WUHAN, China, Dec. 18, 2025 /PRNewswire/ -- GeeTest, a global leader in bot management and online security solutions serving over 360,000 enterprises worldwide, today highlights its powerful Business Rules Engine. This advanced no-code/low-code platform enables organizations to build flexible, automated risk control systems that deliver precise, real-time decision-making without relying on complex coding.

Businesses today must continually optimize operations, strengthen risk controls, respond instantly to market changes, and deliver personalized customer experiences amid intense competition. Traditional business rules engines often require extensive programming expertise and struggle with real-time adaptability. GeeTest Business Rules Engine addresses these pain points by decoupling business logic from application code, allowing non-technical teams (such as risk managers and business analysts) to visually configure, test, and deploy sophisticated rules using an intuitive drag-and-drop interface.

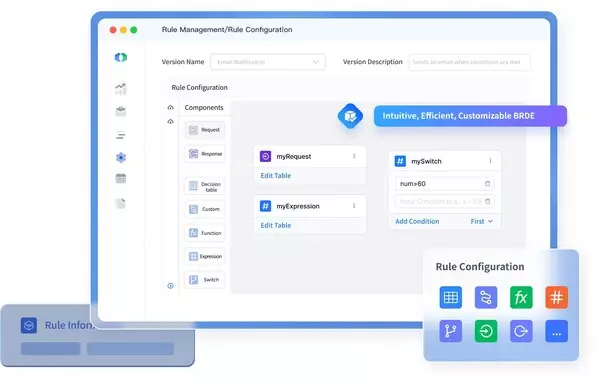

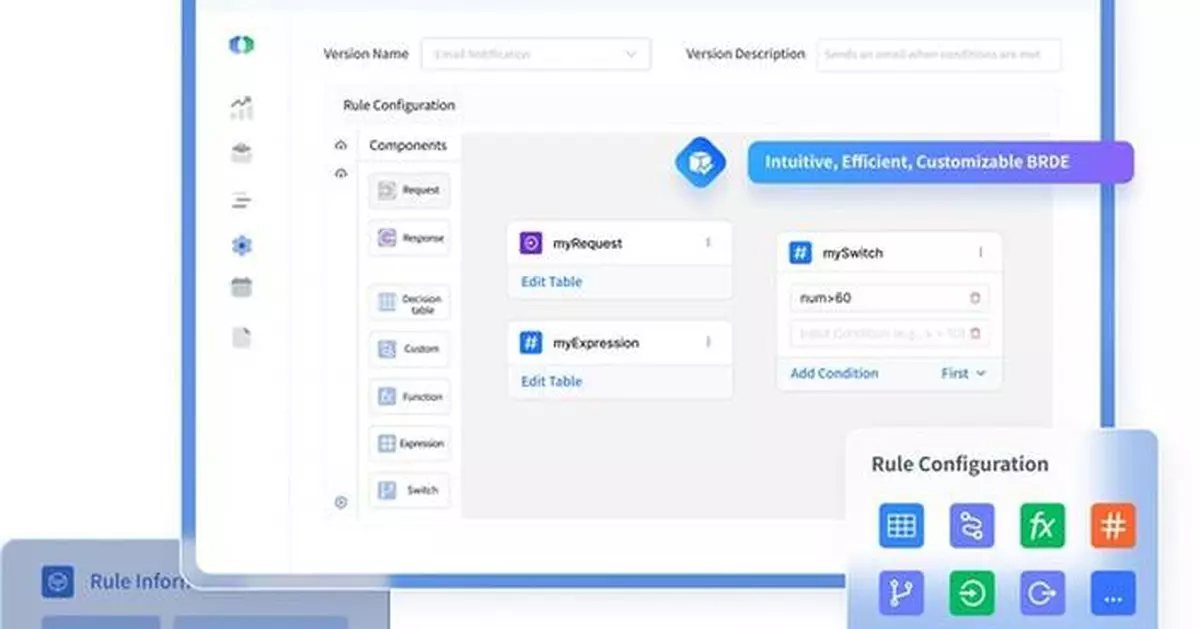

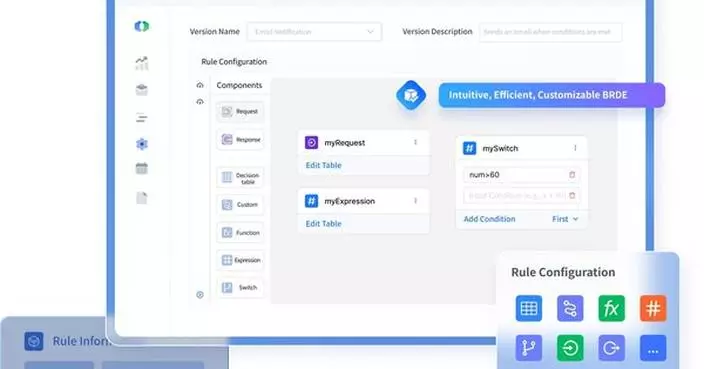

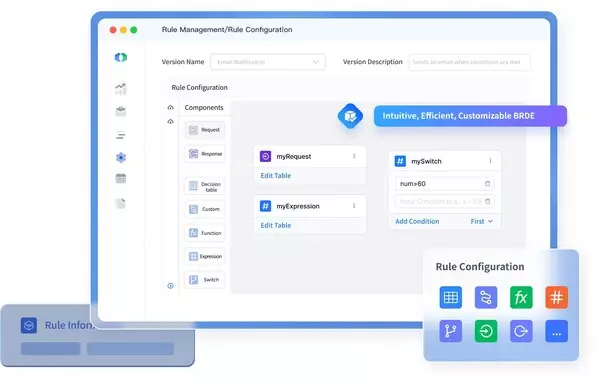

At the core of GeeTest Business Rules Engine is an intuitive drag-and-drop interface that visualizes decision logic through flowchart-based workflows. Users can assemble rules like building blocks, incorporating powerful components to handle even the most intricate scenarios without writing a single line of code.

Key features that distinguish GeeTest Business Rules Engine include:

- Visual Drag-and-Drop Configuration: Process-driven flowchart layouts that make complex logic easier to understand, build, and align with real business needs.

- Real-Time Dynamic Updates: Instant rule deployment and modification without service downtime or coding, enabling rapid adaptation.

- Automated Code Generation: API-driven generation of executable code in Java, Python, PHP, and other languages to speed integration and reduce development effort.

- Agile Rule Management: Pre-deployment data simulation, flexible rule status control, and safer rollout of updates.

- Powerful Built-In Components: Decision tables, custom nodes, and expression evaluation powered by the optimized ZEN language for fast and reliable computations.

- Real-Time Custom Computations: Integration of multiple data sources to support on-the-fly calculations, monitoring, and automated alerts.

About GeeTest

GeeTest provides AI-powered bot management and user verification solutions for enterprises worldwide. As of 2025, GeeTest protects more than 360,000 businesses globally, spanning industries such as finance, e-commerce, gaming, SaaS, and digital platforms. GeeTest solutions help organizations defend against automated abuse while maintaining a seamless and compliant user experience.

For more about GeeTest, follow the company on LinkedIn.

