Gold and silver prices plunged Friday as the U.S. dollar surged and investors took profits, following news of U.S. President Donald Trump's nomination of Kevin Warsh as the next Federal Reserve chair.

At market close, the most-active gold futures contract on the New York Mercantile Exchange (NYMEX) settled at 4,745.10 U.S. dollars per ounce, down 11.39 percent from the previous trading day. Silver futures also suffered significant losses, with the benchmark contract dropping 31.37 percent to 78.531 U.S. dollars per ounce.

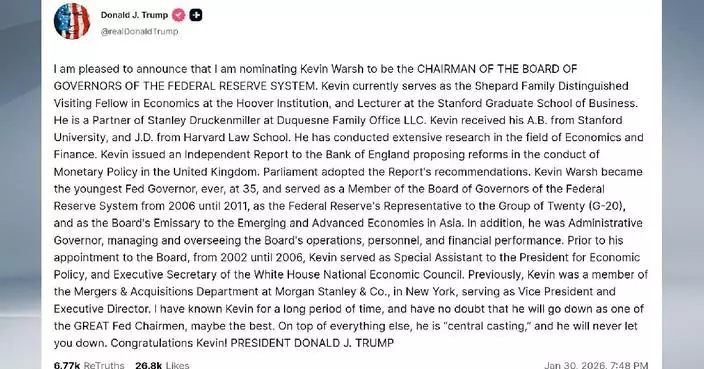

Trump announced on Friday that he is nominating Kevin Warsh, a former Federal Reserve governor, to be the next chair of the central bank.

Gold, silver prices drop sharply

The Beijing Stock Exchange (BSE) has seen a significant expansion of its investor base, with the total number of qualified investors exceeding 10 million as of Jan 20, indicating the bourse's rising vitality and appeal.

This represents a net increase of almost 2 million accounts on the third-born of China's A-share market compared to the same period last year.

This figure marks the highest number of qualified investors since the establishment of the BSE in 2021, doubling from 4 million at its inception. In just the past five months alone, the number surged from 9 million to more than 10 million.

Experts say that the rapid growth of the investor base is attributed to the robust performance of the bourse's new share market.

Since the beginning of 2026, the frozen funds for new share subscriptions on the BSE has exceeded 1 trillion yuan (about 143.85 billion U.S. dollars), reflecting sustained high investor enthusiasm for entering the market.

"The scale of 10 million investors is a key indicator of the maturity of the Beijing Stock Exchange's market ecosystem. The impressive performance of the new stock market has validated the investment value of BSE-listed companies, attracting incremental capital inflows. And the expansion of market size and growth in investor numbers form a virtuous cycle, providing more sufficient capital support for innovation-oriented small and medium-sized enterprises," said Lu Zhe, chief economist at the Soochow Securities.

The total market capitalization of the BSE has approached to 1 trillion yuan. Data shows that the number of companies listed on the bourse has reached 290, with a total value of 949.571 billion yuan (about 136.59 billion U.S. dollars).

Meanwhile, the BSE has demonstrated strong market resilience, with the Beijing Stock Exchange 50 Index up by around 50 percent cumulatively in 2025. The benchmark index includes 50 stocks considered to be representative of the market, providing a tool to monitor the overall performance of the bourse.

Since the opening of the BSE, over 90 percent of the listed companies have cumulatively distributed 19.86 billion yuan (about 2.86 billion U.S. dollars) in cash dividends, with 16 companies having paid out dividends exceeding their total amount of funds raised through listing.

The 2025 third-quarter report shows that the average revenue of 279 BSE-listed companies stood at 520 million yuan (about 74.8 million U.S. dollars), an increase of 5.99 percent year-on-year. Their average net profit was almost 32.99 million yuan (about 4.74 million U.S. dollars).

Five companies included in the Beijing Stock Exchange 50 Index, as well as eight companies not included, have disclosed their equity distribution plans, with the combined cash distribution amounting to 358 million yuan (about 51.5 million U.S. dollars).

Beijing Stock Exchange sees record number of qualified investors