TORONTO--(BUSINESS WIRE)--Dec 18, 2025--

Rupert Resources Ltd (“ Rupert ” or the “ Company ”) today provides an update on its exploration strategy across its existing 425km 2 land package and the addition of 1150km 2 of new exploration permit applications and reservations in the Central Lapland Belt (“CLB”), of Northern Finland. The updated exploration strategy will be progressed in parallel with the advancement of the Ikkari project through the feasibility study and environmental permitting during 2026.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20251218147217/en/

HIGHLIGHTS

Graham Crew, Chief Executive Officer of Rupert Resources said:

“Following a structured and extensive review of our exploration strategy and the impressive dataset gathered over the past decade in the Central Lapland Belt, we remain highly encouraged by the prospectivity of our land position. The consolidation of additional ground across key structural targets reflects our confidence in the belt-scale opportunity.

As Ikkari progresses toward development, we are purposefully rebalancing our exploration portfolio. Near-mine exploration will continue to focus on high-return opportunities, while deeper, capital-intensive drilling in and around the Ikkari deposit is deferred until it can be funded from operating cash flow. In parallel, we are increasing our focus on regional greenfield exploration where the potential exists to replicate the low discovery cost and transformational impact the Ikkari discovery achieved. This disciplined approach is aimed at building a pipeline of potential projects and delivering value for our shareholders.”

Exploration Strategy Review

During the 2025 summer season, Rupert’s exploration team, complimented by external experts conducted a review of all exploration data gathered since the Company began exploration in the CLB in 2016.

The review incorporated a reassessment of existing targets and a belt-scale targeting exercise that leveraged geological insights gained from the Ikkari discovery and resource development as well as advanced analytical tools such as the Vrify AI platform. This work identified several underexplored structural corridors with the potential to host deposits of similar scale.

Scope of the review

The review process was built around the significant data set that has been gathered by the Company over ten years of exploration activities in the CLB and complimented by extensive and world-class regional geophysical database supplied through the Geological Survey of Finland (GTK). The Company data set included:

Since 2016 the exploration team has refined its targeting model and exploration processes, delineating bedrock mineralisation at 8 separate targets including the 4.1Moz Ikkari deposit (see press release February 18, 2025). The exploration model has proven both successful and cost effective over challenging terrain with limited outcrop and bedrock covered by glacial till.

External consultants

This review was carried out by the Company’s exploration team complimented by world renowned external experts:

Next steps for Area-1

Since the Ikkari discovery, exploration has focused predominantly on targets within a nominal trucking distance of the proposed Ikkari mill. To date, this work has delineated a number of mineralised prospects, and the most promising targets, Heinä South and Heinä SW, will continue to be advanced with follow-up drilling targeting the down-plunge continuation of intercepts such as 16.5g/t over 25m in drill hole 124019 (see press release March 3, 2024) and 45.7g/t over 8m in drill hole 125001 (see press release April 17, 2025).

The Rupert Exploration team has identified a number of potential targets at depth and along strike from Ikkari. These targets, by their nature will be higher cost (deeper) drill targets, and if successful, unlikely to be value additive to Ikkari in the first 10 years of operation, as outlined in the 2025 PFS. An initial drilling and assay cost estimate of $20-$30m was developed as part of the strategy review. As a result, the Company has elected to defer this drilling programme until the Ikkari project enters the production phase and the programme can be funded from cash flow.

Existing Joint Venture Agreements

During 2021 the Company entered into a joint venture agreement with S2 Resources (now Valkea Resources). The minimum spend commitment of C$1.65 million has been met through the initial phase of exploration and the company is in the process of earning a 70% interest in the property by spending C$5 million on the project.

The scout drilling completed to date has confirmed the presence of gold mineralisation but is yet to delineate a target of sufficient grade or volume to indicate economic potential. Systematic exploration on the untested portions of the permits will continue in 2026.

