NEW YORK (AP) — Wall Street sank on Tuesday as rising pressure from the bond market pulled U.S. stocks further from their records.

The S&P 500 fell 0.7% for its worst day in a month after paring a loss that earlier reached 1.5%. The Dow Jones Industrial Average dropped 249 points, or 0.5%, and the Nasdaq composite lost 0.8%. All three are still relatively close to their recently set all-time highs.

Big Tech companies led the market lower. They’ve been soaring for years on expectations that they’ll continue to dominate the economy, but they have also shot so high that critics say their prices have become too expensive.

Nvidia, whose chips are powering much of the world’s move into artificial-intelligence technology, fell 2% and was the single strongest force pulling the S&P 500 downward. Amazon sank 1.6%, and Apple dropped 1%.

The overall stock market felt pressure from rising yields in the bond market, where the 10-year Treasury yield climbed to 4.27% from 4.23% late Friday. When bonds are paying more in interest, investors are less willing to pay high prices for stocks.

Longer-term bond yields are on the rise around the world, in part because of worries about how difficult it will be for governments to repay their growing mountains of debt.

In the United States, longer-term Treasury yields are feeling additional pressure from President Donald Trump’s attacks on the Federal Reserve for not cutting interest rates sooner. The fear is that a less independent Fed will be less likely to make the unpopular decisions needed to keep inflation under control over the long term, such as keeping short-term rates higher than investors would like.

Tuesday was also the first opportunity for trading after a federal appeals court ruled late Friday that Trump overstepped his legal authority when announcing sweeping tariffs on almost every country on Earth, though it left the tariffs in place for now.

Trump’s tariffs have certainly created confusion across the global economy and may have hurt the U.S. job market. But less income from them could also force the U.S. government to borrow more to pay its bills, according to Scott Wren, senior global market strategist at Wells Fargo Investment Institute.

