WASHINGTON (AP) — President Donald Trump ordered a blockade of “sanctioned oil tankers” into and out of Venezuela, U.S. forces seized an oil tanker off the country's coast and the military attacked three more alleged drug-smuggling boats in the region — all in the course of a week.

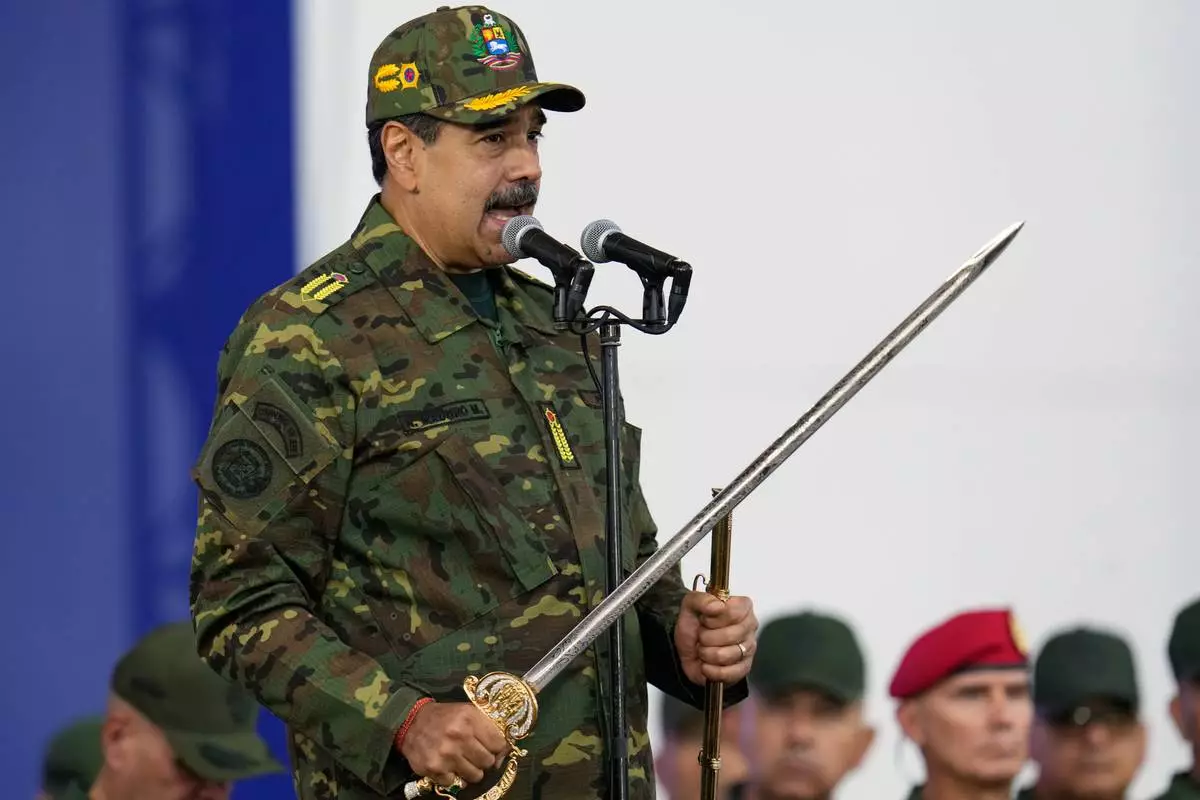

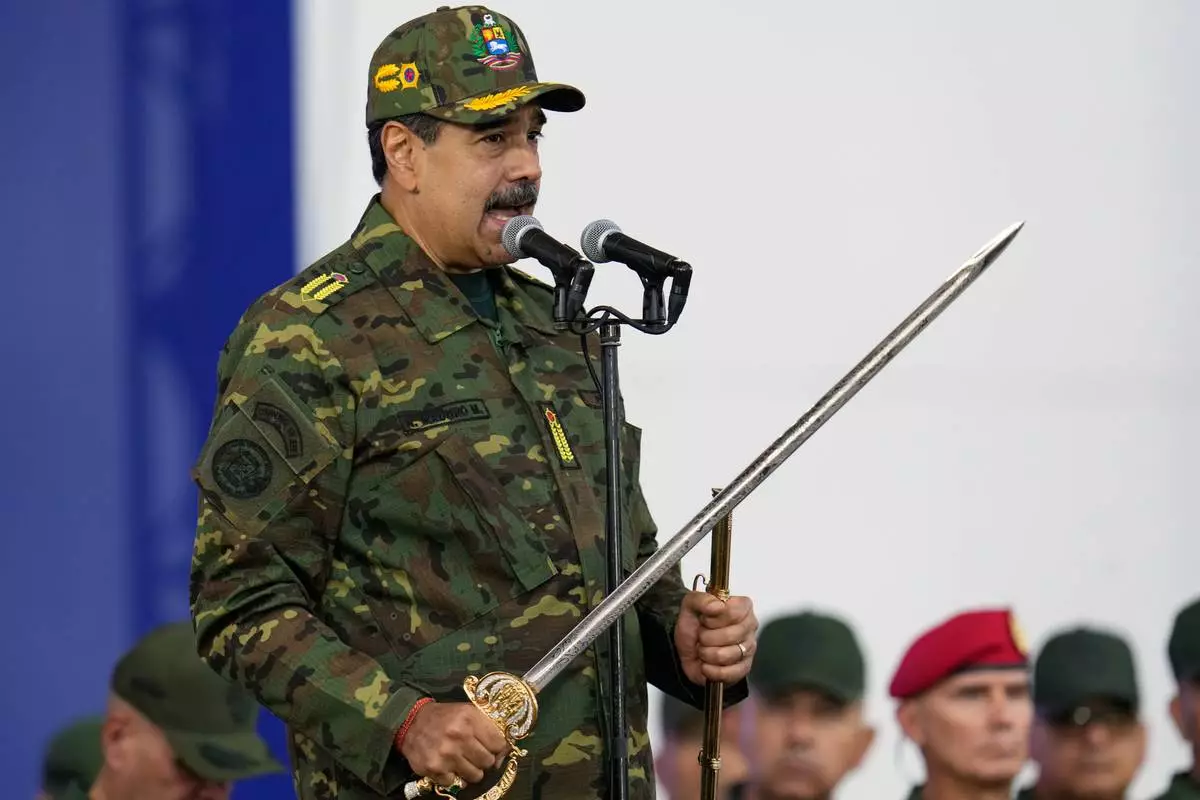

The Trump administration says it is in “armed conflict” with drug cartels to halt the flow of narcotics into the United States and its actions are ramping up pressure on Venezuelan leader Nicolás Maduro, who faces charges of narcoterrorism in the U.S. Trump's monthslong campaign, meanwhile, is drawing increasing scrutiny from members of Congress.

The U.S. has sent a fleet of warships to the region, the largest buildup of forces in generations, and Trump has stated repeatedly that land attacks are coming soon. Maduro has insisted the real purpose of the U.S. military operations is to force him from power.

Trump's Republican administration says the military has carried out 26 known strikes in the Caribbean Sea and the eastern Pacific Ocean since early September, killing at least 99 people.

Here is a timeline of the U.S. military actions, concerns among some lawmakers and the response in Venezuela:

Trump signs an executive order that paves the way for criminal organizations and drug cartels to be named “foreign terrorist organizations.” They include Tren de Aragua, a Venezuelan street gang.

The U.S. intelligence community has disputed Trump’s central claim that Maduro’s administration is working with Tren de Aragua and orchestrating drug trafficking and illegal immigration into the U.S.

The Trump administration formally designates eight Latin American crime organizations as foreign terrorist organizations.

