| MEDTRONIC PLC WORLD WIDE REVENUE(1) (Unaudited) | ||||||||||||||||||||||||||||

| THIRD QUARTER | YEAR-TO-DATE | |||||||||||||||||||||||||||

| REPORTED | ORGANIC | REPORTED | ORGANIC | |||||||||||||||||||||||||

| (in millions) | FY26 | FY25 | Growth | Currency | FY26(5) | FY25(5) | Growth | FY26 | FY25 | Growth | Currency | FY26(6) | FY25(6) | Growth | ||||||||||||||

| Cardiovascular | $ 3,457 | $ 3,037 | 13.8 % | $ 99 | $ 3,359 | $ 3,037 | 10.6 % | $ 10,179 | $ 9,145 | 11.3 % | $ 213 | $ 9,966 | $ 9,145 | 9.0 % | ||||||||||||||

| Cardiac Rhythm & Heart Failure | 1,856 | 1,545 | 20.1 | 48 | 1,808 | 1,545 | 17.0 | 5,394 | 4,659 | 15.8 | 107 | 5,287 | 4,659 | 13.5 | ||||||||||||||

| Structural Heart & Aortic | 929 | 874 | 6.3 | 32 | 897 | 874 | 2.6 | 2,814 | 2,610 | 7.8 | 71 | 2,743 | 2,610 | 5.1 | ||||||||||||||

| Coronary & Peripheral Vascular | 672 | 618 | 8.8 | 18 | 654 | 618 | 5.9 | 1,971 | 1,876 | 5.0 | 35 | 1,935 | 1,876 | 3.1 | ||||||||||||||

| Neuroscience | 2,558 | 2,458 | 4.1 | 38 | 2,520 | 2,458 | 2.5 | 7,536 | 7,226 | 4.3 | 81 | 7,455 | 7,226 | 3.2 | ||||||||||||||

| Cranial & Spinal Technologies | 1,310 | 1,250 | 4.8 | 13 | 1,296 | 1,250 | 3.7 | 3,819 | 3,632 | 5.1 | 31 | 3,788 | 3,632 | 4.3 | ||||||||||||||

| Specialty Therapies | 746 | 732 | 1.9 | 15 | 731 | 732 | (0.2) | 2,191 | 2,181 | 0.4 | 28 | 2,163 | 2,181 | (0.8) | ||||||||||||||

| Neuromodulation | 503 | 476 | 5.8 | 10 | 493 | 476 | 3.6 | 1,527 | 1,413 | 8.1 | 22 | 1,504 | 1,413 | 6.5 | ||||||||||||||

| Medical Surgical | 2,173 | 2,072 | 4.9 | 61 | 2,112 | 2,057 | 2.7 | 6,428 | 6,196 | 3.7 | 128 | 6,295 | 6,164 | 2.1 | ||||||||||||||

| Surgical & Endoscopy | 1,654 | 1,596 | 3.6 | 51 | 1,603 | 1,581 | 1.4 | 4,945 | 4,790 | 3.2 | 106 | 4,834 | 4,758 | 1.6 | ||||||||||||||

| Acute Care & Monitoring | 519 | 476 | 9.1 | 10 | 509 | 476 | 7.0 | 1,483 | 1,406 | 5.5 | 22 | 1,461 | 1,406 | 3.9 | ||||||||||||||

| Diabetes | 796 | 694 | 14.8 | 44 | 751 | 694 | 8.3 | 2,274 | 2,027 | 12.2 | 90 | 2,184 | 2,027 | 7.8 | ||||||||||||||

| Total Reportable Segments | 8,985 | 8,260 | 8.8 | 242 | 8,743 | 8,245 | 6.0 | 26,417 | 24,593 | 7.4 | 512 | 25,901 | 24,562 | 5.4 | ||||||||||||||

| Other(2) | 32 | 32 | 3.0 | — | — | — | — | 140 | 17 | NM(3) | 4 | — | — | — | ||||||||||||||

| TOTAL | $ 9,017 | $ 8,292 | 8.7 % | $ 243 | $ 8,743 | $ 8,245 | 6.0 % | $ 26,557 | $ 24,610 | 7.9 % | $ 516 | $ 25,901 | $ 24,562 | 5.4 % | ||||||||||||||

| See description of non-GAAP financial measures contained in the press release dated February 17, 2026. | |

| (1) | The data in this schedule has been intentionally rounded to the nearest million and, therefore, may not sum. Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely. |

| (2) | Includes the historical operations and ongoing transition agreements from businesses the Company has exited or divested, and for the year-to-date figures, adjustments to the Company's Italian payback accruals resulting from the two July 22, 2024 rulings by the Constitutional Court and the Legislative Decree published by the Italian government on June 30, 2025 for certain prior years since 2015. |

| (3) | Not meaningful (NM). |

| (4) | The currency impact to revenue measures the change in revenue between current and prior year periods using constant exchange rates. |

| (5) | The three months ended January 23, 2026 excludes $275 million of revenue adjustments, including $32 million of inorganic revenue for the transition activity noted in (2) and $242 million of favorable currency impact on the remaining segments. The three months ended January 24, 2025 excludes $47 million of revenue adjustments, including $32 million of inorganic revenue related to the transition activity noted in (2) and $15 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division. |

| (6) | The nine months ended January 23, 2026 excludes $656 million of revenue adjustments, including $39 million reduction in the Italian payback accruals due to changes in estimates further described in note (2), $101 million of inorganic revenue for the transition activity noted in (2), $5 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division, and $512 million of favorable currency impact on the remaining segments. The nine months ended January 24, 2025 excludes $48 million of revenue adjustments, including $90 million of incremental Italian payback accruals further described in note (2), $106 million of inorganic revenue related to the transition activity noted in (2), and $31 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division. |

| MEDTRONIC PLC U.S. REVENUE(1)(2) (Unaudited) | ||||||||||||||||||||||||

| THIRD QUARTER | YEAR-TO-DATE | |||||||||||||||||||||||

| REPORTED | ORGANIC | REPORTED | ORGANIC | |||||||||||||||||||||

| (in millions) | FY26 | FY25 | Growth | FY26 | FY25 | Growth | FY26 | FY25 | Growth | FY26 | FY25 | Growth | ||||||||||||

| Cardiovascular | $ 1,589 | $ 1,405 | 13.1 % | $ 1,589 | $ 1,405 | 13.1 % | $ 4,660 | $ 4,242 | 9.9 % | $ 4,660 | $ 4,242 | 9.9 % | ||||||||||||

| Cardiac Rhythm & Heart Failure | 953 | 775 | 23.0 | 953 | 775 | 23.0 | 2,708 | 2,309 | 17.3 | 2,708 | 2,309 | 17.3 | ||||||||||||

| Structural Heart & Aortic | 367 | 372 | (1.4) | 367 | 372 | (1.4) | 1,128 | 1,129 | — | 1,128 | 1,129 | — | ||||||||||||

| Coronary & Peripheral Vascular | 269 | 258 | 4.2 | 269 | 258 | 4.2 | 824 | 804 | 2.5 | 824 | 804 | 2.5 | ||||||||||||

| Neuroscience | 1,709 | 1,689 | 1.2 | 1,709 | 1,689 | 1.2 | 5,063 | 4,931 | 2.7 | 5,063 | 4,931 | 2.7 | ||||||||||||

| Cranial & Spinal Technologies | 977 | 943 | 3.6 | 977 | 943 | 3.6 | 2,833 | 2,724 | 4.0 | 2,833 | 2,724 | 4.0 | ||||||||||||

| Specialty Therapies | 402 | 419 | (4.0) | 402 | 419 | (4.0) | 1,204 | 1,235 | (2.5) | 1,204 | 1,235 | (2.5) | ||||||||||||

| Neuromodulation | 330 | 327 | 1.1 | 330 | 327 | 1.1 | 1,026 | 972 | 5.6 | 1,026 | 972 | 5.6 | ||||||||||||

| Medical Surgical | 929 | 893 | 4.1 | 929 | 893 | 4.1 | 2,756 | 2,718 | 1.4 | 2,756 | 2,718 | 1.4 | ||||||||||||

| Surgical & Endoscopy | 634 | 623 | 1.7 | 634 | 623 | 1.7 | 1,920 | 1,928 | (0.4) | 1,920 | 1,928 | (0.4) | ||||||||||||

| Acute Care & Monitoring | 295 | 269 | 9.5 | 295 | 269 | 9.5 | 836 | 790 | 5.8 | 836 | 790 | 5.8 | ||||||||||||

| Diabetes | 248 | 236 | 4.9 | 248 | 236 | 4.9 | 695 | 683 | 1.7 | 695 | 683 | 1.7 | ||||||||||||

| Total Reportable Segments | 4,475 | 4,223 | 6.0 | 4,475 | 4,223 | 6.0 | 13,174 | 12,573 | 4.8 | 13,174 | 12,573 | 4.8 | ||||||||||||

| Other(3) | 18 | 15 | 23.4 | — | — | — | 60 | 51 | 16.8 | — | — | — | ||||||||||||

| TOTAL | $ 4,493 | $ 4,237 | 6.0 % | $ 4,475 | $ 4,223 | 6.0 % | $ 13,234 | $ 12,624 | 4.8 % | $ 13,174 | $ 12,573 | 4.8 % | ||||||||||||

| See description of non-GAAP financial measures contained in the press release dated February 17, 2026. | |

| (1) | U.S. includes the United States and U.S. territories. |

| (2) | The data in this schedule has been intentionally rounded to the nearest million and, therefore, may not sum. Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely. |

| (3) | Includes historical operations and ongoing transition agreements from businesses the Company has exited or divested. |

| MEDTRONIC PLC INTERNATIONAL REVENUE(1) (Unaudited) | ||||||||||||||||||||||||||||

| THIRD QUARTER | YEAR-TO-DATE | |||||||||||||||||||||||||||

| REPORTED | ORGANIC | REPORTED | ORGANIC | |||||||||||||||||||||||||

| (in millions) | FY26 | FY25 | Growth | Currency | FY26(5) | FY25(5) | Growth | FY26 | FY25 | Growth | Currency | FY26(6) | FY25(6) | Growth | ||||||||||||||