** The press release content is from PR Newswire. Bastille Post is not involved in its creation. **

GeeTest Introduces Advanced Business Rules Engine to Empower Businesses with Intelligent, Automated Decision-Making

JAKARTA, Indonesia, Dec. 18, 2025 /PRNewswire/ -- PT Sarana Multi Infrastruktur (Persero) (PT SMI) continues to strengthen its role as Indonesia's Development Finance Institution (DFI) by delivering infrastructure financing that generates tangible economic and social impact.

As a state-owned enterprise under the Ministry of Finance of the Republic of Indonesia, PT SMI carries a special mandate to bridge government fiscal policy with infrastructure financing needs. In recent years, this mandate has been strengthened through PT SMI's ongoing transformation into a full-fledged DFI, aligning its role more closely with global best practices in sustainable development financing.

As a DFI, PT SMI goes beyond the role of a conventional infrastructure financier. The company is increasingly focused on addressing market gaps, mobilizing long-term capital, and de-risking projects in sectors that are critical for national development but may be less attractive to purely commercial financing. This includes early-stage project support, blended finance structures, and the use of concessional funds to catalyze private sector participation.

PT SMI's DFI transformation is reflected in its stronger emphasis on development impact alongside financial sustainability. Financing decisions are guided not only by creditworthiness, but also by measurable economic, social, and environmental outcomes, including job creation, regional equity, climate resilience, and emissions reduction. This approach positions PT SMI as a key instrument in delivering Indonesia's sustainable development agenda. Through corporate financing, public sector financing, and advisory as well as project development services, PT SMI functions not only as a funding provider but also as a catalyst that enhances project readiness, planning quality, and long-term sustainability.

Strong Financial Performance with Broad Economic Impact

As of 3rd Quarter of 2025, PT SMI recorded total assets exceeding IDR 115 trillion and maintained its top-tier IdAAA credit rating. Non-performing loans (NPL) remained at a low level, reflecting prudent risk management practices. On the funding side, PT SMI benefits from a well-diversified funding structure, including bonds and sukuk issuances, bank loans, and support from international development finance institutions.

Cumulatively, PT SMI's financing commitments have surpassed IDR 254 trillion, supporting infrastructure projects with a total value of more than IDR 1,149 trillion. The resulting economic impact has been substantial, contributing over IDR 1,100 trillion to Indonesia's Gross Domestic Product (GDP) and creating approximately 10.7 million jobs. The multiplier effect of PT SMI-financed infrastructure projects has also exceeded the national average, underscoring infrastructure's role as a key driver of economic growth.

