|

The Launch, Together With Bridgewise's Board Appointment of Several Capital Market Industry Veterans, Underscores Its Ambition to Transform the Investment Intelligence Sector

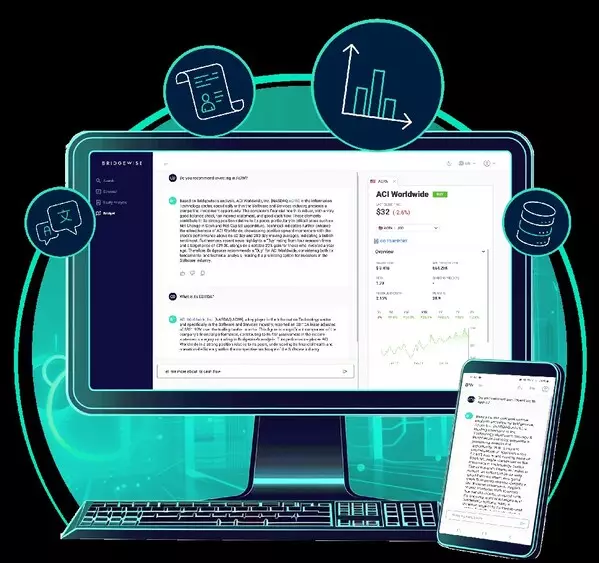

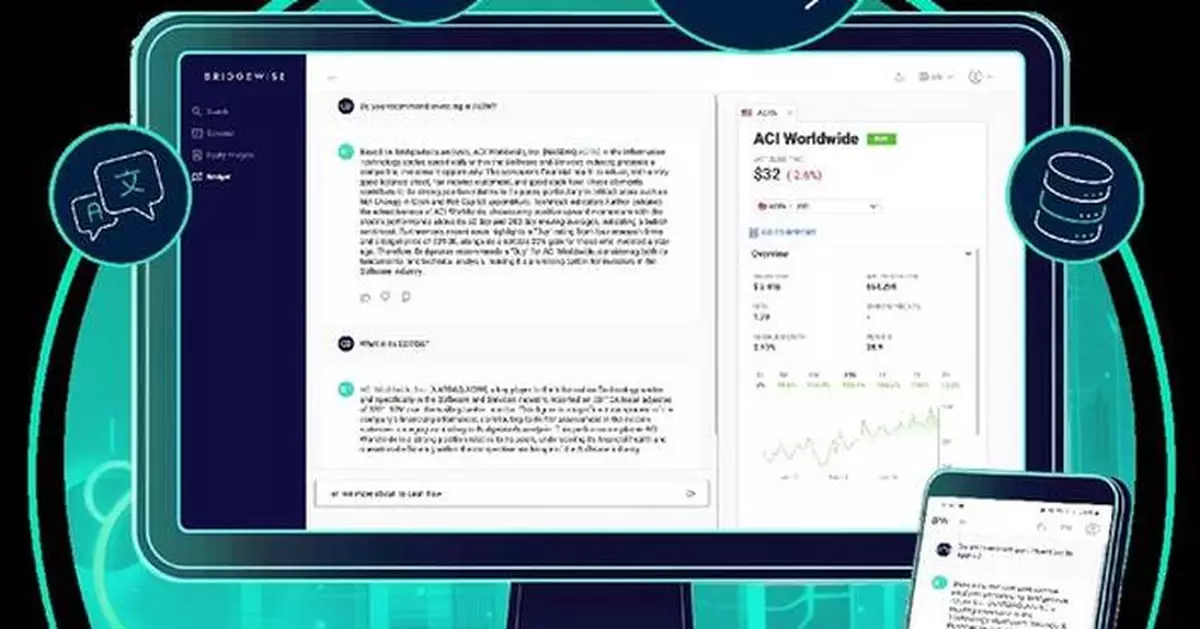

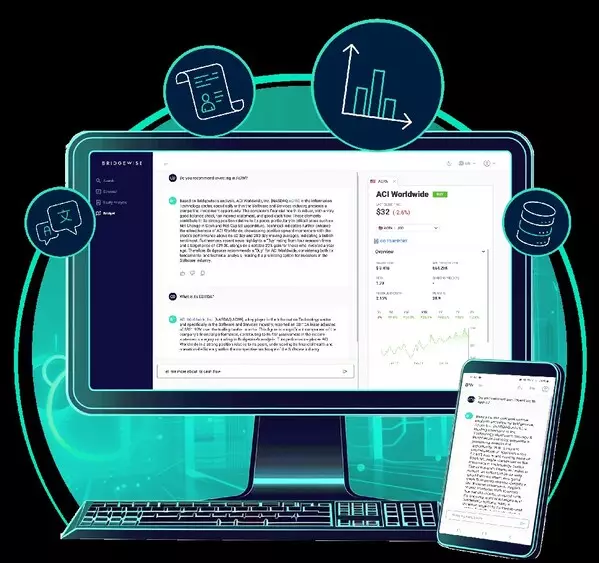

NEW YORK and SINGAPORE, Oct. 2, 2024 /PRNewswire/ -- Bridgewise, the financial research intelligence platform for global securities, announced today the launch of BRIDGETTM, its revolutionary Conversational AI Investment Tool, designed specifically for the institutional investment sector, including brokers and trading platforms. Leveraging the flexibility, convenience, and capabilities of large language models (LLM) AI, BRIDGETTM transforms traditional investment intelligence reports into dynamic, interactive conversations, and provides regulatory-compliant investment recommendations that are delivered through its customizable, multilingual platform. Bridgewise is currently available in more than 25 languages and across 15 markets and has a coverage of more than 50,000 global financial instruments.

This announcement follows hot on the heels of several Bridgewise announcements this year, including its successful $21-million fundraise, the launch of its Bridgewise Funds (FundWise), and its appointment of several capital market industry veterans to its Advisory Board, all of which marks the fifth year of Bridgewise's rapid expansion and innovation since its founding in 2019. Its Advisory Board now includes new board members such as Christian Reuss (former CEO of the Swiss Stock Exchange), Dato Neto (former Managing Director of Banco Model, Brazil), David Lenchus (Managing Director and Head of Research of HC Wainwright), David Siegel (former CEO of Investopedia and President of Seeking Alpha) and Yochai Korn (former Global Head of Market Data and Research at Interactive Brokers).

