WASHINGTON (AP) — Washington Commanders defensive end Deatrich Wise Jr. will miss the rest of the season after having quadriceps surgery, and the team believes running back Austin Ekeler tore his right Achilles tendon in a loss to the Green Bay Packers but is awaiting tests to confirm the severity of that injury, a person with knowledge of the situations told The Associated Press on Friday.

The person spoke on condition of anonymity because nothing had been announced about the two players.

Wise is a 31-year-old in his ninth NFL season who joined the Commanders this offseason after playing his entire career with the New England Patriots. He was injured in the first half of Green Bay’s 27-18 victory on Thursday night while trying to block an extra-point attempt.

Wise was driven off the field and raised his right fist as he was taken away.

ESPN was first to report that his season is over.

Ekeler, a 30-year-old in his ninth NFL season and second with Washington, fell to the ground on a play in the fourth quarter Thursday. It was a non-contact injury, and Ekeler kept his weight off his right leg as he was helped off the field.

After staying on the bench on Washington's sideline for a few minutes, Ekeler was driven toward the locker room.

Ekeler has started both games this season for the Commanders (1-1), gaining 43 yards on 14 carries and catching five passes for 38 yards.

Ekeler is a valuable pass-catcher out of the backfield for quarterback Jayden Daniels, last season's AP NFL Rookie of the Year as Washington went 12-5 in the regular season and made it all the way to the NFC title game.

Last season, Ekeler ran for 367 yards and gained another 366 yards on catches. He entered this season with more than 4,200 receiving yards and more than 4,700 rushing yards over his NFL career.

Washington traded Brian Robinson Jr. to the San Francisco 49ers shortly before the season began, putting Ekeler in a starting role and leaving rookie Jacory Croskey-Merritt in the No. 2 role.

Croskey-Merritt was a seventh-round draft pick and ran for 82 yards and a touchdown in Washington's 21-6 victory over the New York Giants in Week 1. Against Green Bay, he had four carries for 17 yards.

Commanders coach Dan Quinn said he would have more information next week on the various injuries from Thursday's game, including to wide receiver Noah Brown and tight end John Bates.

AP NFL: https://apnews.com/hub/nfl

Washington Commanders defensive end Deatrich Wise (91) is taken off on a cart after being injured during the first half of an NFL football game against the Green Bay Packers Thursday, Sept. 11, 2025, in Green Bay, Wis.(AP Photo/Matt Ludtke)

FILE - Washington Commanders running back Austin Ekeler (30) looks on before an NFL preseason football game against the Cincinnati Bengals, Monday, Aug. 18, 2025, in Landover, Md. (AP Photo/Nick Wass, file)

Washington Commanders defensive end Deatrich Wise (91) is taken off on a cart after being injured during the first half of an NFL football game against the Green Bay Packers Thursday, Sept. 11, 2025, in Green Bay, Wis. (AP Photo/Mike Roemer)

NEW YORK (AP) — Up until this week, Wall Street has generally benefited from the Trump administration’s policies and has been supportive of the president. That relationship has suddenly soured.

When President Donald Trump signed the One Big Beautiful Bill into law in July, it pushed another significant round of tax cuts and also cut the budget of the Consumer Financial Protection Bureau, at times the banking industry's nemesis, by nearly half. Trump’s bank regulators have also been pushing a deregulatory agenda that both banks and large corporations have embraced.

But now the president has proposed a one-year, 10% cap on the interest rate on credit cards, a lucrative business for many financial institutions, and his Department of Justice has launched an investigation into Federal Reserve Chair Jerome Powell that many say threatens the institution that is supposed to set interest rates free of political interference.

Bank CEOs warned the White House on Tuesday that Trump’s actions will do more harm than good to the American economy. But in response, Trump did not back down on his proposals or attacks on the Fed.

BNY Chief Executive Officer Robin Vince told reporters that going after the Fed’s independence “doesn’t seem, to us, to be accomplishing the administration’s primary objectives for things like affordability, reducing the cost of borrowing, reducing the cost of mortgages, reducing the cost of everyday living for Americans.”

“Let’s not shake the foundation of the bond market and potentially do something that could cause interest rates to actually get pushed up, because somehow there’s lack of confidence in the Fed’s independence,” Vince added.

The Federal Reserve’s independence is sacrosanct among the big banks. While banks may have wanted Powell and other Fed policymakers to move interest rates one way or another more quickly, they have generally understood why Powell has done what he's done.

“I don’t agree with everything the Fed has done. I do have enormous respect for Jay Powell, the man,” JPMorgan Chase CEO Jamie Dimon told reporters Tuesday.