The label is normally reserved for groups like al-Qaida or the Islamic State that use violence for political ends — not for profit-focused crime rings.

The U.S. military deploys three guided-missile destroyers to the waters off Venezuela.

The naval force in the Caribbean grows within weeks to include three amphibious assault ships and other vessels, carrying about 6,000 sailors and Marines and a variety of aircraft.

The U.S. deploys F-35 fighter jets to Puerto Rico in September, while a Navy submarine carrying cruise missiles operates off South America.

The U.S. carries out its first strike against what Trump says was a drug-carrying vessel that departed from Venezuela and was operated by Tren de Aragua.

Trump says all 11 people on the boat were killed and posts a short video clip of a small vessel appearing to explode in flames.

In a letter to the White House, Democratic senators say the Trump administration has provided “no legitimate legal justification” for the strike.

Sen. Jack Reed of Rhode Island, the top Democrat on the Senate Armed Services Committee, says in a floor speech that week that the U.S. military is not “empowered to hunt down suspected criminals and kill them without trial.”

The U.S. military carries out its second strike against an alleged drug boat, killing three people.

Asked what proof the U.S. has that the vessel was carrying drugs, Trump told reporters that big bags of cocaine and fentanyl were spattered all over the ocean. However, images of what Trump described were not released by the military or the White House.

Trump says the U.S. military carried out its third fatal strike against an alleged drug-smuggling vessel. The president says the attack killed three people and intelligence “confirmed the vessel was trafficking illicit narcotics.”

Several senators and human rights groups continue to question the legality of the strikes, describing them as a potential overreach of executive authority.

Trump declares drug cartels to be unlawful combatants and says the U.S. is now in an “armed conflict” with them, according to a Trump administration memo obtained by The Associated Press.

The memo appears to represent an extraordinary assertion of presidential war powers and draws criticism from some lawmakers, including Republican Sen. Rand Paul of Kentucky.

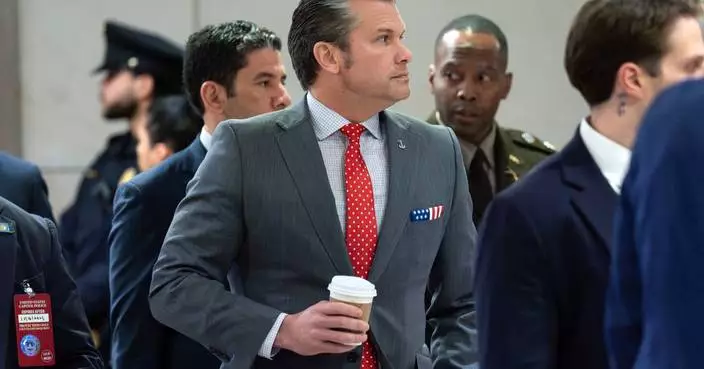

Defense Secretary Pete Hegseth says he ordered a fourth strike on a small boat he accuses of carrying drugs. He says four men were killed but offers no details on who they were or what group they belonged to.

Senate Republicans vote down legislation that would have required the president to seek authorization from Congress before further military strikes. The vote fell mostly along party lines, 48-51.

Trump announces the fifth strike against a small boat accused of carrying drugs, saying it killed six people. The president says intelligence confirmed the vessel was trafficking narcotics on a known drug-trafficking route.

Trump confirms he has authorized the CIA to conduct covert operations inside Venezuela and says he is weighing carrying out land operations in the country.

He declines to say whether the CIA has authority to take action against Maduro.

The Navy admiral who oversees military operations in the region says he will retire in December.

Adm. Alvin Holsey became leader of U.S. Southern Command only the previous November, overseeing an area that encompasses the Caribbean and waters off South America. Such postings typically last three to four years.

Trump says the U.S. struck a sixth suspected drug-carrying vessel in the Caribbean, killing two people and leaving two survivors who were on the semi-submersible craft.