Kelvin Phua, GM Bridgewise APAC: "We are incredibly excited to bring BRIDGETâ„¢ to Asia, where we see immense potential for transforming the investment landscape with AI-driven financial intelligence. Bridgewise sees the APAC market as a top strategic priority. We are continuing our rapid growth with new presences in Thailand, Malaysia, and Indonesia, alongside an expanded presence in the United Arab Emirates. We believe that Bridgewise technology and AI intelligence capabilities can revolutionize the way APAC capital markets operate, enhancing their efficiency and expanding the region's exposure to global capital markets."

Research has estimated that generative AI (Gen AI) could add between $200 billion and $340 billion in value annually, or 2.8 to 4.7 percent of total industry revenues across the global banking sector[1]. Against this high-growth potential, Gen AI has emerged as a crucial enabler of innovation and transformation, empowering financial institutions to exceed the expectations of today's sophisticated customers and investors, who are increasingly demanding faster, more convenient and timely services. For the finance institutions who serve global and regional institutional investors, this expectation is arguably compounded by the dynamic and fast-changing as well as the cross-border regulatory compliance requirements.

Gaby Diamant, Co-Founder and CEO of Bridgewise, says, "Bridgewise's BRIDGETTM is a conversational AI investment tool that presents a significant leap forward for the global investment and securities industry. By integrating advanced AI with regulatory compliance, we are not only enhancing the efficiency and accuracy of investment decisions but also ensuring that these decisions are made within a secure and compliant framework. As one of the world's few financial research intelligence platforms focused on serving the institutional investment sector, we are able to tailor BRIDGETTM to meet institutional-specific standards and requirements. This tool is a game-changer for financial institutions looking to stay ahead in a rapidly evolving sector, and to empower their analysts and investors to interact with data in a more intuitive and insightful manner, thereby enhancing decision-making processes."