| Cardiovascular | $ 1,868 | $ 1,632 | 14.5 % | $ 99 | $ 1,770 | $ 1,632 | 8.5 % | $ 5,519 | $ 4,904 | 12.5 % | $ 213 | $ 5,306 | $ 4,904 | 8.2 % | ||||||||||||||

| Cardiac Rhythm & Heart Failure | 903 | 770 | 17.3 | 48 | 855 | 770 | 11.0 | 2,686 | 2,350 | 14.3 | 107 | 2,580 | 2,350 | 9.8 | ||||||||||||||

| Structural Heart & Aortic | 562 | 502 | 12.0 | 32 | 530 | 502 | 5.5 | 1,686 | 1,482 | 13.8 | 71 | 1,615 | 1,482 | 9.0 | ||||||||||||||

| Coronary & Peripheral Vascular | 403 | 360 | 12.2 | 18 | 385 | 360 | 7.1 | 1,146 | 1,072 | 6.9 | 35 | 1,111 | 1,072 | 3.6 | ||||||||||||||

| Neuroscience | 849 | 769 | 10.4 | 38 | 811 | 769 | 5.4 | 2,474 | 2,295 | 7.8 | 81 | 2,392 | 2,295 | 4.2 | ||||||||||||||

| Cranial & Spinal Technologies | 333 | 307 | 8.4 | 13 | 320 | 307 | 4.1 | 985 | 907 | 8.6 | 31 | 955 | 907 | 5.2 | ||||||||||||||

| Specialty Therapies | 343 | 313 | 9.7 | 15 | 328 | 313 | 5.0 | 987 | 947 | 4.3 | 28 | 959 | 947 | 1.3 | ||||||||||||||

| Neuromodulation | 173 | 149 | 16.0 | 10 | 163 | 149 | 9.1 | 501 | 441 | 13.5 | 22 | 478 | 441 | 8.4 | ||||||||||||||

| Medical Surgical | 1,244 | 1,180 | 5.5 | 61 | 1,183 | 1,165 | 1.6 | 3,671 | 3,478 | 5.6 | 128 | 3,539 | 3,447 | 2.7 | ||||||||||||||

| Surgical & Endoscopy | 1,020 | 973 | 4.8 | 51 | 969 | 958 | 1.1 | 3,024 | 2,862 | 5.7 | 106 | 2,914 | 2,831 | 2.9 | ||||||||||||||

| Acute Care & Monitoring | 224 | 206 | 8.5 | 10 | 214 | 206 | 3.8 | 647 | 616 | 5.0 | 22 | 625 | 616 | 1.4 | ||||||||||||||

| Diabetes | 548 | 457 | 19.8 | 44 | 504 | 457 | 10.1 | 1,579 | 1,344 | 17.5 | 90 | 1,489 | 1,344 | 10.9 | ||||||||||||||

| Total Reportable Segments | 4,510 | 4,038 | 11.7 | 242 | 4,267 | 4,023 | 6.1 | 13,243 | 12,020 | 10.2 | 512 | 12,726 | 11,989 | 6.2 | ||||||||||||||

| Other(2) | 14 | 17 | (14.6) | — | — | — | — | 80 | (35) | NM(3) | 4 | — | — | — | ||||||||||||||

| TOTAL | $ 4,524 | $ 4,055 | 11.6 % | $ 243 | $ 4,267 | $ 4,023 | 6.1 % | $ 13,323 | $ 11,986 | 11.2 % | $ 516 | $ 12,726 | $ 11,989 | 6.2 % | ||||||||||||||

| See description of non-GAAP financial measures contained in the press release dated February 17, 2026. | |

| (1) | The data in this schedule has been intentionally rounded to the nearest million and, therefore, may not sum. Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely. |

| (2) | Includes the historical operations and ongoing transition agreements from businesses the Company has exited or divested, and for the year-to-date figures, adjustments to the Company's Italian payback accruals resulting from the two July 22, 2024 rulings by the Constitutional Court and the Legislative Decree published by the Italian government on June 30, 2025 for certain prior years since 2015. |

| (3) | Not meaningful (NM). |

| (4) | The currency impact to revenue measures the change in revenue between current and prior year periods using constant exchange rates. |

| (5) | The three months ended January 23, 2026 excludes $257 million of revenue adjustments, including $14 million of inorganic revenue for the transition activity noted in (2) and $242 million of favorable currency impact on the remaining segments. The three months ended January 24, 2025 excludes $32 million of revenue adjustments, including $17 million of inorganic revenue related to the transition activity noted in (2) and $15 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division. |

| (6) | The nine months ended January 23, 2026 excludes $597 million of revenue adjustments, including $39 million reduction in the Italian payback accruals due to changes in estimates further described in note (2), $41 million of inorganic revenue for the transition activity noted in (2), $5 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division, and $512 million of favorable currency impact on the remaining segments. The nine months ended January 24, 2025 excludes $3 million of revenue adjustments, including $90 million of incremental Italian payback accruals further described in note (2), $55 million of inorganic revenue related to the transition activity noted in (2), and $31 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division. |

| MEDTRONIC PLC CONSOLIDATED STATEMENTS OF INCOME (Unaudited) | |||||||

| Three months ended | Nine months ended | ||||||

| (in millions, except per share data) | January 23, 2026 | January 24, 2025 | January 23, 2026 | January 24, 2025 | |||

| Net sales | $ 9,017 | $ 8,292 | $ 26,557 | $ 24,610 | |||

| Costs and expenses: | |||||||

| Cost of products sold, excluding amortization of intangible assets | 3,261 | 2,779 | 9,323 | 8,485 | |||

| Research and development expense | 722 | 675 | 2,202 | 2,048 | |||

| Selling, general, and administrative expense | 2,956 | 2,717 | 8,727 | 8,129 | |||

| Amortization of intangible assets | 441 | 416 | 1,364 | 1,243 | |||

| Restructuring charges, net | 77 | 43 | 131 | 120 | |||

| Certain litigation charges, net | 62 | 22 | 89 | 104 | |||

| Other operating expense (income), net | 35 | (5) | 126 | (38) | |||

| Operating profit | 1,464 | 1,646 | 4,594 | 4,519 | |||

| Other non-operating income, net | (121) | (72) | (247) | (403) | |||

| Interest expense, net | 181 | 179 | 539 | 555 | |||

| Income before income taxes | 1,404 | 1,540 | 4,302 | 4,367 | |||

| Income tax provision | 254 | 237 | 724 | 737 | |||

| Net income | 1,150 | 1,303 | 3,578 | 3,630 | |||

| Net income attributable to noncontrolling interests | (6) | (9) | (21) | (24) | |||

| Net income attributable to Medtronic | $ 1,143 | $ 1,294 | $ 3,557 | $ 3,606 | |||

| Basic earnings per share | $ 0.89 | $ 1.01 | $ 2.77 | $ 2.80 | |||

| Diluted earnings per share | $ 0.89 | $ 1.01 | $ 2.76 | $ 2.79 | |||

| Basic weighted average shares outstanding | 1,282.6 | 1,282.4 | 1,282.1 | 1,286.7 | |||

| Diluted weighted average shares outstanding | 1,289.5 | 1,286.2 | 1,288.2 | 1,290.6 | |||

| The data in the schedule above has been intentionally rounded to the nearest million. |

| MEDTRONIC PLC GAAP TO NON-GAAP RECONCILIATIONS(1) (Unaudited) | |||||||||||||||||

| Three months ended January 23, 2026 | |||||||||||||||||

| (in millions, except per share data) | Net | Cost of | Gross | Operating | Operating | Income | Net Income | Diluted | Effective | ||||||||

| GAAP | $ 9,017 | $ 3,261 | 63.8 % | $ 1,464 | 16.2 % | $ 1,404 | $ 1,143 | $ 0.89 | 18.1 % | ||||||||

| Non-GAAP Adjustments: | |||||||||||||||||

| Amortization of intangible assets(2) | — | — | — | 441 | 4.9 | 441 | 360 | 0.28 | 18.4 | ||||||||

| Restructuring and associated costs(3) | — | (89) | 1.0 | 172 | 1.9 | 172 | 141 | 0.11 | 18.0 | ||||||||

| Acquisition and divestiture-related items(4) | — | (6) | 0.1 | 38 | 0.4 | 38 | 33 | 0.03 | 13.2 | ||||||||

| Certain litigation charges, net | — | — | — | 62 | 0.7 | 62 | 52 | 0.04 | 16.1 | ||||||||

| (Gain)/loss on minority investments(5) | — | — | — | — | — | 8 | 7 | 0.01 | 12.5 | ||||||||

| Certain tax adjustments, net | — | — | — | — | — | — | 14 | 0.01 | — | ||||||||

| Non-GAAP | $ 9,017 | $ 3,166 | 64.9 % | $ 2,177 | 24.1 % | $ 2,125 | $ 1,750 | $ 1.36 | 17.3 % | ||||||||

| Currency impact | (243) | (52) | (0.4) | (67) | (0.1) | (0.04) | |||||||||||

| Currency Adjusted | $ 8,775 | $ 3,114 | 64.5 % | $ 2,110 | 24.0 % | $ 1.32 | |||||||||||

| Three months ended January 24, 2025 | |||||||||||||||||

| (in millions, except per share data) | Net | Cost of | Gross | Operating | Operating | Income | Net Income | Diluted | Effective | ||||||||

| GAAP | $ 8,292 | $ 2,779 | 66.5 % | $ 1,646 | 19.9 % | $ 1,540 | $ 1,294 | $ 1.01 | 15.4 % | ||||||||

| Non-GAAP Adjustments: | |||||||||||||||||

| Amortization of intangible assets | — | — | — | 416 | 5.0 | 416 | 339 | 0.26 | 18.5 | ||||||||

| Restructuring and associated costs(3) | — | (4) | — | 46 | 0.6 | 46 | 37 | 0.03 | 19.6 | ||||||||

| Acquisition and divestiture-related items(4) | — | (1) | — | 28 | 0.3 | 28 | 23 | 0.02 | 17.9 | ||||||||

| Certain litigation charges, net | — | — | — | 22 | 0.3 | 22 | 18 | 0.01 | 22.7 | ||||||||