The president later says the survivors would be sent to Ecuador and Colombia, their home countries, “for detention and prosecution.” Repatriation avoided questions about what their legal status would have been in the U.S. justice system.

The U.S. military attacks a seventh vessel that Hegseth says was carrying “substantial amounts of narcotics” and associated with a Colombian rebel group, the National Liberation Army, or ELN. Three people are killed.

Rep. Adam Smith, top Democrat on the House Armed Services Committee, calls for a hearing on the boat strikes.

“Never before in my over 20 years on the committee can I recall seeing a combatant commander leave their post this early and amid such turmoil," Smith said in a statement of Holsey's impending departure. “I have also never seen such a staggering lack of transparency on behalf of an Administration and the Department to meaningfully inform Congress on the use of lethal military force.”

Hegseth says the U.S. military launched its eighth strike against an alleged drug-carrying vessel, killing two people in the eastern Pacific.

The attack marks an expansion of the military’s targeting area to the waters off South America where much of the cocaine from the world’s largest producers is smuggled.

Hegseth announces the ninth strike, another in the eastern Pacific, saying three men are killed.

Hegseth orders the U.S. military's most advanced aircraft carrier, the USS Gerald R. Ford, to the region in a significant escalation of military firepower.

Hegseth says the military conducted the 10th strike on a suspected drug-running boat, leaving six people dead. He says the vessel was operated by the Tren de Aragua gang.

Hegseth says three more strikes were carried out in the eastern Pacific, killing 14 people and leaving one survivor.

Hegseth says Mexican authorities “assumed responsibility for coordinating the rescue” of the sole survivor, who is presumed dead after Mexico suspended its search after four days.

Hegseth says the U.S. military carried out another strike on a boat he said was carrying drugs in the eastern Pacific, killing all four people aboard in the 14th attack.

Sen. Mark Warner, the ranking Democrat on the Senate Intelligence Committee, says the Trump administration briefed Republicans — but not Democrats — on the boat strikes.

The Senate at the time was facing a potential vote on a war powers resolution that would prohibit strikes in or near Venezuela without congressional approval.

U.N. human rights chief Volker Türk calls for an investigation into the strikes, in what appeared to be the first such condemnation of its kind from a United Nations organization.

Ravina Shamdasani, a spokeswoman for Türk’s office, relayed his message at a briefing: "The U.S. must halt such attacks and take all measures necessary to prevent the extrajudicial killing of people aboard these boats.”

Hegseth posts another video as he announces the 15th known strike, saying the vessel in the Caribbean was operated by a U.S.-designated terrorist organization. He does not name the group and says three people were killed.

In the 16th known strike, Hegseth posts on social media that two people were killed aboard a vessel in the eastern Pacific.

The same day, the Ford aircraft carrier leaves the Mediterranean Sea on its way to the Caribbean.

Hegseth announces the 17th known strike, which killed three people.

Senate Republicans vote to reject legislation that would have limited Trump's ability to order an attack on Venezuelan soil without congressional authorization. Lawmakers from both parties had demanded more information on the strikes, but Republicans appeared more willing to give Trump leeway to continue his buildup of naval forces.

The U.S. military strikes two vessels in the eastern Pacific, killing six people, according to an announcement from Hegseth the following day.

The 20th known strike on a boat accused of transporting drugs kills four people in the Caribbean, according to a social media post from the U.S. military's Southern Command.

Venezuela’s government launches what it says is a “massive” mobilization of troops and volunteers for two days of exercises prompted by the U.S. military buildup.

Defense Minister Vladimir Padrino López asserts that Venezuela’s military is “stronger than ever in its unity, morale and equipment.”

Three people are killed after the U.S. military conducts its 21st strike on an alleged drug-smuggling boat in the eastern Pacific, according to a post from Southern Command a day later.

The Ford arrives in the Caribbean, a major moment in the Trump administration's show of force.