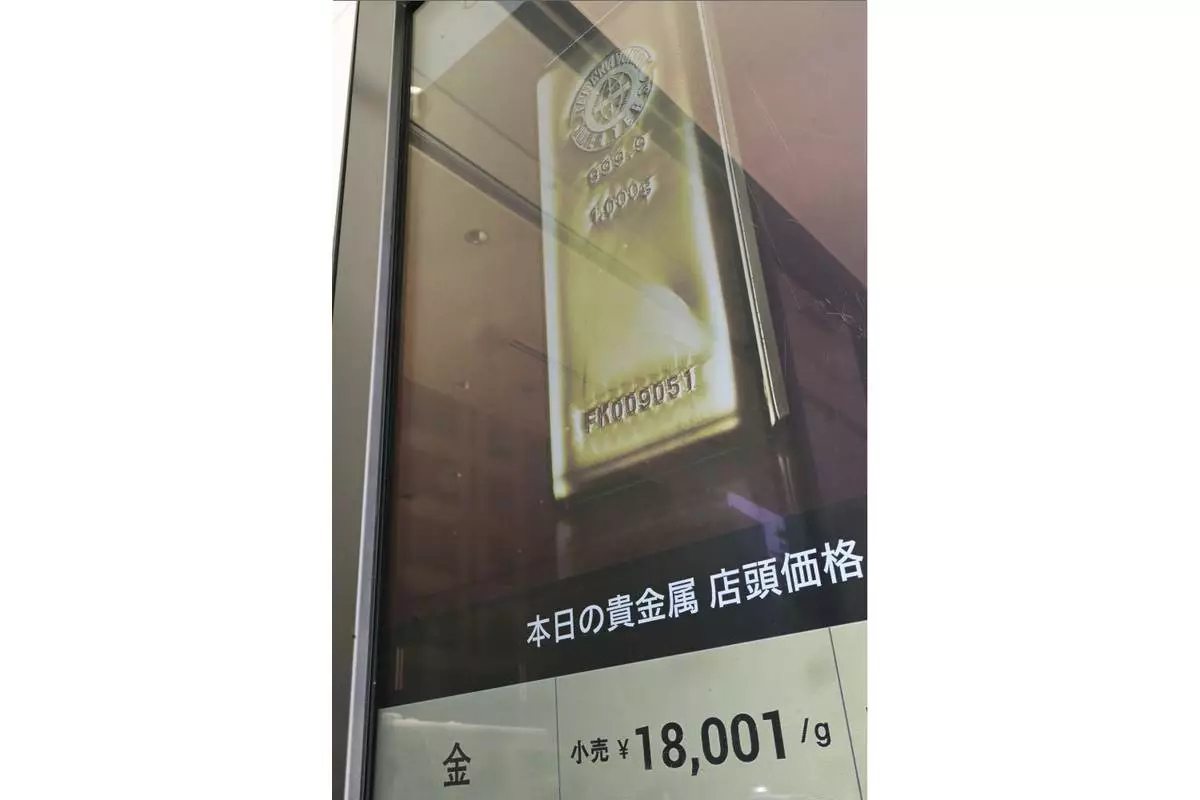

In another signal of increasing worries in financial markets, the price of gold rose to touch another record. The metal has often provided a haven for investors in times of uncertainty.

Treasury yields briefly trimmed their gains after a report on Tuesday said U.S. manufacturing shrank by more last month than economists expected. Many companies told the Institute for Supply Management that tariffs are continuing to make conditions chaotic.

“Too much uncertainty for us and our customers regarding tariffs and the U.S./global economy,” one company in the chemical products industry said, while noting that orders across most product lines have weakened.

The worse-than-expected data on manufacturing could give the Federal Reserve more leeway to cut its main interest rate for the first time this year at its next meeting in a couple of weeks. That’s the widespread expectation among traders, though economic reports coming later this week could change things.

The highlight for the week is coming on Friday, when economists expect a report to show that U.S. employers upped their hiring by a bit last month. Last month’s weaker-than-expected jobs report raised worries about the economy and cranked up expectations for coming cuts to rates by the Fed.

On Wall Street, Constellation Brands tumbled 6.6% after the beer, wine and spirits company warned that it’s seen a slowdown in purchases of its high-end beers, particularly among its Hispanic customers. That pushed it to slash its forecast for profit this fiscal year.

Kraft Heinz fell 7% after announcing that it’s splitting into two, a decade after a merger of the brands created one of the biggest food companies on the planet.

One of the companies will include shelf stable meals and include brands such as Heinz, Philadelphia cream cheese and Kraft Mac & Cheese. The other will include the Oscar Mayer, Kraft Singles and Lunchables brands. The official names of the two companies will be released later.

Among the stock market’s few gainers was PepsiCo, which rose 1.1% after an investment firm said it sent suggestions to the company’s board to reaccelerate its growth and boost financial performance. The investor, Elliott Investment Management, has a history of buying into companies and pushing for big changes that can lead to better stock performance.

All told, the S&P 500 fell 44.72 points to 6,415.54. The Dow Jones Industrial Average dropped 249.07 to 45,295.81, and the Nasdaq composite sank 175.92 to 21,279.63.

In stock markets abroad, indexes slumped across Europe, with Germany’s DAX losing 2.3%. That followed a more mixed finish in Asia, where indexes rose 0.9% in Seoul but fell 0.5% in Hong Kong.

AP Business Writer Elaine Kurtenbach contributed.

An electronic notice board shows the price of gold at a jewelry shop in Tokyo Monday, Sept. 1, 2025. (Kenichiro Kojima/Kyodo News via AP)

Currency traders watch monitors near a screen showing the Korea Composite Stock Price Index (KOSPI), top left, and the foreign exchange rate between U.S. dollar and South Korean won, top center, at the foreign exchange dealing room of the Hana Bank headquarters in Seoul, South Korea, Tuesday, Sept. 2, 2025. (AP Photo/Ahn Young-joon)

A currency trader watches monitors near a screen showing the Korea Composite Stock Price Index (KOSPI), left, and the foreign exchange rate between U.S. dollar and South Korean won at the foreign exchange dealing room of the Hana Bank headquarters in Seoul, South Korea, Tuesday, Sept. 2, 2025. (AP Photo/Ahn Young-joon)

Currency traders watch monitors near a screen showing the Korea Composite Stock Price Index (KOSPI) at the foreign exchange dealing room of the Hana Bank headquarters in Seoul, South Korea, Tuesday, Sept. 2, 2025. (AP Photo/Ahn Young-joon)

A currency trader passes by screens showing the Korea Composite Stock Price Index (KOSPI), center left, and the foreign exchange rate between U.S. dollar and South Korean won, center, at the foreign exchange dealing room of the Hana Bank headquarters in Seoul, South Korea, Tuesday, Sept. 2, 2025. (AP Photo/Ahn Young-joon)