| (Gain)/loss on minority investments(5) | — | — | — | — | — | 68 | 52 | 0.04 | 22.1 | ||||||||

| Medical device regulations(6) | — | (8) | 0.1 | 11 | 0.1 | 11 | 9 | 0.01 | 18.2 | ||||||||

| Certain tax adjustments, net | — | — | — | — | — | — | 15 | 0.01 | — | ||||||||

| Non-GAAP | $ 8,292 | $ 2,766 | 66.6 % | $ 2,169 | 26.2 % | $ 2,130 | $ 1,787 | $ 1.39 | 15.7 % | ||||||||

| See description of non-GAAP financial measures contained in the press release dated February 17, 2026. | |

| (1) | The data in this schedule has been intentionally rounded to the nearest million or $0.01 for EPS figures, and, therefore, may not sum. |

| (2) | The Company recognized $30 million of accelerated amortization on certain intangible assets within the Cardiovascular Portfolio. |

| (3) | The charges primarily relate to employee termination benefits, facility related and contract termination costs, and asset write offs. |

| (4) | The charges primarily include business combination costs, changes in fair value of contingent consideration, exit of business-related charges, and gains related to certain business or asset sales. Exit of business-related charges primarily relate to the impending separation of the Diabetes business. For the three months ended January 23, 2026, charges also include costs associated with the Company's June 2021 decision to stop the distribution and sale of the Medtronic HVAD System. |

| (5) | We exclude unrealized and realized gains and losses on our minority investments as we do not believe that these components of income or expense have a direct correlation to our ongoing or future business operations. |

| (6) | The charges represent incremental costs of complying with the new European Union (E.U.) medical device regulations for previously registered products and primarily include charges for contractors supporting the project and other direct third-party expenses. We consider these costs to be duplicative of previously incurred costs and/or one-time costs. |

| MEDTRONIC PLC GAAP TO NON-GAAP RECONCILIATIONS(1) (Unaudited) | |||||||||||||||||

| Nine months ended January 23, 2026 | |||||||||||||||||

| (in millions, except per share data) | Net | Cost of | Gross | Operating | Operating | Income | Net Income | Diluted | Effective | ||||||||

| GAAP | $ 26,557 | $ 9,323 | 64.9 % | $ 4,594 | 17.3 % | $ 4,302 | $ 3,557 | $ 2.76 | 16.8 % | ||||||||

| Non-GAAP Adjustments: | |||||||||||||||||

| Amortization of intangible assets(2) | — | — | — | 1,364 | 5.2 | 1,364 | 1,110 | 0.86 | 18.6 | ||||||||

| Restructuring and associated costs(3) | — | (105) | 0.4 | 251 | 1.0 | 251 | 202 | 0.16 | 19.5 | ||||||||

| Acquisition and divestiture-related items(4) | — | (21) | — | 96 | 0.4 | 96 | 73 | 0.06 | 24.0 | ||||||||

| Certain litigation charges, net | — | — | — | 89 | 0.3 | 89 | 73 | 0.06 | 19.1 | ||||||||

| (Gain)/loss on minority investments(5) | — | — | — | — | — | 145 | 137 | 0.11 | 5.5 | ||||||||

| Other(6) | (39) | — | — | (39) | (0.1) | (39) | (30) | (0.02) | 20.5 | ||||||||

| Certain tax adjustments, net(7) | — | — | — | — | — | — | — | — | — | ||||||||

| Non-GAAP | $ 26,518 | $ 9,197 | 65.3 % | $ 6,356 | 24.0 % | $ 6,209 | $ 5,122 | $ 3.98 | 17.2 % | ||||||||

| Currency impact | (513) | (48) | (0.5) | (170) | (0.2) | (0.10) | |||||||||||

| Currency Adjusted | $ 26,005 | $ 9,149 | 64.8 % | $ 6,185 | 23.8 % | $ 3.88 | |||||||||||

| Nine months ended January 24, 2025 | |||||||||||||||||

| (in millions, except per share data) | Net | Cost of | Gross | Operating | Operating | Income | Net Income | Diluted | Effective | ||||||||

| GAAP | $ 24,610 | $ 8,485 | 65.5 % | $ 4,519 | 18.4 % | $ 4,367 | $ 3,606 | $ 2.79 | 16.9 % | ||||||||

| Non-GAAP Adjustments: | |||||||||||||||||

| Amortization of intangible assets | — | — | — | 1,243 | 4.9 | 1,243 | 1,017 | 0.79 | 18.3 | ||||||||

| Restructuring and associated costs(3) | — | (24) | 0.1 | 154 | 0.6 | 154 | 124 | 0.10 | 19.5 | ||||||||

| Acquisition and divestiture-related items(4) | — | (17) | — | 15 | 0.1 | 15 | 3 | — | 73.3 | ||||||||

| Certain litigation charges, net | — | — | — | 104 | 0.4 | 104 | 86 | 0.07 | 17.3 | ||||||||

| (Gain)/loss on minority investments(5) | — | — | — | — | — | 41 | 14 | 0.01 | 61.0 | ||||||||

| Medical device regulations(8) | — | (27) | 0.1 | 38 | 0.2 | 38 | 30 | 0.02 | 21.1 | ||||||||

| Other(6) | 90 | — | 0.2 | 90 | 0.4 | 90 | 70 | 0.05 | 22.2 | ||||||||

| Certain tax adjustments, net(7) | — | — | — | — | — | — | 49 | 0.04 | — | ||||||||

| Non-GAAP | $ 24,700 | $ 8,417 | 65.9 % | $ 6,162 | 24.9 % | $ 6,051 | $ 4,999 | $ 3.87 | 17.0 % | ||||||||

| See description of non-GAAP financial measures contained in the press release dated February 17, 2026. | |

| (1) | The data in this schedule has been intentionally rounded to the nearest million or $0.01 for EPS figures, and, therefore, may not sum. |

| (2) | The Company recognized $121 million of accelerated amortization on certain intangible assets within the Cardiovascular Portfolio. |

| (3) | The charges primarily relate to employee termination benefits, facility related and contract termination costs, and asset write offs. |

| (4) | The charges primarily include business combination costs, changes in fair value of contingent consideration, exit of business-related charges, and gains related to certain business or asset sales. Exit of business-related charges primarily relate to the impending separation of the Diabetes business and costs associated with the Company's June 2021 decision to stop the distribution and sale of the Medtronic HVAD System. |

| (5) | We exclude unrealized and realized gains and losses on our minority investments as we do not believe that these components of income or expense have a direct correlation to our ongoing or future business operations. |

| (6) | Reflects adjustments to the Company's Italian payback accruals resulting from the two July 22, 2024 rulings by the Constitutional Court and the Legislative Decree published by the Italian government on June 30, 2025 for certain prior years since 2015. |

| (7) | The charges for the nine months ended January 23, 2026 primarily includes a tax benefit recognized due to a change in interest accrued on uncertain tax positions, offset by amortization of previously established deferred tax assets arising from intercompany intellectual property transactions. The charges for the nine months ended January 24, 2025 primarily includes amortization of previously established deferred tax assets arising from intercompany intellectual property transactions. |

| (8) | The charges represent incremental costs of complying with the new European Union (E.U.) medical device regulations for previously registered products and primarily include charges for contractors supporting the project and other direct third-party expenses. We consider these costs to be duplicative of previously incurred costs and/or one-time costs. |

| MEDTRONIC PLC GAAP TO NON-GAAP RECONCILIATIONS(1) (Unaudited) | |||||||||||||||

| Three months ended January 23, 2026 | |||||||||||||||

| (in millions) | Net Sales | SG&A | SG&A | R&D | R&D | Other | Other | Other Non- | |||||||

| GAAP | $ 9,017 | $ 2,956 | 32.8 % | $ 722 | 8.0 % | $ 35 | 0.4 % | $ (121) | |||||||

| Non-GAAP Adjustments: | |||||||||||||||

| Restructuring and associated costs(2) | — | (6) | (0.1) | — | — | — | — | — | |||||||

| Acquisition and divestiture-related items(3) | — | (35) | (0.4) | — | — | 3 | — | — | |||||||

| (Gain)/loss on minority investments(4) | — | — | — | — | — | — | — | (8) | |||||||

| Non-GAAP | $ 9,017 | $ 2,914 | 32.3 % | $ 722 | 8.0 % | $ 38 | 0.4 % | $ (130) | |||||||

| Nine months ended January 23, 2026 | |||||||||||||||

| (in millions) | Net Sales | SG&A | SG&A | R&D | R&D | Other | Other | Other Non- | |||||||

| GAAP | $ 26,557 | $ 8,727 | 32.9 % | $ 2,202 | 8.3 % | $ 126 | 0.5 % | $ (247) | |||||||

| Non-GAAP Adjustments: | |||||||||||||||

| Restructuring and associated costs(2) | — | (15) | — | — | — | — | — | — | |||||||

| Acquisition and divestiture-related items(3) | — | (96) | (0.3) | — | — | 21 | 0.1 | — | |||||||

| Other(5) | (39) | — | — | — | — | — | — | — | |||||||

| (Gain)/loss on minority investments(4) | — | — | — | — | — | — | — | (145) | |||||||

| Non-GAAP | $ 26,518 | $ 8,616 | 32.5 % | $ 2,202 | 8.3 % | $ 147 | 0.6 % | $ (392) | |||||||

| See description of non-GAAP financial measures contained in the press release dated February 17, 2026. | |

| (1) | The data in this schedule has been intentionally rounded to the nearest million, and, therefore, may not sum. |

| (2) | The charges primarily relate to employee termination benefits, facility related and contract termination costs, and asset write offs. |

| (3) | The charges primarily include business combination costs, changes in fair value of contingent consideration, exit of business-related charges, and gains related to certain business or asset sales. Exit of business-related charges primarily relate to the impending separation of the Diabetes business and costs associated with the Company's June 2021 decision to stop the distribution and sale of the Medtronic HVAD System. |

| (4) | We exclude unrealized and realized gains and losses on our minority investments as we do not believe that these components of income or expense have a direct correlation to our ongoing or future business operations. |