Addressing Key Challenges

In today's fast-paced financial environment, analysts and investors face numerous challenges, including information overload, time constraints, and the need for precise, actionable insights. Unlike other existing LLMs which may generate quirky and interesting responses but do not deliver reliable investment recommendations, Bridgewise's BRIDGETTM offers regulatory-compliant investment insights, including specific buy/sell recommendations for stocks. BRIDGETTM also addresses several key AI chatbot-related drawbacks, such as:

- Lack of Opinions or Investment Recommendations: Traditional chatbots refrain from recommending one stock over another, while BRIDGETTM provides actionable, regulatory-compliant advice, including specific buy/sell recommendations.

- Finance-Focused Expertise: Unlike general LLMs, BRIDGETTM uses a specialized Micro Language Model (MLM) tailored for conversations about investments and capital markets, offering a high level of expertise and precision.

- Hallucinations: Other chatbots often generate inaccurate or illogical suggestions, such as recommending nonexistent stocks or those with poor fundamentals. BRIDGETTM is designed to minimize these pitfalls, ensuring reliability in its investment advice because its MLM has been exclusively trained to understand and address the nuances of investment-specific topics.

The Bridgewise BRIDGETTM Fact Sheet is available here.

About Bridgewise:

Bridgewise is a technological capital-markets intelligence company that leverages proprietary AI to generate analysis of more than 90% of global equities and funds. It powers the investment decisions of institutional and retail investors in more than 25 languages and across 15 countries, including over 50 institutional clients. Its proprietary generative AI-based technology platform has delivered over 10 million analyses, which provides comprehensive insights into global stocks and securities.

Founded in 2019, Bridgewise aims to bridge the knowledge gap in the investment world and democratize access to financial market information, providing easy to understand, comprehensive equity and fund research that was previously exclusively available only to major financial institutions.

Bridgewise partners with leading financial institutions around the world, including exchanges, trading platforms, investment houses, financial advisors, and financial media & education platforms. Its innovative AI-driven content solutions are integrated into financial platforms, helping increase investor awareness and activity, and ultimately, to help them make more informed investment decisions.

More about Bridgewise can be found here.

[1] "The economic potential of generative AI: The next productivity frontier." McKinsey, 14 June 2023. |

The Launch, Together With Bridgewise's Board Appointment of Several Capital Market Industry Veterans, Underscores Its Ambition to Transform the Investment Intelligence Sector

NEW YORK and SINGAPORE, Oct. 2, 2024 /PRNewswire/ -- Bridgewise, the financial research intelligence platform for global securities, announced today the launch of BRIDGETTM, its revolutionary Conversational AI Investment Tool, designed specifically for the institutional investment sector, including brokers and trading platforms. Leveraging the flexibility, convenience, and capabilities of large language models (LLM) AI, BRIDGETTM transforms traditional investment intelligence reports into dynamic, interactive conversations, and provides regulatory-compliant investment recommendations that are delivered through its customizable, multilingual platform. Bridgewise is currently available in more than 25 languages and across 15 markets and has a coverage of more than 50,000 global financial instruments.

This announcement follows hot on the heels of several Bridgewise announcements this year, including its successful $21-million fundraise, the launch of its Bridgewise Funds (FundWise), and its appointment of several capital market industry veterans to its Advisory Board, all of which marks the fifth year of Bridgewise's rapid expansion and innovation since its founding in 2019. Its Advisory Board now includes new board members such as Christian Reuss (former CEO of the Swiss Stock Exchange), Dato Neto (former Managing Director of Banco Model, Brazil), David Lenchus (Managing Director and Head of Research of HC Wainwright), David Siegel (former CEO of Investopedia and President of Seeking Alpha) and Yochai Korn (former Global Head of Market Data and Research at Interactive Brokers).

