SBL Holdings, Inc. (“Security Benefit”), through its subsidiary Security Benefit Life Insurance Company (SBLIC), a Kansas-domiciled insurance company that has been in business for 133 years, is a leader in the U.S. retirement market. Security Benefit together with its affiliates offers products in a full range of retirement markets and wealth segments for employers and individuals and held $55.1 billion in assets under management as of December 31, 2024. Security Benefit, an Eldridge Industries business, continues its mission of helping Americans To and Through Retirement ®. Learn more at www.securitybenefit.com and follow us on LinkedIn, Facebook, and X.

SB-10064-29

FINANCIAL PROFESSIONAL USE ONLY - NOT FOR USE WITH CONSUMERS

Annuities are issued by SBLIC in all states except New York.

*The S&P 500 Annual Point to Point Index Account with Trigger Rate may not be available in all states. Visit SecurityBenefit.com for details.

Security Benefit Life Insurance Company is not a fiduciary and the information provided is not intended to be investment advice. This information is general in nature and intended for use with the general public. For additional information, including any specific advice or recommendations, please visit with your financial professional.

The Security Benefit Foundations Annuity, form 5800 (11-10) and ICC10 5800 (11-10), a fixed index flexible premium deferred annuity, is issued by Security Benefit Life Insurance Company. Product features, limitations, and availability may vary by state. In Idaho, Foundations is issued on form ICC10 5800 (11-10).

Guarantees provided by annuities are subject to the financial strength of the issuing insurance company. Annuities are not FDIC or NCUA/NCUSIF insured; are not obligations or deposits of and are not guaranteed or underwritten by any bank, savings and loan, or credit union or its affiliates; and are unrelated to and not a condition of the provision or term of any banking service or activity.

Fixed index annuities are not stock market investments and do not directly participate in any equity, bond, other security, or commodities investments. Neither an index nor any fixed index annuity is comparable to a direct investment in the equity, bond, other security, or commodities markets.

S&P Dow Jones Indices Disclaimer: The “S&P 500,” “S&P 500 Low Volatility Daily Risk Control 5% Index,” “S&P Multi-Asset Risk Control (MARC) 5% Index,” and “S&P 500 Factor Rotator Daily RC2 7% Index” are products of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and have been licensed for use by Security Benefit Life Insurance Company (SBL). S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”), and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by SBL. The Foundations Annuity is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of purchasing the Foundations Annuity nor do they have any liability for any errors, omissions, or interruptions of the above named indices.

Nasdaq-100® Disclaimer: Nasdaq®, Nasdaq-100®, Nasdaq-100 Index®, and NDX® are registered trademarks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by Security Benefit Life Insurance Company The Product(s) have not been passed on by the Corporations as to their legality or suitability. The Product(s) are not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE PRODUCT(S).

Russell 2000® Disclaimer: The Foundations Annuity (the “Product”) has been developed solely by Security Benefit Life Insurance Company. The Product is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a trading name of certain of the LSE Group companies. All rights in the Russell® 2000 (the “Index”) vest in the relevant LSE Group company which owns the Index. “Russell®” is a trade mark(s) of the relevant LSE Group company and is/ are used by any other LSE Group company under license. The Index is calculated by or on behalf of FTSE International Limited or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the Index or (b) investment in or operation of the Product. The LSE Group makes no claim, prediction, warranty or representation either as to the results to be obtained from the Product or the suitability of the Index for the purpose to which it is being put by Security Benefit Life Insurance Company.

MSCI Disclaimer: The MSCI indexes are the exclusive property of MSCI Inc. (“MSCI”). MSCI and the MSCI index names are service mark(s) of MSCI or its affiliates and have been licensed for use for certain purposes by Security Benefit Life Insurance Company. The financial products referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such financial products or any index on which such financial products are based. The annuity contract contains a more detailed description of the limited relationship MSCI has with Security Benefit Life Insurance Company and any relevant financial products. No purchaser, seller or holder of this product, or any other person or entity, should use or refer to any MSCI trade name, trademark or service mark to sponsor, endorse, market or promote this product without first contacting MSCI to determine whether MSCI’s permission is required. Under no circumstances may any person or entity claim any affiliation with MSCI without the prior written permission of MSCI.

Security Benefit bolsters its flagship Foundations Annuity with New Indices and Index Accounts