| (5) | Reflects adjustments to the Company's Italian payback accruals resulting from the Legislative Decree published by the Italian government on June 30, 2025 for certain prior years since 2015. |

| MEDTRONIC PLC GAAP TO NON-GAAP RECONCILIATIONS(1) (Unaudited) | |||

| Nine months ended | |||

| (in millions) | January 23, 2026 | January 24, 2025 | |

| Net cash provided by operating activities | $ 4,757 | $ 4,516 | |

| Additions to property, plant, and equipment | (1,416) | (1,400) | |

| Free Cash Flow(2) | $ 3,341 | $ 3,116 | |

| See description of non-GAAP financial measures contained in the press release dated February 17, 2026. | |

| (1) | The data in this schedule has been intentionally rounded to the nearest million, and, therefore, may not sum. |

| (2) | Free cash flow represents operating cash flows less property, plant, and equipment additions. |

| MEDTRONIC PLC CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) | |||

| Nine months ended | |||

| (in millions) | January 23, 2026 | January 24, 2025 | |

| Operating Activities: | |||

| Net income | $ 3,578 | $ 3,630 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |||

| Depreciation and amortization | 2,242 | 2,021 | |

| Provision for credit losses | 102 | 96 | |

| Deferred income taxes | 59 | (81) | |

| Stock-based compensation | 362 | 340 | |

| Other, net | 280 | 14 | |

| Change in operating assets and liabilities, net of acquisitions and divestitures: | |||

| Accounts receivable, net | 87 | (184) | |

| Inventories | (803) | (478) | |

| Accounts payable and accrued liabilities | (77) | (157) | |

| Other operating assets and liabilities | (1,074) | (685) | |

| Net cash provided by operating activities | 4,757 | 4,516 | |

| Investing Activities: | |||

| Acquisitions, net of cash acquired | — | (98) | |

| Additions to property, plant, and equipment | (1,416) | (1,400) | |

| Purchases of investments | (6,572) | (6,093) | |

| Sales and maturities of investments | 5,982 | 6,255 | |

| Other investing activities, net | (10) | (111) | |

| Net cash used in investing activities | (2,017) | (1,447) | |

| Financing Activities: | |||

| Change in current debt obligations, net | 173 | (1,070) | |

| Issuance of long-term debt | 1,747 | 3,209 | |

| Payments on long-term debt | (2,930) | — | |

| Dividends to shareholders | (2,731) | (2,692) | |

| Issuance of ordinary shares | 419 | 400 | |

| Repurchase of ordinary shares | (600) | (2,961) | |

| Other financing activities, net | 60 | 96 | |

| Net cash used in financing activities | (3,863) | (3,018) | |

| Effect of exchange rate changes on cash and cash equivalents | 52 | (95) | |

| Net change in cash and cash equivalents | (1,072) | (44) | |

| Cash and cash equivalents at beginning of period | 2,218 | 1,284 | |

| Cash and cash equivalents at end of period | $ 1,147 | $ 1,240 | |

| Supplemental Cash Flow Information | |||

| Cash paid for: | |||

| Income taxes | $ 1,598 | $ 1,515 | |

| Interest | 573 | 567 | |

| The data in this schedule has been intentionally rounded to the nearest million, and, therefore, may not sum. |

PDF - https://mma.prnewswire.com/media/2904972/Earnings_Presentation_FY26Q3_Final.pdf

PDF - https://mma.prnewswire.com/media/2904973/Exhibit_99_1___FY26_Q3_Earnings_Release_2_16.pdf

Cardiovascular portfolio up 11% year-over-year; Cardiac Ablation Solutions grew 80% on strength of pulsed field ablation portfolio

GALWAY, Ireland, Feb. 17, 2026 /PRNewswire/ -- Medtronic plc (NYSE: MDT), a global leader in healthcare technology, today announced financial results for its third quarter (Q3) of fiscal year 2026 (FY26), which ended January 23, 2026.

Q3 Key Highlights

- Revenue of $9.0 billion, increased 8.7% as reported and 6.0% organic, 50 basis points ahead of Q3 guidance

- GAAP diluted EPS of $0.89; non-GAAP diluted EPS of $1.36, three cents ahead of Q3 guidance mid-point

- Company reiterates FY26 organic revenue growth and EPS guidance

- Cardiac Ablation Solutions revenue increased 80%, including 137% in the U.S., on strength of pulsed field ablation (PFA) portfolio

- Secured CE Mark for Sphere-360™ and initiated U.S. pivotal trial

- Secured U.S. FDA clearance for Hugo™ robotic-assisted surgery; first cases completed this month

- Secured U.S. FDA clearance for Stealth AXiS™ Surgical System for spinal procedures

- Diabetes revenue increased 8.3% led by double-digit strength in International markets

- Executing M&A strategy with two key transactions in the quarter: CathWorks in Coronary and Renal Denervation and Anteris in Structural Heart

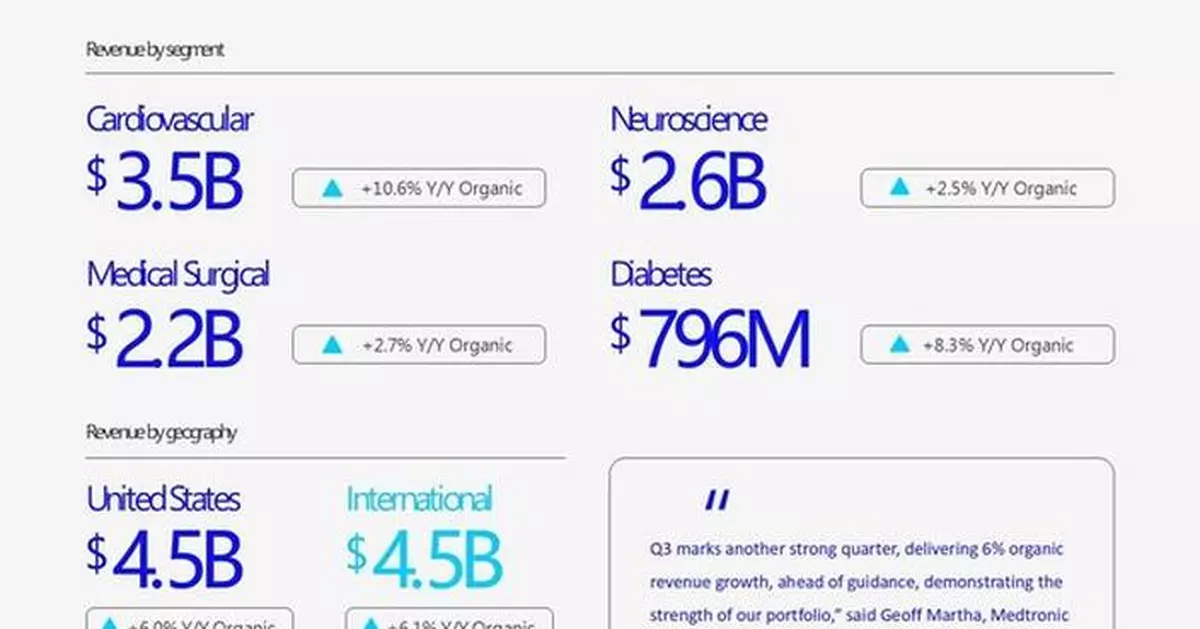

"Q3 marks another strong quarter, delivering 6% organic revenue growth, ahead of guidance, demonstrating the strength of our portfolio," said Geoff Martha, Medtronic chairman and chief executive officer. "By unlocking new markets and investing in high-growth opportunities, we are accelerating performance across the company. Our innovation pipeline and portfolio breadth give us confidence in our ability to sustain long-term growth. It's an exciting time for Medtronic."

Financial Results

Medtronic reported Q3 worldwide revenue of $9.017 billion, an increase of 8.7% as reported and 6.0% on an organic basis. The organic revenue growth comparison excludes:

- Other revenue of $32 million in the current year and $32 million in the prior year

- Revenue from the Dutch Obesity Clinic (NOK) divestiture with no revenue in the current year and $15 million in the prior year

- Foreign exchange benefit of $242 million on the remaining segments

Q3 revenue by segment included:

- Cardiovascular Portfolio revenue of $3.457 billion, an increase of 13.8% as reported and 10.6% organic, with high-teens increase in Cardiac Rhythm & Heart Failure, low-single digit increase in Structural Heart & Aortic, and mid-single digit increase in Coronary & Peripheral Vascular, all on an organic basis

- Neuroscience Portfolio revenue of $2.558 billion, an increase of 4.1% reported and 2.5% organic, with mid-single digit increase in Neuromodulation, mid-single digit increase in Cranial & Spinal Technologies, and flat result in Specialty Therapies, all on an organic basis

- Medical Surgical Portfolio revenue of $2.173 billion, an increase of 4.9% as reported and 2.7% organic, with low-single digit increase in Surgical & Endoscopy, and high-single digit increase in Acute Care & Monitoring, all on an organic basis

- Diabetes business revenue of $796 million, an increase of 14.8% as reported and 8.3% organic

Q3 GAAP operating profit and operating margin were $1.464 billion and 16.2%, respectively. As detailed in the financial schedules included at the end of the release, Q3 non-GAAP operating profit and operating margin were $2.177 billion and 24.1%, respectively.

Q3 GAAP net income and diluted earnings per share (EPS) were $1.143 billion and $0.89, respectively. As detailed in the financial schedules included at the end of this release, Q3 non-GAAP net income and non-GAAP diluted EPS were $1.750 billion and $1.36, respectively.

Guidance

The company reiterates its FY26 organic revenue growth of approximately 5.5% and diluted non-GAAP EPS guidance of $5.62 to $5.66. This includes a potential impact from tariffs of approximately $185 million, unchanged from the prior guidance. Excluding the potential impact from tariffs, this guidance represents FY26 diluted non-GAAP EPS growth of approximately 4.5%.

"This quarter, we again delivered accelerated growth while investing decisively in our future," said Thierry Piéton, Medtronic chief financial officer. "We continued to invest in R&D to strengthen our innovation pipeline, funded significant growth opportunities while driving G&A leverage, and we executed on our M&A and venture strategy with two key transactions in the quarter. Bottom line, we are executing on our roadmap and positioning the business for sustainable growth."