New permit areas & reservations

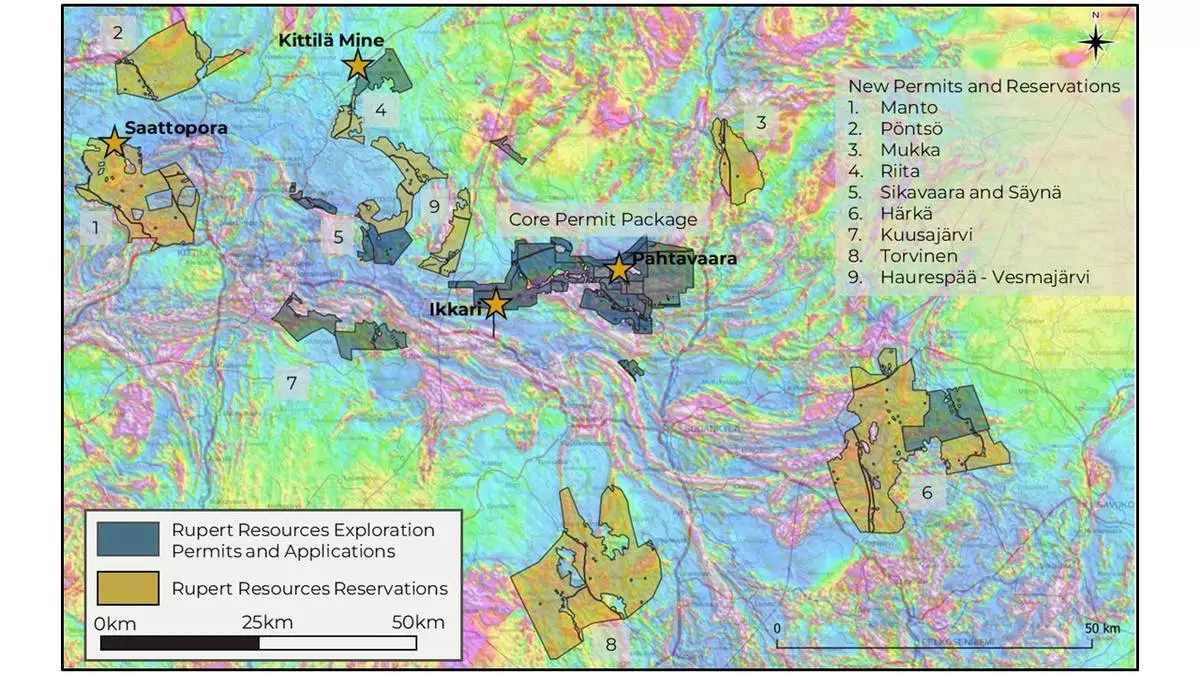

Following a comprehensive belt-scale structural reinterpretation and prospectivity analysis, the company has reserved or placed applications for an exploration permit on a total of 1150km 2 of highly prospective ground. Reservations secure the permit areas for up to 2 years whilst further evaluation and reconnaissance exploration activities occur. The most prospective portions of these will then be converted into applications for exploration permits. Granting of an exploration permit, a process that normally takes 3-4 months, allows for mechanised exploration to commence aimed at the delineation of drill targets and the drill testing of these. The most attractive exploration opportunities are summarised below:

Exploration Budget

The investment in exploration is expected to continue at a similar rate to recent years, however the composition of the workstreams will evolve as activities transition into lower cost regional exploration programmes across a large land area. A total of C$16 million is expected to be invested in the initial phase of work at new exploration ground over the next two years. Continuity of funding at this level enables the company to systematically explore the significant land holding, focussing resources on the most prospective areas.

The initial phase of work is primarily geophysics and BoT drilling covering a large land area, 2026 is expected to see approximately C$7-8m investment across the new exploration permits. As targets progress beyond the initial phase of work and diamond drilling testing commences in 2027, a higher of level of spending could be anticipated. Funding will be contingent on the quality of the targets delineated and the results of the drill testing allowing the company the flexibility allocate capital to the strongest targets.

In addition to the investment in the new exploration ground, work is expected to continue around the Ikkari project and more widely across the existing exploration permits. A total of C$9 million is expected to be invested on the existing Area 1 and Pahtavaara permit areas over the next two years. This programme has three main objectives:

Figures

Figure 1, a map of the existing and new exploration permits and reservations, can be found in the Appendix at end of release.

Review by Qualified Person

Mr. Craig Hartshorne, a Chartered Geologist and a Fellow of the Geological Society of London, is the Qualified Person responsible for the accuracy of scientific and technical information in this news release.

About Rupert Resources

Rupert Resources is a gold exploration and development company listed on the Toronto Stock Exchange. The Company is focused on making and advancing discoveries of scale and quality with high margin and low environmental impact potential. The Company’s principal focus is Ikkari, a new high-quality, multi-million ounce gold discovery in Northern Finland.

Cautionary Note Regarding Forward Looking Statements

This press release contains statements which, other than statements of historical fact constitute “forward-looking information” within the meaning of applicable securities laws, including statements with respect to: results of exploration and development activities and mineral resources. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, are intended to identify such forward-looking statements. Forward-looking statements included in this press release include, but are not limited to, statements relating to: the Mineral Resource and Mineral Reserve estimates; plans and expectations regarding future exploration programs; plans and expectations regarding future project development; the progression of the EIA and Definitive Feasibility Study on the timeline contemplated herein, if at all; operating and cost estimates; future gold prices; the LOM; the achievement of commercial production at Ikkari on the timeline contemplated herein, if at all; and the Company’s plans for future advancement of the Ikkari Project. Investors are cautioned that forward-looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the general risks of the mining industry, as well as those risk factors discussed or referred to in the Company's Annual Information Form for the year ended December 31, 2024, available on the Company’s website atwww.rupertresources.comand on SEDAR+ atwww.sedarplus.ca. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company does not intend, and does not assume any obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Cautionary Note Regarding Mineral Resources and Mineral Reserves

Unless otherwise indicated, the scientific and technical disclosure included in this press release, including all Mineral Resource and Mineral Reserve estimates contained in such technical disclosure, has been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (“ CIM ”) Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014 (the “ CIM Definition Standards ”). Readers are cautioned that Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all, or any part, of Mineral Resources will be converted into Mineral Reserves. Inferred Mineral Resources are Mineral Resources for which quantity and grade or quality are estimated based on limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. Inferred Mineral Resources are based on limited information and have a great amount of uncertainty as to their existence and as to their economic and legal feasibility, although it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves.

Figure 1. Map outlining the location of the new Reservations and Applications for Exploration Permits centred on the core permit package where both the Ikkari deposit and the Pahtavaara mine are located.