NEW YORK (AP) — Stocks rose in afternoon trading on Wall Street Monday at the start of what’s expected to be a quiet holiday week.

The S&P 500 rose 0.6% and is just below the all-time high it set earlier this month. The Dow Jones Industrial Average rose 267 points, or 0.6%, as of 12:01 p.m. Eastern time. The Nasdaq composite climbed 0.6%.

The broader market eked out a slight gain last week in what has been a choppy month. Technology companies, especially those focused on artificial intelligence, have been the main force behind the market's oscillations. The direction of AI-related stocks will likely determine whether the market closes out December with gains or losses.

“If a Santa Claus rally does kick in this year, St. Nick’s gift bag will likely need to be full of positive tech sentiment,” wrote Chris Larkin, managing director of trading and investing at E-Trade from Morgan Stanley.

The gains on Monday were broad, with technology companies and banks leading the way. JPMorgan Chase rose 1.4% and Nvidia rose 1.1%.

Uber rose 2.5% and Lyft rose 3.8% after announcing plans to bring robotaxi services to London next year.

Paramount Skydance rose 5.1%. The company sweetened its hostile takeover bid for Warner Bros. Discovery with an “irrevocable personal guarantee” from Larry Ellison, the founder of Oracle and father of Paramount CEO David Ellison. He is putting up billions of dollars to back the deal as part of the latest move in Paramount's bidding war against Netflix.

Warner Bros. Discovery rose 3% and Netflix fell 0.8%.

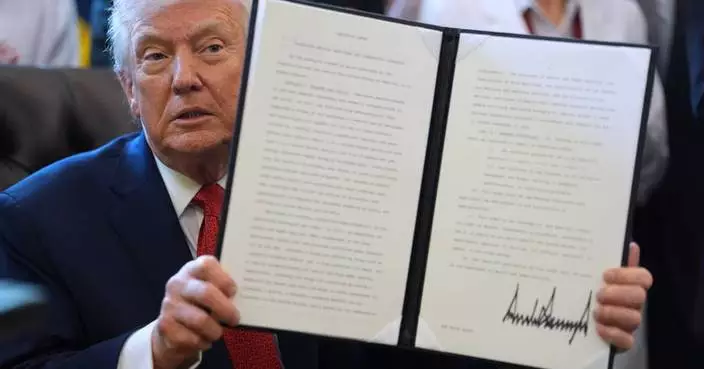

Dominion Energy slipped 4.7% after the Trump administration said it is pausing leases for five large-scale offshore wind projects. They include Dominion's Coastal Virginia Offshore Wind project.

Gold and silver touched records and oil prices jumped after the U.S. Coast Guard said it was pursuing another sanctioned oil tanker in the Caribbean.

Gold prices rose 1.9% and are hovering around $4,470 per ounce, adding to their consistent gains throughout the year. Silver prices were up about 1.6%.

Crude oil prices in the U.S. rose 2.2% and prices for Brent crude oil, the international standard, rose 2.2%.

Treasury yields edged higher in the bond market. The yield on the 10-year Treasury rose to 4.16% from 4.15% late Friday.

Markets in Asia gained ground while markets in Europe slipped.

Markets in the U.S. will close early on Wednesday for Christmas Eve and remain closed on Thursday for Christmas. The short week for trading includes several economic reports that could shed more light on the condition and direction of the U.S. economy.

On Tuesday, the government releases the first of three estimates on gross domestic product, a reflection of how the broader U.S. economy fared in the third quarter. On Wednesday, the Labor Department will release its weekly data on applications for jobless benefits, which stands as a proxy for U.S. layoffs.

The Conference Board offers up results from its December consumer confidence survey on Tuesday as well.

The upcoming reports follow a mix of updates last week that show inflation remains elevated and consumer confidence has diminished over the last year. Overall, the job market has been slowing and retail sales have weakened.

The ongoing and wide-ranging U.S. trade war has been hanging over consumers and businesses already squeezed and worried by higher prices. The mix of stubbornly high inflation and a weaker jobs market has also put the Federal Reserve in a more difficult policy position moving forward.

The Fed has cut its benchmark interest rate at its last three meetings, despite inflation that has remained stubbornly above its 2% target. Fed officials have grown increasingly concerned about the slowing job market, pushing them to trim rates. Cutting interest rates to bolster the economy because of a weak job market could fuel inflation, however.

Wall Street is mostly betting that the Fed will hold steady on interest rates at its meeting in January.

Elaine Kurtenbach and Matt Ott contributed to this story.

James Denaro works on the floor at the New York Stock Exchange in New York, Wednesday, Dec. 10, 2025. (AP Photo/Seth Wenig)

Trader Jonathan Mueller works on the floor of the New York Stock Exchange, Thursday, Dec. 11, 2025. (AP Photo/Richard Drew)

Trader William Lawrence works on the floor of the New York Stock Exchange, Thursday, Dec. 11, 2025. (AP Photo/Richard Drew)

A person looks at an electronic stock board showing Japan's Nikkei index at a securities firm Monday, Dec. 22, 2025, in Tokyo. (AP Photo/Eugene Hoshiko)

People stand in front of an electronic stock board showing Japan's Nikkei index at a securities firm Monday, Dec. 22, 2025, in Tokyo. (AP Photo/Eugene Hoshiko)

A person stands in front of an electronic stock board showing Japan's Nikkei index at a securities firm Monday, Dec. 22, 2025, in Tokyo. (AP Photo/Eugene Hoshiko)

A person walks in front of an electronic stock board showing Japan's Nikkei index at a securities firm Monday, Dec. 22, 2025, in Tokyo. (AP Photo/Eugene Hoshiko)