WESTLAKE VILLAGE, Calif.--(BUSINESS WIRE)--Apr 21, 2025--

LTC Properties, Inc. (NYSE: LTC) (“LTC” or the “Company”), a real estate investment trust that primarily invests in seniors housing and health care properties, today announced the appointment of industry veteran, David Boitano, as Executive Vice President and Chief Investment Officer, following the promotion of Clint Malin to Co-Chief Executive Officer in December 2024.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250421263930/en/

Boitano has spent most of his seniors housing and health care finance career at Ventas, playing a pivotal role in sourcing investments, including RIDEA, with direct underwriting responsibility for more than $5.0 billion in transactions.

“We are delighted to welcome Dave to LTC,” said Malin and Co-Chief Executive Officer Pam Kessler. “With an impressive track record in the seniors housing and health care finance sector, Dave has cultivated strong industry relationships and demonstrated success in building real estate portfolios. We believe his deep expertise will be invaluable as we drive growth and expand LTC’s RIDEA platform.”

“I am excited to be joining LTC, especially now at a pivotal time as the Company embarks on its RIDEA strategy,” said Boitano. “Throughout my career, I’ve admired LTC’s ability to provide flexible and innovative financing solutions that support its operating partners in an evolving market. I look forward to contributing to the Company’s continued success.”

About LTC

Forward-Looking Statements

This press release includes statements that are not purely historical and are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the Company’s expectations, beliefs, intentions or strategies regarding the future. All statements other than historical facts contained in this press release are forward-looking statements. These forward-looking statements involve a number of risks and uncertainties. Please see LTC’s most recent Annual Report on Form 10‑K and its other publicly available filings with the Securities and Exchange Commission for a discussion of these and other risks and uncertainties. All forward-looking statements included in this press release are based on information available to the Company on the date hereof, and LTC assumes no obligation to update such forward-looking statements. Although the Company’s management believes that the assumptions and expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. The actual results achieved by the Company may differ materially from any forward-looking statements due to the risks and uncertainties of such statements.

Dave Boitano, EVP & CIO

NEW YORK (AP) — Up until this week, Wall Street has generally benefited from the Trump administration’s policies and has been supportive of the president. That relationship has suddenly soured.

When President Donald Trump signed the One Big Beautiful Bill into law in July, it pushed another significant round of tax cuts and also cut the budget of the Consumer Financial Protection Bureau, at times the banking industry's nemesis, by nearly half. Trump’s bank regulators have also been pushing a deregulatory agenda that both banks and large corporations have embraced.

But now the president has proposed a one-year, 10% cap on the interest rate on credit cards, a lucrative business for many financial institutions, and his Department of Justice has launched an investigation into Federal Reserve Chair Jerome Powell that many say threatens the institution that is supposed to set interest rates free of political interference.

Bank CEOs warned the White House on Tuesday that Trump’s actions will do more harm than good to the American economy. But in response, Trump did not back down on his proposals or attacks on the Fed.

BNY Chief Executive Officer Robin Vince told reporters that going after the Fed’s independence “doesn’t seem, to us, to be accomplishing the administration’s primary objectives for things like affordability, reducing the cost of borrowing, reducing the cost of mortgages, reducing the cost of everyday living for Americans.”

“Let’s not shake the foundation of the bond market and potentially do something that could cause interest rates to actually get pushed up, because somehow there’s lack of confidence in the Fed’s independence,” Vince added.

The Federal Reserve’s independence is sacrosanct among the big banks. While banks may have wanted Powell and other Fed policymakers to move interest rates one way or another more quickly, they have generally understood why Powell has done what he's done.

“I don’t agree with everything the Fed has done. I do have enormous respect for Jay Powell, the man,” JPMorgan Chase CEO Jamie Dimon told reporters Tuesday.

Dimon's message did not seem to resonate with President Trump, who told journalists that Dimon is wrong in saying it’s not a great idea to chip away at the Federal Reserve’s independence by going after Chair Jerome Powell.