Video Webcast Information

Medtronic will host a video webcast today, February 17, at 8:00 a.m. EST (7:00 a.m. CST) to provide information about its business for the public, investors, analysts, and news media. This webcast can be accessed by clicking on the Quarterly Earnings icon at investorrelations.medtronic.com, and this earnings release will be archived at news.medtronic.com. Within 24 hours of the webcast, a replay of the webcast and transcript of the company's prepared remarks will be available by clicking on the Past Events and Presentations link under the News & Events drop-down at investorrelations.medtronic.com.

Financial Schedules and Earnings Presentation

The third quarter financial schedules and non-GAAP reconciliations can be viewed by clicking on the Quarterly Earnings link at investorrelations.medtronic.com. To view a printable PDF of the financial schedules and non-GAAP reconciliations, click here. To view the earnings presentation, click here.

About Medtronic

Bold thinking. Bolder actions. We are Medtronic. Medtronic plc, headquartered in Galway, Ireland, is the leading global healthcare technology company that boldly attacks the most challenging health problems facing humanity by searching out and finding solutions. Our Mission — to alleviate pain, restore health, and extend life — unites a global team of 95,000+ passionate people across more than 150 countries. Our technologies and therapies treat 70 health conditions and include cardiac devices, surgical robotics, insulin pumps, surgical tools, patient monitoring systems, and more. Powered by our diverse knowledge, insatiable curiosity, and desire to help all those who need it, we deliver innovative technologies that transform the lives of two people every second, every hour, every day. Expect more from us as we empower insight-driven care, experiences that put people first, and better outcomes for our world. In everything we do, we are engineering the extraordinary. For more information on Medtronic (NYSE: MDT), visit www.Medtronic.com and follow on LinkedIn.

FORWARD LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to risks and uncertainties, including risks related to competitive factors, difficulties and delays inherent in the development, manufacturing, marketing and sale of medical products, government regulation, geopolitical conflicts, changing global trade policies, material acquisition and divestiture transactions, general economic conditions, and other risks and uncertainties described in the company's periodic reports on file with the U.S. Securities and Exchange Commission including the most recent Annual Report on Form 10-K of the company. In some cases, you can identify these statements by forward-looking words or expressions, such as "anticipate," "believe," "could," "estimate," "expect," "forecast," "intend," "looking ahead," "may," "plan," "possible," "potential," "project," "should," "going to," "will," and similar words or expressions, the negative or plural of such words or expressions and other comparable terminology. Actual results may differ materially from anticipated results. Medtronic does not undertake to update its forward-looking statements or any of the information contained in this press release, including to reflect future events or circumstances.

NON-GAAP FINANCIAL MEASURES

This press release contains financial measures, including adjusted net income, adjusted diluted EPS, and organic revenue, which are considered "non-GAAP" financial measures under applicable SEC rules and regulations. References to quarterly or annual figures increasing, decreasing or remaining flat are in comparison to fiscal year 2025, and references to sequential changes are in comparison to the prior fiscal quarter. Unless stated otherwise, quarterly and annual rates and ranges are given on an organic basis.

Medtronic management believes that non-GAAP financial measures provide information useful to investors in understanding the company's underlying operational performance and trends and to facilitate comparisons with the performance of other companies in the med tech industry. Non-GAAP net income and diluted EPS exclude the effect of certain charges or gains that contribute to or reduce earnings but that result from transactions or events that management believes may or may not recur with similar materiality or impact to operations in future periods (Non-GAAP Adjustments). Medtronic generally uses non-GAAP financial measures to facilitate management's review of the operational performance of the company and as a basis for strategic planning. Non-GAAP financial measures should be considered supplemental to and not a substitute for financial information prepared in accordance with U.S. generally accepted accounting principles (GAAP), and investors are cautioned that Medtronic may calculate non-GAAP financial measures in a way that is different from other companies. Management strongly encourages investors to review the company's consolidated financial statements and publicly filed reports in their entirety. Reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the financial schedules accompanying this press release.

Medtronic calculates forward-looking non-GAAP financial measures based on internal forecasts that omit certain amounts that would be included in GAAP financial measures. For instance, forward-looking organic revenue growth guidance excludes the impact of foreign currency fluctuations, as well as significant acquisitions, divestitures, or other significant discrete items. Forward-looking diluted non-GAAP EPS guidance also excludes other potential charges or gains that would be recorded as Non-GAAP Adjustments to earnings during the fiscal year. Medtronic does not attempt to provide reconciliations of forward-looking non-GAAP EPS guidance to projected GAAP EPS guidance because the combined impact and timing of recognition of these potential charges or gains is inherently uncertain and difficult to predict and is unavailable without unreasonable efforts. In addition, the company believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. Such items could have a substantial impact on GAAP measures of financial performance.

Contacts:

Justin Paquette

Public Relations

+1-612-271-7935

Ingrid Goldberg

Investor Relations

+1-763-505-2696

MEDTRONIC PLC

WORLD WIDE REVENUE(1)

(Unaudited)

THIRD QUARTER

YEAR-TO-DATE

REPORTED

ORGANIC

REPORTED

ORGANIC

(in millions)

FY26

FY25

Growth

Currency

Impact(4)

FY26(5)

FY25(5)

Growth

FY26

FY25

Growth

Currency

Impact(4)

FY26(6)

FY25(6)

Growth

Cardiovascular

$ 3,457

$ 3,037

13.8 %

$ 99

$ 3,359

$ 3,037

10.6 %

$ 10,179

$ 9,145

11.3 %

$ 213

$ 9,966

$ 9,145

9.0 %

Cardiac Rhythm & Heart Failure

1,856

1,545

20.1

48

1,808

1,545

17.0

5,394

4,659

15.8

107

5,287

4,659

13.5

Structural Heart & Aortic

929

874

6.3

32

897

874

2.6

2,814

2,610

7.8

71

2,743

2,610

5.1

Coronary & Peripheral Vascular

672

618

8.8

18

654

618

5.9

1,971

1,876

5.0

35

1,935

1,876

3.1

Neuroscience

2,558

2,458

4.1

38

2,520

2,458

2.5

7,536

7,226

4.3

81

7,455

7,226

3.2

Cranial & Spinal Technologies

1,310

1,250

4.8

13

1,296

1,250

3.7

3,819

3,632

5.1

31

3,788

3,632

4.3

Specialty Therapies

746

732

1.9

15

731

732

(0.2)

2,191

2,181

0.4

28

2,163

2,181

(0.8)

Neuromodulation

503

476

5.8

10

493

476

3.6

1,527

1,413

8.1

22

1,504

1,413

6.5

Medical Surgical

2,173

2,072

4.9

61

2,112

2,057

2.7

6,428

6,196

3.7

128

6,295

6,164

2.1

Surgical & Endoscopy

1,654

1,596

3.6

51

1,603

1,581

1.4

4,945

4,790

3.2

106

4,834

4,758

1.6

Acute Care & Monitoring

519

476

9.1

10

509

476

7.0

1,483

1,406

5.5

22

1,461

1,406

3.9

Diabetes

796

694

14.8

44

751

694

8.3

2,274

2,027

12.2

90

2,184

2,027

7.8

Total Reportable Segments

8,985

8,260

8.8

242

8,743

8,245

6.0

26,417

24,593

7.4

512

25,901

24,562

5.4

Other(2)

32

32

3.0

—

—

—

—

140

17

NM(3)

4

—

—

—

TOTAL

$ 9,017

$ 8,292

8.7 %

$ 243

$ 8,743

$ 8,245

6.0 %

$ 26,557

$ 24,610

7.9 %

$ 516

$ 25,901

$ 24,562

5.4 %

| See description of non-GAAP financial measures contained in the press release dated February 17, 2026. | |

| (1) | The data in this schedule has been intentionally rounded to the nearest million and, therefore, may not sum. Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely. |

| (2) | Includes the historical operations and ongoing transition agreements from businesses the Company has exited or divested, and for the year-to-date figures, adjustments to the Company's Italian payback accruals resulting from the two July 22, 2024 rulings by the Constitutional Court and the Legislative Decree published by the Italian government on June 30, 2025 for certain prior years since 2015. |

| (3) | Not meaningful (NM). |

| (4) | The currency impact to revenue measures the change in revenue between current and prior year periods using constant exchange rates. |

| (5) | The three months ended January 23, 2026 excludes $275 million of revenue adjustments, including $32 million of inorganic revenue for the transition activity noted in (2) and $242 million of favorable currency impact on the remaining segments. The three months ended January 24, 2025 excludes $47 million of revenue adjustments, including $32 million of inorganic revenue related to the transition activity noted in (2) and $15 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division. |

| (6) | The nine months ended January 23, 2026 excludes $656 million of revenue adjustments, including $39 million reduction in the Italian payback accruals due to changes in estimates further described in note (2), $101 million of inorganic revenue for the transition activity noted in (2), $5 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division, and $512 million of favorable currency impact on the remaining segments. The nine months ended January 24, 2025 excludes $48 million of revenue adjustments, including $90 million of incremental Italian payback accruals further described in note (2), $106 million of inorganic revenue related to the transition activity noted in (2), and $31 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division. |

See description of non-GAAP financial measures contained in the press release dated February 17, 2026.

(1)

The data in this schedule has been intentionally rounded to the nearest million and, therefore, may not sum. Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

(2)

Includes the historical operations and ongoing transition agreements from businesses the Company has exited or divested, and for the year-to-date figures, adjustments to the Company's Italian payback accruals resulting from the two July 22, 2024 rulings by the Constitutional Court and the Legislative Decree published by the Italian government on June 30, 2025 for certain prior years since 2015.

(3)

Not meaningful (NM).

(4)

The currency impact to revenue measures the change in revenue between current and prior year periods using constant exchange rates.

(5)

The three months ended January 23, 2026 excludes $275 million of revenue adjustments, including $32 million of inorganic revenue for the transition activity noted in (2) and $242 million of favorable currency impact on the remaining segments. The three months ended January 24, 2025 excludes $47 million of revenue adjustments, including $32 million of inorganic revenue related to the transition activity noted in (2) and $15 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division.