The aircraft carrier's arrival brings the total number of troops in the region to around 12,000 on nearly a dozen Navy ships in what Hegseth has dubbed “Operation Southern Spear.”

Trump says the U.S. “ may be having some discussions ” with Maduro and that “Venezuela would like to talk,” without offering details.

“I’ll talk to anybody,” Trump said. “We’ll see what happens.”

Adm. Frank “Mitch” Bradley appears for closed-door classified briefings at the Capitol as lawmakers begin investigating the strikes. The investigation began following reports that Bradley ordered a follow-on attack that killed the survivors of the first strike on Sept. 2 to comply with Hegesth’s demands.

Republican Sen. Tom Cotton later tells reporters that “Bradley was very clear that he was given no such order, to give no quarter or to kill them all."

Democrats say they found the video of the entire attack disturbing.

Washington Rep. Adam Smith, the top Democrat on the House Armed Services Committee, says the survivors were “basically two shirtless people clinging to the bow of a capsized and inoperable boat, drifting in the water — until the missiles come and kill them.”

Four people are killed in the 22nd strike on an alleged drug-smuggling boat in the eastern Pacific, according to a post from Southern Command.

The U.S. seizes an oil tanker off the coast of Venezuela after leaving that country with about 2 million barrels of heavy crude.

Attorney General Pam Bondi says the tanker was involved in “an illicit oil shipping network supporting foreign terrorist organizations.” Venezuela's government says the seizure “constitutes a blatant theft and an act of international piracy.”

The U.S. military strikes three alleged-drug smuggling boats, killing eight people, in the eastern Pacific Ocean, Southern Command announces.

Hegseth says the Pentagon will not publicly release unedited video of the Sept. 2 strike that killed two survivors, even as questions mount in Congress about the attack and the overall campaign near Venezuela.

Trump says he's ordering a blockade of all “sanctioned oil tankers” going into and out of Venezuela, a move that seems designed to put a tighter chokehold on the South American country’s oil-dependent economy.

Trump alleges that Venezuela is using oil to fund drug trafficking, terrorism and other crimes and vows to continue the military buildup until the country returns to the U.S. oil, land and assets, though it's unclear why the president feels the U.S. has a claim.

The U.S. military says it attacked a boat accused of smuggling drugs in the eastern Pacific Ocean, killing four people. The death toll from the campaign’s 26 known strikes climbs to at least 99 people.

Garcia Cano reported from Caracas, Venezuela.

A man looks out at the sea in the city of La Guaira, Venezuela, where the nation's flag flies, Wednesday, Dec. 17, 2025. (AP Photo/Ariana Cubillos)

Secretary of State Marco Rubio walks to a secure room in the basement of the Capitol to brief senators on military strikes near Venezuela, Tuesday, Dec. 16, 2025, in Washington. (AP Photo/Julia Demaree Nikhinson)

A man looks out at the sea in the city of La Guaira, Venezuela, where the nation's flag flies, Wednesday, Dec. 17, 2025. (AP Photo/Ariana Cubillos)

President Nicolas Maduro joins a rally marking the anniversary of the Battle of Santa Ines, which took place during Venezuela's 19th-century Federal War, in Caracas, Venezuela, Wednesday, Dec. 10, 2025. (AP Photo/Cristian Hernandez)

Defense Secretary Pete Hegseth arrives to brief members of Congress on military strikes near Venezuela, Tuesday, Dec. 16, 2025, at the Capitol in Washington. (AP Photo/Julia Demaree Nikhinson)

U.S. Navy Adm. Frank M. Bradley walks along a hallway after a meeting with senators on Capitol Hill, Thursday, Dec. 4, 2025, in Washington. (AP Photo/Mark Schiefelbein)

Venezuelan President Nicolas Maduro holds a ceremonial sword said to have belonged to independence hero Simon Bolivar during a government-organized civic-military march in Caracas, Venezuela, Tuesday, Nov. 25, 2025. (AP Photo/Ariana Cubillos)