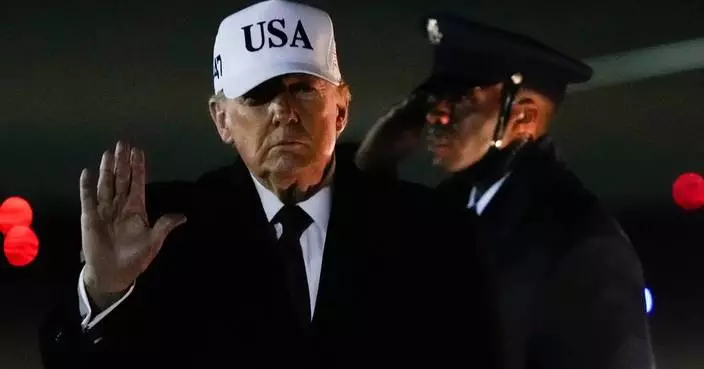

“Yeah, I think it’s fine what I’m doing,” Trump said Tuesday in response to a reporter’s question at Joint Base Andrews after returning from a day trip to Michigan. He called Powell “a bad Fed person” who has “done a bad job.”

Along with the attacks on the Fed, President Trump is going after the credit card industry. With “affordability” likely to be a key issue in this year’s midterm elections, Trump wants to lower costs for consumers and says he wants a 10% cap on credit card interest rates in place by Jan. 20. Whether he hopes to accomplish this by bullying the credit card industry into just capping interest rates voluntarily, or through some sort of executive action, is unclear.

The average interest rate on credit cards is between 19.65% and 21.5%, according to the Federal Reserve and other industry tracking sources. A cap of 10% would likely cost banks roughly $100 billion in lost revenue per year, researchers at Vanderbilt University found. Shares of credit card companies like American Express, JPMorgan, Citigroup, Capital One and others fell sharply Monday as investors worried about the potential hit to profits these banks may face if an interest rate cap were implemented.

In a call with reporters, JPMorgan’s Chief Financial Officer Jeffrey Barnum indicated the industry was willing to fight with all resources at its disposal to stop the Trump administration from capping those rates. JPMorgan is one of the nation's biggest credit card companies, with its customers collectively holding $239.4 billion in balances with the bank, and having major co-brand partnerships with companies such as United Airlines and Amazon. JPMorgan also recently acquired the Apple Card credit card portfolio from Goldman Sachs.

“Our belief is that actions like this will have the exact opposite consequence to what the administration wants in terms of helping consumers,” Barnum said. “Instead of lowering the price of credit, it will simply reduce the supply of credit, and that will be bad for everyone: consumers, the broader economy, and yes, for us, also.”

Even the major airline and hotel partners who partner with banks to issue their cards were also not pleased with the White House's push to cap interest rates.

“I think one of the big issues and challenges with (a potential cap) is the fact that it would actually restrict the lower end consumer from having access to any credit, not just what the interest rate they’re paying, which would upend the whole credit card industry,” said Ed Bastion, CEO of Delta Air Lines, to analysts on Tuesday. Delta has a major partnership with American Express, and its co-brand credit card brings in billions of dollars in revenue for Delta.

Trump seemed to double down on his attacks on the credit card industry overnight. In a post on his social media platform Truth Social, he said he endorsed a bill introduced by Sen. Roger Marshall, R-Kansas, that would likely cut into the revenue banks earn from merchants whenever they accept a credit card at point-of-sale.

“Everyone should support great Republican Senator Roger Marshall’s Credit Card Competition Act, in order to stop the out of control Swipe Fee ripoff,” Trump wrote.

Trump told reporters Tuesday that he was not going to back down the credit card interest rate issue.

“We should have lower rates. Jamie Dimon probably wants higher rates. Maybe he makes more money that way,” Trump said.

The comments from Wall Street are coming as the major banks report their quarterly results. JPMorgan, the nation’s largest consumer and investment bank, and The Bank of New York Mellon Corp., one of the world’s largest custodial banks, both reported their results Tuesday with Citigroup, Bank of America, Wells Fargo and others to report later this week.

President Donald Trump arrives at Joint Base Andrews, Tuesday, Jan. 13, 2026, in Joint Base Andrews, Md. (AP Photo/Evan Vucci)

FILE - Jamie Dimon, CEO of JPMorgan Chase, speaks at the America Business Forum, Thursday, Nov. 6, 2025, in Miami. (AP Photo/Rebecca Blackwell, file)