(6)

The nine months ended January 23, 2026 excludes $656 million of revenue adjustments, including $39 million reduction in the Italian payback accruals due to changes in estimates further described in note (2), $101 million of inorganic revenue for the transition activity noted in (2), $5 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division, and $512 million of favorable currency impact on the remaining segments. The nine months ended January 24, 2025 excludes $48 million of revenue adjustments, including $90 million of incremental Italian payback accruals further described in note (2), $106 million of inorganic revenue related to the transition activity noted in (2), and $31 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division.

| MEDTRONIC PLC U.S. REVENUE(1)(2) (Unaudited) | ||||||||||||||||||||||||

| THIRD QUARTER | YEAR-TO-DATE | |||||||||||||||||||||||

| REPORTED | ORGANIC | REPORTED | ORGANIC | |||||||||||||||||||||

| (in millions) | FY26 | FY25 | Growth | FY26 | FY25 | Growth | FY26 | FY25 | Growth | FY26 | FY25 | Growth | ||||||||||||

| Cardiovascular | $ 1,589 | $ 1,405 | 13.1 % | $ 1,589 | $ 1,405 | 13.1 % | $ 4,660 | $ 4,242 | 9.9 % | $ 4,660 | $ 4,242 | 9.9 % | ||||||||||||

| Cardiac Rhythm & Heart Failure | 953 | 775 | 23.0 | 953 | 775 | 23.0 | 2,708 | 2,309 | 17.3 | 2,708 | 2,309 | 17.3 | ||||||||||||

| Structural Heart & Aortic | 367 | 372 | (1.4) | 367 | 372 | (1.4) | 1,128 | 1,129 | — | 1,128 | 1,129 | — | ||||||||||||

| Coronary & Peripheral Vascular | 269 | 258 | 4.2 | 269 | 258 | 4.2 | 824 | 804 | 2.5 | 824 | 804 | 2.5 | ||||||||||||

| Neuroscience | 1,709 | 1,689 | 1.2 | 1,709 | 1,689 | 1.2 | 5,063 | 4,931 | 2.7 | 5,063 | 4,931 | 2.7 | ||||||||||||

| Cranial & Spinal Technologies | 977 | 943 | 3.6 | 977 | 943 | 3.6 | 2,833 | 2,724 | 4.0 | 2,833 | 2,724 | 4.0 | ||||||||||||

| Specialty Therapies | 402 | 419 | (4.0) | 402 | 419 | (4.0) | 1,204 | 1,235 | (2.5) | 1,204 | 1,235 | (2.5) | ||||||||||||

| Neuromodulation | 330 | 327 | 1.1 | 330 | 327 | 1.1 | 1,026 | 972 | 5.6 | 1,026 | 972 | 5.6 | ||||||||||||

| Medical Surgical | 929 | 893 | 4.1 | 929 | 893 | 4.1 | 2,756 | 2,718 | 1.4 | 2,756 | 2,718 | 1.4 | ||||||||||||

| Surgical & Endoscopy | 634 | 623 | 1.7 | 634 | 623 | 1.7 | 1,920 | 1,928 | (0.4) | 1,920 | 1,928 | (0.4) | ||||||||||||

| Acute Care & Monitoring | 295 | 269 | 9.5 | 295 | 269 | 9.5 | 836 | 790 | 5.8 | 836 | 790 | 5.8 | ||||||||||||

| Diabetes | 248 | 236 | 4.9 | 248 | 236 | 4.9 | 695 | 683 | 1.7 | 695 | 683 | 1.7 | ||||||||||||

| Total Reportable Segments | 4,475 | 4,223 | 6.0 | 4,475 | 4,223 | 6.0 | 13,174 | 12,573 | 4.8 | 13,174 | 12,573 | 4.8 | ||||||||||||

| Other(3) | 18 | 15 | 23.4 | — | — | — | 60 | 51 | 16.8 | — | — | — | ||||||||||||

| TOTAL | $ 4,493 | $ 4,237 | 6.0 % | $ 4,475 | $ 4,223 | 6.0 % | $ 13,234 | $ 12,624 | 4.8 % | $ 13,174 | $ 12,573 | 4.8 % | ||||||||||||

MEDTRONIC PLC

U.S. REVENUE(1)(2)

(Unaudited)

THIRD QUARTER

YEAR-TO-DATE

REPORTED

ORGANIC

REPORTED

ORGANIC

(in millions)

FY26

FY25

Growth

FY26

FY25

Growth

FY26

FY25

Growth

FY26

FY25

Growth

Cardiovascular

$ 1,589

$ 1,405

13.1 %

$ 1,589

$ 1,405

13.1 %

$ 4,660

$ 4,242

9.9 %

$ 4,660

$ 4,242

9.9 %

Cardiac Rhythm & Heart Failure

953

775

23.0

953

775

23.0

2,708

2,309

17.3

2,708

2,309

17.3

Structural Heart & Aortic

367

372

(1.4)

367

372

(1.4)

1,128

1,129

—

1,128

1,129

—

Coronary & Peripheral Vascular

269

258

4.2

269

258

4.2

824

804

2.5

824

804

2.5

Neuroscience

1,709

1,689

1.2

1,709

1,689

1.2

5,063

4,931

2.7

5,063

4,931

2.7

Cranial & Spinal Technologies

977

943

3.6

977

943

3.6

2,833

2,724

4.0

2,833

2,724

4.0

Specialty Therapies

402

419

(4.0)

402

419

(4.0)

1,204

1,235

(2.5)

1,204

1,235

(2.5)

Neuromodulation

330

327

1.1

330

327

1.1

1,026

972

5.6

1,026

972

5.6

Medical Surgical

929

893

4.1

929

893

4.1

2,756

2,718

1.4

2,756

2,718

1.4

Surgical & Endoscopy

634

623

1.7

634

623

1.7

1,920

1,928

(0.4)

1,920

1,928

(0.4)

Acute Care & Monitoring

295

269

9.5

295

269

9.5

836

790

5.8

836

790

5.8

Diabetes

248

236

4.9

248

236

4.9

695

683

1.7

695

683

1.7

Total Reportable Segments

4,475

4,223

6.0

4,475

4,223

6.0

13,174

12,573

4.8

13,174

12,573

4.8

Other(3)

18

15

23.4

—

—

—

60

51

16.8

—

—

—

TOTAL

$ 4,493

$ 4,237

6.0 %

$ 4,475

$ 4,223

6.0 %

$ 13,234

$ 12,624

4.8 %

$ 13,174

$ 12,573

4.8 %

| See description of non-GAAP financial measures contained in the press release dated February 17, 2026. | |

| (1) | U.S. includes the United States and U.S. territories. |

| (2) | The data in this schedule has been intentionally rounded to the nearest million and, therefore, may not sum. Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely. |

| (3) | Includes historical operations and ongoing transition agreements from businesses the Company has exited or divested. |

See description of non-GAAP financial measures contained in the press release dated February 17, 2026.

(1)

U.S. includes the United States and U.S. territories.

(2)

The data in this schedule has been intentionally rounded to the nearest million and, therefore, may not sum. Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

(3)

Includes historical operations and ongoing transition agreements from businesses the Company has exited or divested.

| MEDTRONIC PLC INTERNATIONAL REVENUE(1) (Unaudited) | ||||||||||||||||||||||||||||

| THIRD QUARTER | YEAR-TO-DATE | |||||||||||||||||||||||||||

| REPORTED | ORGANIC | REPORTED | ORGANIC | |||||||||||||||||||||||||

| (in millions) | FY26 | FY25 | Growth | Currency | FY26(5) | FY25(5) | Growth | FY26 | FY25 | Growth | Currency | FY26(6) | FY25(6) | Growth | ||||||||||||||

| Cardiovascular | $ 1,868 | $ 1,632 | 14.5 % | $ 99 | $ 1,770 | $ 1,632 | 8.5 % | $ 5,519 | $ 4,904 | 12.5 % | $ 213 | $ 5,306 | $ 4,904 | 8.2 % | ||||||||||||||

| Cardiac Rhythm & Heart Failure | 903 | 770 | 17.3 | 48 | 855 | 770 | 11.0 | 2,686 | 2,350 | 14.3 | 107 | 2,580 | 2,350 | 9.8 | ||||||||||||||

| Structural Heart & Aortic | 562 | 502 | 12.0 | 32 | 530 | 502 | 5.5 | 1,686 | 1,482 | 13.8 | 71 | 1,615 | 1,482 | 9.0 | ||||||||||||||

| Coronary & Peripheral Vascular | 403 | 360 | 12.2 | 18 | 385 | 360 | 7.1 | 1,146 | 1,072 | 6.9 | 35 | 1,111 | 1,072 | 3.6 | ||||||||||||||

| Neuroscience | 849 | 769 | 10.4 | 38 | 811 | 769 | 5.4 | 2,474 | 2,295 | 7.8 | 81 | 2,392 | 2,295 | 4.2 | ||||||||||||||

| Cranial & Spinal Technologies | 333 | 307 | 8.4 | 13 | 320 | 307 | 4.1 | 985 | 907 | 8.6 | 31 | 955 | 907 | 5.2 | ||||||||||||||

| Specialty Therapies | 343 | 313 | 9.7 | 15 | 328 | 313 | 5.0 | 987 | 947 | 4.3 | 28 | 959 | 947 | 1.3 | ||||||||||||||

| Neuromodulation | 173 | 149 | 16.0 | 10 | 163 | 149 | 9.1 | 501 | 441 | 13.5 | 22 | 478 | 441 | 8.4 | ||||||||||||||

| Medical Surgical | 1,244 | 1,180 | 5.5 | 61 | 1,183 | 1,165 | 1.6 | 3,671 | 3,478 | 5.6 | 128 | 3,539 | 3,447 | 2.7 | ||||||||||||||

| Surgical & Endoscopy | 1,020 | 973 | 4.8 | 51 | 969 | 958 | 1.1 | 3,024 | 2,862 | 5.7 | 106 | 2,914 | 2,831 | 2.9 | ||||||||||||||

| Acute Care & Monitoring | 224 | 206 | 8.5 | 10 | 214 | 206 | 3.8 | 647 | 616 | 5.0 | 22 | 625 | 616 | 1.4 | ||||||||||||||

| Diabetes | 548 | 457 | 19.8 | 44 | 504 | 457 | 10.1 | 1,579 | 1,344 | 17.5 | 90 | 1,489 | 1,344 | 10.9 | ||||||||||||||

| Total Reportable Segments | 4,510 | 4,038 | 11.7 | 242 | 4,267 | 4,023 | 6.1 | 13,243 | 12,020 | 10.2 | 512 | 12,726 | 11,989 | 6.2 | ||||||||||||||

| Other(2) | 14 | 17 | (14.6) | — | — | — | — | 80 | (35) | NM(3) | 4 | — | — | — | ||||||||||||||

| TOTAL | $ 4,524 | $ 4,055 | 11.6 % | $ 243 | $ 4,267 | $ 4,023 | 6.1 % | $ 13,323 | $ 11,986 | 11.2 % | $ 516 | $ 12,726 | $ 11,989 | 6.2 % | ||||||||||||||