Dimon's message did not seem to resonate with President Trump, who told journalists that Dimon is wrong in saying it’s not a great idea to chip away at the Federal Reserve’s independence by going after Chair Jerome Powell.

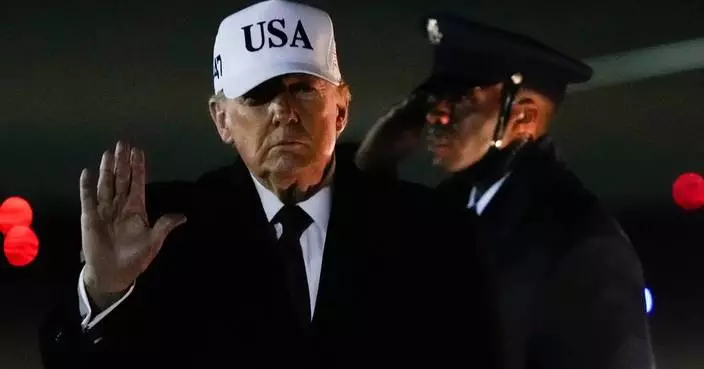

“Yeah, I think it’s fine what I’m doing,” Trump said Tuesday in response to a reporter’s question at Joint Base Andrews after returning from a day trip to Michigan. He called Powell “a bad Fed person” who has “done a bad job.”

Along with the attacks on the Fed, President Trump is going after the credit card industry. With “affordability” likely to be a key issue in this year’s midterm elections, Trump wants to lower costs for consumers and says he wants a 10% cap on credit card interest rates in place by Jan. 20. Whether he hopes to accomplish this by bullying the credit card industry into just capping interest rates voluntarily, or through some sort of executive action, is unclear.

The average interest rate on credit cards is between 19.65% and 21.5%, according to the Federal Reserve and other industry tracking sources. A cap of 10% would likely cost banks roughly $100 billion in lost revenue per year, researchers at Vanderbilt University found. Shares of credit card companies like American Express, JPMorgan, Citigroup, Capital One and others fell sharply Monday as investors worried about the potential hit to profits these banks may face if an interest rate cap were implemented.

In a call with reporters, JPMorgan’s Chief Financial Officer Jeffrey Barnum indicated the industry was willing to fight with all resources at its disposal to stop the Trump administration from capping those rates. JPMorgan is one of the nation's biggest credit card companies, with its customers collectively holding $239.4 billion in balances with the bank, and having major co-brand partnerships with companies such as United Airlines and Amazon. JPMorgan also recently acquired the Apple Card credit card portfolio from Goldman Sachs.

“Our belief is that actions like this will have the exact opposite consequence to what the administration wants in terms of helping consumers,” Barnum said. “Instead of lowering the price of credit, it will simply reduce the supply of credit, and that will be bad for everyone: consumers, the broader economy, and yes, for us, also.”

Even the major airline and hotel partners who partner with banks to issue their cards were also not pleased with the White House's push to cap interest rates.

“I think one of the big issues and challenges with (a potential cap) is the fact that it would actually restrict the lower end consumer from having access to any credit, not just what the interest rate they’re paying, which would upend the whole credit card industry,” said Ed Bastion, CEO of Delta Air Lines, to analysts on Tuesday. Delta has a major partnership with American Express, and its co-brand credit card brings in billions of dollars in revenue for Delta.

Trump seemed to double down on his attacks on the credit card industry overnight. In a post on his social media platform Truth Social, he said he endorsed a bill introduced by Sen. Roger Marshall, R-Kansas, that would likely cut into the revenue banks earn from merchants whenever they accept a credit card at point-of-sale.

“Everyone should support great Republican Senator Roger Marshall’s Credit Card Competition Act, in order to stop the out of control Swipe Fee ripoff,” Trump wrote.

Trump told reporters Tuesday that he was not going to back down the credit card interest rate issue.

“We should have lower rates. Jamie Dimon probably wants higher rates. Maybe he makes more money that way,” Trump said.

The comments from Wall Street are coming as the major banks report their quarterly results. JPMorgan, the nation’s largest consumer and investment bank, and The Bank of New York Mellon Corp., one of the world’s largest custodial banks, both reported their results Tuesday with Citigroup, Bank of America, Wells Fargo and others to report later this week.

President Donald Trump arrives at Joint Base Andrews, Tuesday, Jan. 13, 2026, in Joint Base Andrews, Md. (AP Photo/Evan Vucci)

FILE - Jamie Dimon, CEO of JPMorgan Chase, speaks at the America Business Forum, Thursday, Nov. 6, 2025, in Miami. (AP Photo/Rebecca Blackwell, file)