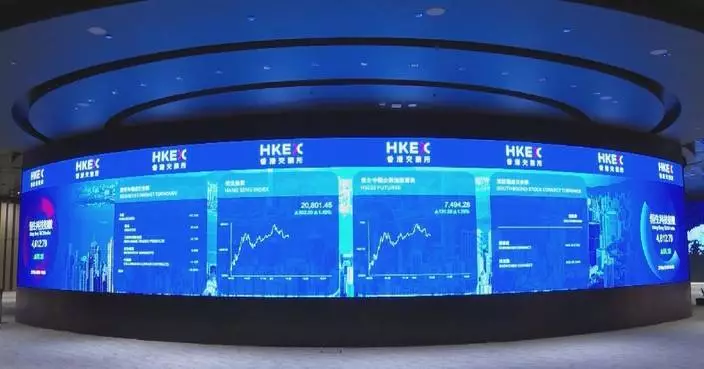

Hong Kong's stock market ended higher Monday with the benchmark Hang Seng Index up 0.06 percent to close at 26,765.52 points.

The Hang Seng China Enterprises Index dropped 0.15 percent to 9,147.21 points, and the Hang Seng Tech Index shrank 1.24 percent to 5,725.99 points.

Hong Kong's Hang Seng Index closes 0.06 pct higher

As China's stock market continues to rebound, international investors are increasingly recognizing the country's high-quality development prospects, announcing plans to maintain an overweight allocation to Chinese assets in 2026 and step up long-term investment, citing confidence in their innovation and sustained growth.

Global investors are shifting their focus from short-term valuation gains to the long-term growth potential of Chinese assets, as corporate transformation and industrial upgrading accelerate. The steady improvement in corporate fundamentals has become the core driver underpinning foreign investors' bullish outlook.

"In the past, markets mainly focused on relative valuation attractiveness. Now, more and more companies are proving themselves through earnings performance and cash flow. We see continuous improvements in Chinese firms' capabilities in research and development investment, product iteration, and global expansion. Innovation is no longer just about scaling up, but increasingly about efficiency and quality," said Wen Tianna, President of Hong Kong Boda Capital International.

The sustained innovation capacity of Chinese enterprises, coupled with targeted governmental policies, is further amplifying the global appeal of Chinese assets.

"For global investors, Chinese assets offer both high-quality earnings growth and strong macro policy support, making them a core component of global asset allocation," said Wang Xinjie, Chief Investment Strategist of Standard Chartered China Wealth Solutions Department.

Looking ahead to 2026, investment in the AI industrial chain has emerged as a broad consensus. Meanwhile, sectors such as new consumption are also becoming focal points, drawing increasing global attention to opportunities in China.

"Recently, our UBS Greater China Conference in Shanghai attracted more than 3,600 participants. Notably, the number of investors from the United States, Europe, the Middle East, and Africa rose by 32 percent year on year. The surge in Chinese innovation is creating valuable opportunities for global investors to position for high-quality growth," said Xu Bin, Head of Research from UBS Securities.

Foreign investors bullish on long-term growth potential of Chinese assets in 2026