MEDTRONIC PLC

INTERNATIONAL REVENUE(1)

(Unaudited)

THIRD QUARTER

YEAR-TO-DATE

REPORTED

ORGANIC

REPORTED

ORGANIC

(in millions)

FY26

FY25

Growth

Currency

Impact(4)

FY26(5)

FY25(5)

Growth

FY26

FY25

Growth

Currency

Impact(4)

FY26(6)

FY25(6)

Growth

Cardiovascular

$ 1,868

$ 1,632

14.5 %

$ 99

$ 1,770

$ 1,632

8.5 %

$ 5,519

$ 4,904

12.5 %

$ 213

$ 5,306

$ 4,904

8.2 %

Cardiac Rhythm & Heart Failure

903

770

17.3

48

855

770

11.0

2,686

2,350

14.3

107

2,580

2,350

9.8

Structural Heart & Aortic

562

502

12.0

32

530

502

5.5

1,686

1,482

13.8

71

1,615

1,482

9.0

Coronary & Peripheral Vascular

403

360

12.2

18

385

360

7.1

1,146

1,072

6.9

35

1,111

1,072

3.6

Neuroscience

849

769

10.4

38

811

769

5.4

2,474

2,295

7.8

81

2,392

2,295

4.2

Cranial & Spinal Technologies

333

307

8.4

13

320

307

4.1

985

907

8.6

31

955

907

5.2

Specialty Therapies

343

313

9.7

15

328

313

5.0

987

947

4.3

28

959

947

1.3

Neuromodulation

173

149

16.0

10

163

149

9.1

501

441

13.5

22

478

441

8.4

Medical Surgical

1,244

1,180

5.5

61

1,183

1,165

1.6

3,671

3,478

5.6

128

3,539

3,447

2.7

Surgical & Endoscopy

1,020

973

4.8

51

969

958

1.1

3,024

2,862

5.7

106

2,914

2,831

2.9

Acute Care & Monitoring

224

206

8.5

10

214

206

3.8

647

616

5.0

22

625

616

1.4

Diabetes

548

457

19.8

44

504

457

10.1

1,579

1,344

17.5

90

1,489

1,344

10.9

Total Reportable Segments

4,510

4,038

11.7

242

4,267

4,023

6.1

13,243

12,020

10.2

512

12,726

11,989

6.2

Other(2)

14

17

(14.6)

—

—

—

—

80

(35)

NM(3)

4

—

—

—

TOTAL

$ 4,524

$ 4,055

11.6 %

$ 243

$ 4,267

$ 4,023

6.1 %

$ 13,323

$ 11,986

11.2 %

$ 516

$ 12,726

$ 11,989

6.2 %

| See description of non-GAAP financial measures contained in the press release dated February 17, 2026. | |

| (1) | The data in this schedule has been intentionally rounded to the nearest million and, therefore, may not sum. Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely. |

| (2) | Includes the historical operations and ongoing transition agreements from businesses the Company has exited or divested, and for the year-to-date figures, adjustments to the Company's Italian payback accruals resulting from the two July 22, 2024 rulings by the Constitutional Court and the Legislative Decree published by the Italian government on June 30, 2025 for certain prior years since 2015. |

| (3) | Not meaningful (NM). |

| (4) | The currency impact to revenue measures the change in revenue between current and prior year periods using constant exchange rates. |

| (5) | The three months ended January 23, 2026 excludes $257 million of revenue adjustments, including $14 million of inorganic revenue for the transition activity noted in (2) and $242 million of favorable currency impact on the remaining segments. The three months ended January 24, 2025 excludes $32 million of revenue adjustments, including $17 million of inorganic revenue related to the transition activity noted in (2) and $15 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division. |

| (6) | The nine months ended January 23, 2026 excludes $597 million of revenue adjustments, including $39 million reduction in the Italian payback accruals due to changes in estimates further described in note (2), $41 million of inorganic revenue for the transition activity noted in (2), $5 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division, and $512 million of favorable currency impact on the remaining segments. The nine months ended January 24, 2025 excludes $3 million of revenue adjustments, including $90 million of incremental Italian payback accruals further described in note (2), $55 million of inorganic revenue related to the transition activity noted in (2), and $31 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division. |

See description of non-GAAP financial measures contained in the press release dated February 17, 2026.

(1)

The data in this schedule has been intentionally rounded to the nearest million and, therefore, may not sum. Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

(2)

Includes the historical operations and ongoing transition agreements from businesses the Company has exited or divested, and for the year-to-date figures, adjustments to the Company's Italian payback accruals resulting from the two July 22, 2024 rulings by the Constitutional Court and the Legislative Decree published by the Italian government on June 30, 2025 for certain prior years since 2015.

(3)

Not meaningful (NM).

(4)

The currency impact to revenue measures the change in revenue between current and prior year periods using constant exchange rates.

(5)

The three months ended January 23, 2026 excludes $257 million of revenue adjustments, including $14 million of inorganic revenue for the transition activity noted in (2) and $242 million of favorable currency impact on the remaining segments. The three months ended January 24, 2025 excludes $32 million of revenue adjustments, including $17 million of inorganic revenue related to the transition activity noted in (2) and $15 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division.

(6)

The nine months ended January 23, 2026 excludes $597 million of revenue adjustments, including $39 million reduction in the Italian payback accruals due to changes in estimates further described in note (2), $41 million of inorganic revenue for the transition activity noted in (2), $5 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division, and $512 million of favorable currency impact on the remaining segments. The nine months ended January 24, 2025 excludes $3 million of revenue adjustments, including $90 million of incremental Italian payback accruals further described in note (2), $55 million of inorganic revenue related to the transition activity noted in (2), and $31 million of inorganic revenue related to a sale of business in the Surgical and Endoscopy division.

| MEDTRONIC PLC CONSOLIDATED STATEMENTS OF INCOME (Unaudited) | |||||||

| Three months ended | Nine months ended | ||||||

| (in millions, except per share data) | January 23, 2026 | January 24, 2025 | January 23, 2026 | January 24, 2025 | |||

| Net sales | $ 9,017 | $ 8,292 | $ 26,557 | $ 24,610 | |||

| Costs and expenses: | |||||||

| Cost of products sold, excluding amortization of intangible assets | 3,261 | 2,779 | 9,323 | 8,485 | |||

| Research and development expense | 722 | 675 | 2,202 | 2,048 | |||

| Selling, general, and administrative expense | 2,956 | 2,717 | 8,727 | 8,129 | |||

| Amortization of intangible assets | 441 | 416 | 1,364 | 1,243 | |||

| Restructuring charges, net | 77 | 43 | 131 | 120 | |||

| Certain litigation charges, net | 62 | 22 | 89 | 104 | |||

| Other operating expense (income), net | 35 | (5) | 126 | (38) | |||

| Operating profit | 1,464 | 1,646 | 4,594 | 4,519 | |||

| Other non-operating income, net | (121) | (72) | (247) | (403) | |||

| Interest expense, net | 181 | 179 | 539 | 555 | |||

| Income before income taxes | 1,404 | 1,540 | 4,302 | 4,367 | |||

| Income tax provision | 254 | 237 | 724 | 737 | |||

| Net income | 1,150 | 1,303 | 3,578 | 3,630 | |||

| Net income attributable to noncontrolling interests | (6) | (9) | (21) | (24) | |||

| Net income attributable to Medtronic | $ 1,143 | $ 1,294 | $ 3,557 | $ 3,606 | |||

| Basic earnings per share | $ 0.89 | $ 1.01 | $ 2.77 | $ 2.80 | |||

| Diluted earnings per share | $ 0.89 | $ 1.01 | $ 2.76 | $ 2.79 | |||

| Basic weighted average shares outstanding | 1,282.6 | 1,282.4 | 1,282.1 | 1,286.7 | |||

| Diluted weighted average shares outstanding | 1,289.5 | 1,286.2 | 1,288.2 | 1,290.6 | |||

MEDTRONIC PLC

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

Three months ended

Nine months ended

(in millions, except per share data)

January 23, 2026

January 24, 2025

January 23, 2026

January 24, 2025

Net sales

$ 9,017

$ 8,292

$ 26,557

$ 24,610

Costs and expenses:

Cost of products sold, excluding amortization of intangible assets

3,261

2,779

9,323

8,485

Research and development expense

722

675

2,202

2,048

Selling, general, and administrative expense

2,956

2,717

8,727

8,129

Amortization of intangible assets

441

416

1,364

1,243

Restructuring charges, net

77

43

131

120

Certain litigation charges, net

62

22

89

104

Other operating expense (income), net

35

(5)

126

(38)

Operating profit

1,464

1,646

4,594

4,519

Other non-operating income, net

(121)

(72)

(247)

(403)

Interest expense, net

181

179

539

555

Income before income taxes

1,404

1,540

4,302

4,367

Income tax provision

254

237

724

737

Net income

1,150

1,303

3,578

3,630

Net income attributable to noncontrolling interests

(6)

(9)

(21)

(24)

Net income attributable to Medtronic

$ 1,143

$ 1,294

$ 3,557

$ 3,606

Basic earnings per share

$ 0.89

$ 1.01

$ 2.77

$ 2.80

Diluted earnings per share

$ 0.89

$ 1.01

$ 2.76

$ 2.79

Basic weighted average shares outstanding

1,282.6

1,282.4

1,282.1

1,286.7

Diluted weighted average shares outstanding

1,289.5

1,286.2

1,288.2

1,290.6

| The data in the schedule above has been intentionally rounded to the nearest million. |