Kelvin Phua, GM Bridgewise APAC: "We are incredibly excited to bring BRIDGETâ„¢ to Asia, where we see immense potential for transforming the investment landscape with AI-driven financial intelligence. Bridgewise sees the APAC market as a top strategic priority. We are continuing our rapid growth with new presences in Thailand, Malaysia, and Indonesia, alongside an expanded presence in the United Arab Emirates. We believe that Bridgewise technology and AI intelligence capabilities can revolutionize the way APAC capital markets operate, enhancing their efficiency and expanding the region's exposure to global capital markets."

Research has estimated that generative AI (Gen AI) could add between $200 billion and $340 billion in value annually, or 2.8 to 4.7 percent of total industry revenues across the global banking sector[1]. Against this high-growth potential, Gen AI has emerged as a crucial enabler of innovation and transformation, empowering financial institutions to exceed the expectations of today's sophisticated customers and investors, who are increasingly demanding faster, more convenient and timely services. For the finance institutions who serve global and regional institutional investors, this expectation is arguably compounded by the dynamic and fast-changing as well as the cross-border regulatory compliance requirements.

Gaby Diamant, Co-Founder and CEO of Bridgewise, says, "Bridgewise's BRIDGETTM is a conversational AI investment tool that presents a significant leap forward for the global investment and securities industry. By integrating advanced AI with regulatory compliance, we are not only enhancing the efficiency and accuracy of investment decisions but also ensuring that these decisions are made within a secure and compliant framework. As one of the world's few financial research intelligence platforms focused on serving the institutional investment sector, we are able to tailor BRIDGETTM to meet institutional-specific standards and requirements. This tool is a game-changer for financial institutions looking to stay ahead in a rapidly evolving sector, and to empower their analysts and investors to interact with data in a more intuitive and insightful manner, thereby enhancing decision-making processes."

Addressing Key Challenges

In today's fast-paced financial environment, analysts and investors face numerous challenges, including information overload, time constraints, and the need for precise, actionable insights. Unlike other existing LLMs which may generate quirky and interesting responses but do not deliver reliable investment recommendations, Bridgewise's BRIDGETTM offers regulatory-compliant investment insights, including specific buy/sell recommendations for stocks. BRIDGETTM also addresses several key AI chatbot-related drawbacks, such as:

- Lack of Opinions or Investment Recommendations: Traditional chatbots refrain from recommending one stock over another, while BRIDGETTM provides actionable, regulatory-compliant advice, including specific buy/sell recommendations.

- Finance-Focused Expertise: Unlike general LLMs, BRIDGETTM uses a specialized Micro Language Model (MLM) tailored for conversations about investments and capital markets, offering a high level of expertise and precision.

- Hallucinations: Other chatbots often generate inaccurate or illogical suggestions, such as recommending nonexistent stocks or those with poor fundamentals. BRIDGETTM is designed to minimize these pitfalls, ensuring reliability in its investment advice because its MLM has been exclusively trained to understand and address the nuances of investment-specific topics.

The Bridgewise BRIDGETTM Fact Sheet is available here.

About Bridgewise:

Bridgewise is a technological capital-markets intelligence company that leverages proprietary AI to generate analysis of more than 90% of global equities and funds. It powers the investment decisions of institutional and retail investors in more than 25 languages and across 15 countries, including over 50 institutional clients. Its proprietary generative AI-based technology platform has delivered over 10 million analyses, which provides comprehensive insights into global stocks and securities.

Founded in 2019, Bridgewise aims to bridge the knowledge gap in the investment world and democratize access to financial market information, providing easy to understand, comprehensive equity and fund research that was previously exclusively available only to major financial institutions.

Bridgewise partners with leading financial institutions around the world, including exchanges, trading platforms, investment houses, financial advisors, and financial media & education platforms. Its innovative AI-driven content solutions are integrated into financial platforms, helping increase investor awareness and activity, and ultimately, to help them make more informed investment decisions.