The data in the schedule above has been intentionally rounded to the nearest million.

| MEDTRONIC PLC GAAP TO NON-GAAP RECONCILIATIONS(1) (Unaudited) | |||||||||||||||||

| Three months ended January 23, 2026 | |||||||||||||||||

| (in millions, except per share data) | Net | Cost of | Gross | Operating | Operating | Income | Net Income | Diluted | Effective | ||||||||

| GAAP | $ 9,017 | $ 3,261 | 63.8 % | $ 1,464 | 16.2 % | $ 1,404 | $ 1,143 | $ 0.89 | 18.1 % | ||||||||

| Non-GAAP Adjustments: | |||||||||||||||||

| Amortization of intangible assets(2) | — | — | — | 441 | 4.9 | 441 | 360 | 0.28 | 18.4 | ||||||||

| Restructuring and associated costs(3) | — | (89) | 1.0 | 172 | 1.9 | 172 | 141 | 0.11 | 18.0 | ||||||||

| Acquisition and divestiture-related items(4) | — | (6) | 0.1 | 38 | 0.4 | 38 | 33 | 0.03 | 13.2 | ||||||||

| Certain litigation charges, net | — | — | — | 62 | 0.7 | 62 | 52 | 0.04 | 16.1 | ||||||||

| (Gain)/loss on minority investments(5) | — | — | — | — | — | 8 | 7 | 0.01 | 12.5 | ||||||||

| Certain tax adjustments, net | — | — | — | — | — | — | 14 | 0.01 | — | ||||||||

| Non-GAAP | $ 9,017 | $ 3,166 | 64.9 % | $ 2,177 | 24.1 % | $ 2,125 | $ 1,750 | $ 1.36 | 17.3 % | ||||||||

| Currency impact | (243) | (52) | (0.4) | (67) | (0.1) | (0.04) | |||||||||||

| Currency Adjusted | $ 8,775 | $ 3,114 | 64.5 % | $ 2,110 | 24.0 % | $ 1.32 | |||||||||||

| Three months ended January 24, 2025 | |||||||||||||||||

| (in millions, except per share data) | Net | Cost of | Gross | Operating | Operating | Income | Net Income | Diluted | Effective | ||||||||

| GAAP | $ 8,292 | $ 2,779 | 66.5 % | $ 1,646 | 19.9 % | $ 1,540 | $ 1,294 | $ 1.01 | 15.4 % | ||||||||

| Non-GAAP Adjustments: | |||||||||||||||||

| Amortization of intangible assets | — | — | — | 416 | 5.0 | 416 | 339 | 0.26 | 18.5 | ||||||||

| Restructuring and associated costs(3) | — | (4) | — | 46 | 0.6 | 46 | 37 | 0.03 | 19.6 | ||||||||

| Acquisition and divestiture-related items(4) | — | (1) | — | 28 | 0.3 | 28 | 23 | 0.02 | 17.9 | ||||||||

| Certain litigation charges, net | — | — | — | 22 | 0.3 | 22 | 18 | 0.01 | 22.7 | ||||||||

| (Gain)/loss on minority investments(5) | — | — | — | — | — | 68 | 52 | 0.04 | 22.1 | ||||||||

| Medical device regulations(6) | — | (8) | 0.1 | 11 | 0.1 | 11 | 9 | 0.01 | 18.2 | ||||||||

| Certain tax adjustments, net | — | — | — | — | — | — | 15 | 0.01 | — | ||||||||

| Non-GAAP | $ 8,292 | $ 2,766 | 66.6 % | $ 2,169 | 26.2 % | $ 2,130 | $ 1,787 | $ 1.39 | 15.7 % | ||||||||

MEDTRONIC PLC

GAAP TO NON-GAAP RECONCILIATIONS(1)

(Unaudited)

Three months ended January 23, 2026

(in millions, except per share data)

Net

Sales

Cost of

Products

Sold

Gross

Margin

Percent

Operating

Profit

Operating

Profit

Percent

Income

Before

Income

Taxes

Net Income

attributable

to

Medtronic

Diluted

EPS

Effective

Tax Rate

GAAP

$ 9,017

$ 3,261

63.8 %

$ 1,464

16.2 %

$ 1,404

$ 1,143

$ 0.89

18.1 %

Non-GAAP Adjustments:

Amortization of intangible assets(2)

—

—

—

441

4.9

441

360

0.28

18.4

Restructuring and associated costs(3)

—

(89)

1.0

172

1.9

172

141

0.11

18.0

Acquisition and divestiture-related items(4)

—

(6)

0.1

38

0.4

38

33

0.03

13.2

Certain litigation charges, net

—

—

—

62

0.7

62

52

0.04

16.1

(Gain)/loss on minority investments(5)

—

—

—

—

—

8

7

0.01

12.5

Certain tax adjustments, net

—

—

—

—

—

—

14

0.01

—

Non-GAAP

$ 9,017

$ 3,166

64.9 %

$ 2,177

24.1 %

$ 2,125

$ 1,750

$ 1.36

17.3 %

Currency impact

(243)

(52)

(0.4)

(67)

(0.1)

(0.04)

Currency Adjusted

$ 8,775

$ 3,114

64.5 %

$ 2,110

24.0 %

$ 1.32

Three months ended January 24, 2025

(in millions, except per share data)

Net

Sales

Cost of

Products

Sold

Gross

Margin

Percent

Operating

Profit

Operating

Profit

Percent

Income

Before

Income

Taxes

Net Income

attributable

to

Medtronic

Diluted

EPS

Effective

Tax Rate

GAAP

$ 8,292

$ 2,779

66.5 %

$ 1,646

19.9 %

$ 1,540

$ 1,294

$ 1.01

15.4 %

Non-GAAP Adjustments:

Amortization of intangible assets

—

—

—

416

5.0

416

339

0.26

18.5

Restructuring and associated costs(3)

—

(4)

—

46

0.6

46

37

0.03

19.6

Acquisition and divestiture-related items(4)

—

(1)

—

28

0.3

28

23

0.02

17.9

Certain litigation charges, net

—

—

—

22

0.3

22

18

0.01

22.7

(Gain)/loss on minority investments(5)

—

—

—

—

—

68

52

0.04

22.1

Medical device regulations(6)

—

(8)

0.1

11

0.1

11

9

0.01

18.2

Certain tax adjustments, net

—

—

—

—

—

—

15

0.01

—

Non-GAAP

$ 8,292

$ 2,766

66.6 %

$ 2,169

26.2 %

$ 2,130

$ 1,787

$ 1.39

15.7 %

| See description of non-GAAP financial measures contained in the press release dated February 17, 2026. | |

| (1) | The data in this schedule has been intentionally rounded to the nearest million or $0.01 for EPS figures, and, therefore, may not sum. |

| (2) | The Company recognized $30 million of accelerated amortization on certain intangible assets within the Cardiovascular Portfolio. |

| (3) | The charges primarily relate to employee termination benefits, facility related and contract termination costs, and asset write offs. |

| (4) | The charges primarily include business combination costs, changes in fair value of contingent consideration, exit of business-related charges, and gains related to certain business or asset sales. Exit of business-related charges primarily relate to the impending separation of the Diabetes business. For the three months ended January 23, 2026, charges also include costs associated with the Company's June 2021 decision to stop the distribution and sale of the Medtronic HVAD System. |

| (5) | We exclude unrealized and realized gains and losses on our minority investments as we do not believe that these components of income or expense have a direct correlation to our ongoing or future business operations. |

| (6) | The charges represent incremental costs of complying with the new European Union (E.U.) medical device regulations for previously registered products and primarily include charges for contractors supporting the project and other direct third-party expenses. We consider these costs to be duplicative of previously incurred costs and/or one-time costs. |

See description of non-GAAP financial measures contained in the press release dated February 17, 2026.

(1)

The data in this schedule has been intentionally rounded to the nearest million or $0.01 for EPS figures, and, therefore, may not sum.

(2)

The Company recognized $30 million of accelerated amortization on certain intangible assets within the Cardiovascular Portfolio.

(3)

The charges primarily relate to employee termination benefits, facility related and contract termination costs, and asset write offs.

(4)

The charges primarily include business combination costs, changes in fair value of contingent consideration, exit of business-related charges, and gains related to certain business or asset sales. Exit of business-related charges primarily relate to the impending separation of the Diabetes business. For the three months ended January 23, 2026, charges also include costs associated with the Company's June 2021 decision to stop the distribution and sale of the Medtronic HVAD System.

(5)

We exclude unrealized and realized gains and losses on our minority investments as we do not believe that these components of income or expense have a direct correlation to our ongoing or future business operations.

(6)

The charges represent incremental costs of complying with the new European Union (E.U.) medical device regulations for previously registered products and primarily include charges for contractors supporting the project and other direct third-party expenses. We consider these costs to be duplicative of previously incurred costs and/or one-time costs.

| MEDTRONIC PLC GAAP TO NON-GAAP RECONCILIATIONS(1) (Unaudited) | |||||||||||||||||

| Nine months ended January 23, 2026 | |||||||||||||||||

| (in millions, except per share data) | Net | Cost of | Gross | Operating | Operating | Income | Net Income | Diluted | Effective | ||||||||

| GAAP | $ 26,557 | $ 9,323 | 64.9 % | $ 4,594 | 17.3 % | $ 4,302 | $ 3,557 | $ 2.76 | 16.8 % | ||||||||

| Non-GAAP Adjustments: | |||||||||||||||||

| Amortization of intangible assets(2) | — | — | — | 1,364 | 5.2 | 1,364 | 1,110 | 0.86 | 18.6 | ||||||||

| Restructuring and associated costs(3) | — | (105) | 0.4 | 251 | 1.0 | 251 | 202 | 0.16 | 19.5 | ||||||||

| Acquisition and divestiture-related items(4) | — | (21) | — | 96 | 0.4 | 96 | 73 | 0.06 | 24.0 | ||||||||