More about Bridgewise can be found here.

[1] "The economic potential of generative AI: The next productivity frontier." McKinsey, 14 June 2023.

** The press release content is from PR Newswire. Bastille Post is not involved in its creation. **

Bridgewise Launches BRIDGET(TM), World's First Conversational AI Investment Tool That Provides Regulatory-Compliant Investment Recommendations

SAN JOSE, Calif., Jan. 16, 2026 /PRNewswire/ -- Technology is no longer a distant, high-level concept, but something that truly serves users. At the M∞VA Universe integrated smart indoor technologies launch in Silicon Valley on January 15, 2026, MOVA demonstrated how its products solve real household needs through a connected ecosystem and practical business strategy.

A Technology Path Built Around Real Household Needs

Across its robot vacuums, wet and dry floor washers, and stick vacuums, MOVA's product development starts with specific use scenarios. One example is the MOBIUS 60 robot vacuum, which introduces zone-specific cleaning to address concerns in premium homes about cross-contamination between different spaces. The system recognizes individual rooms and automatically returns to the dock to switch mop pads, helping prevent kitchen grease from being spread to bedrooms or living areas. This feature prioritizes practical hygiene over headline performance claims.

The same logic applies across the lineup. The X5 Ultra Steam Wet and Dry Vacuum uses Dual-Mode Steam & Hot-Water Spot-Spray Cleaning System to remove stubborn stains that are difficult to clean with traditional wet methods. The M50 Ultra is equipped with a Foldable & Extendable Handle, making it easier to clean under beds, sofas, and other low-clearance furniture. The G70 vacuum features Front Side Edge Cleaning combined with a Robotic Arm, improving cleaning performance along edges and corners where dust commonly accumulates.

MOVA also extends this user-focused approach beyond floor care. The Aero C series hair dryers apply the company's experience in airflow control and temperature management to personal care, focusing on stable performance and user comfort. The T1 Station window-cleaning robot uses hot water to improve cleaning results on outdoor glass surfaces, particularly in environments exposed to heavier dirt and weather conditions. To support this product strategy, MOVA embeds user insight teams within each product line, ensuring that design and engineering decisions remain closely connected to real-world usage.

Validation in Premium Markets

MOVA's focus on what it describes as "effective innovation" has gained traction in competitive premium markets. During Black Friday 2025 in Southwest Europe, MOVA's flagship robot vacuum—featuring live water mopping and a highly integrated automatic docking system—ranked among the top-selling products in the premium segment.

The company combine as broad online reach with offline credibility. MOVA products are available on major online platforms like Amazon. Partnership with local retailers, including BAUHAUS and MediaMarkt strengthen consumer trust. At the same time, collaboration with authoritative third-party reviewers provides professional validation and supports purchase decisions among premium markets.

Building a Sustainable Global Business

Beyond product performance, MOVA emphasizes long-term reliability. The company now serves more than 1.4 million households across over 60 countries and regions*. It also introduced a full-category three-year global warranty, directly addressing premium consumers' expectations for durability and after-sales service.

MOVA's global operations reflect a distributed approach to expertise. A French aesthetics center, a German innovation hub, and a Shanghai user experience center work together across design, engineering, and user research. Looking ahead to 2026, the company plans further global and offline expansion, while continuing to scale its user-driven innovation and quality control systems.

MOVA's Silicon Valley launch marked a clear statement of intent. Rather than presenting a futuristic narrative, the company demonstrated how steady engineering, focused user insight, and disciplined global operations can define a credible premium position. In a market where many products appear increasingly similar, MOVA's strategy suggests that true premium value comes from consistently improving real, everyday cleaning experiences through practical and thoughtful innovation.

*The company now serves more than 1.4 million households across over 60 countries and regions.(According to internal company data)

** The press release content is from PR Newswire. Bastille Post is not involved in its creation. **

MOVA Launches Cleaning Solutions in Silicon Valley: Finding Answers for Premium Cleaning Through Pragmatic Innovation