PT SMI's financing portfolio spans strategic sectors such as roads and toll roads, power generation, renewable energy, transportation, telecommunications, water supply, and social infrastructure including hospitals, education facilities, and tourism areas. Projects are distributed across all regions of Indonesia, from Java and Sumatra to Kalimantan, Sulawesi, Bali–Nusa Tenggara, Papua, and Maluku, reflecting PT SMI's strong commitment to equitable development.

Supporting Regional Development and Public Services

In its role as a DFI, PT SMI places strong emphasis on strengthening subnational development and improving access to essential public services. Public sector financing is therefore become a core pillar of PT SMI's DFI transformation, positioning the company as an effective fiscal tool of the Government of Indonesia.

Up until 3rd Quarter of 2025, PT SMI has disbursed public financing amounting to IDR 36.16 trillion of total commitment and outstanding of IDR 17.59 trillion. Through various regional loan schemes, including the National Economic Recovery Program (PEN), PT SMI enables local governments to continue developing priority infrastructure despite fiscal constraints. As a DFI, PT SMI is able to provide longer tenors, tailored financing structures, and countercyclical support that may not be readily available from commercial lenders.

PT SMI has financed wide range of strategic regional projects, including regional hospitals, local road improvements, water supply systems, and education infrastructure. Beyond physical outputs, this financing is designed to deliver development outcomes such as improved public service quality, stronger regional connectivity, enhanced resilience, and more inclusive local economic growth. By embedding development impact considerations into public financing, PT SMI reinforces its role as a DFI that supports balanced and sustainable regional development that can provide multiplier effect.

Strategic Corporate Financing

On the corporate side, PT SMI has provided financing and investment to 131 active debtors, comprising 51 state-owned enterprises and 80 private companies. This financing is designed to enhance project bankability while crowding in additional funding from other investors and financial institutions. Top 3 financing sectors of the company are : Road and Toll Road (IDR 41.13 trillion, representing 34.42% of total funded sectors), Renewable Energy (IDR 26.93 trillion, 22.54%) and Transportation (IDR 14.46 trillion, 12,1%).

PT SMI's strong commitment to energy transition is reflected in its growing portfolio of renewable energy and low-carbon projects, as well as its policy to limit exposure to high-emission assets. A notable example is PT SMI's financing of the Ijen Geothermal Power Plant (PLTP Ijen), a strategic renewable energy project that contributes to increase clean energy capacity, strengthening national energy security, and reducing greenhouse gas emissions. Beyond its environmental benefits, the project also generates positive socioeconomic impacts through job creation, local supply chain development, and regional economic growth.

In parallel, PT SMI supports broader transition efforts through the development of green and sustainable financing instruments, the integration of environmental and social safeguards, and participation in innovative mechanisms such as energy transition financing and blended finance structures.

Beyond the energy sector, PT SMI has expanded its corporate financing support to State-Owned Legal Entity Universities (PTNBH), including Universitas Gadjah Mada (UGM), through sharia financing scheme. Sharia financing provided by PT SMI is structured in accordance with Islamic principles, emphasizing asset-backed transactions, risk-sharing, and the prohibition of speculative elements.

This sharia-based financing supports the development of modern, resilient, and sustainable higher education infrastructure—such as academic buildings, research facilities, student housing, and supporting campus utilities—while ensuring alignment with ethical and socially responsible financing principles. By offering sharia financing options alongside conventional instruments, PT SMI broadens access to long-term funding for higher education institutions and contributes to sustained improvements in human capital quality, research capability, and national innovation capacity.

Strategic Direction towards 2026

Looking ahead to 2026, PT SMI has outlined a strategic roadmap to further strengthen its transformation as a development finance institution while also actively take part in Asta Cita's program. Other key priorities include diversifying funding sources and optimizing the cost of funds, alongside expanding green and sustainable financing instruments.

PT SMI also aims to increase the share of thematic financing related to climate and social objectives, strengthen public sector financing by enhancing local government capacity, and expand corporate financing and investment in national priority sectors. At the same time, continuous improvements in governance, risk management, and the use of data and analytics will support healthy and sustainable asset growth.

Through these strategies, PT SMI reaffirms its commitment to remain a strategic partner of the Government of Indonesia in advancing inclusive, sustainable infrastructure development that delivers long-term value for the nation.

About PT Sarana Multi Infrastruktur (Persero) ("PT SMI")

PT Sarana Multi Infrastruktur (Persero) ("PT SMI"), established on February 26, 2009, is a State-Owned Enterprise under the coordination of the Ministry of Finance, in the form of a Non-Bank Financial Institution (LKBB). PT SMI plays a role and has a mandate as an agent of sustainable development. PT SMI has 3 business pillars, namely Commercial Financing, Public Financing, and Advisory Service and Project Development.

PT SMI has various functions and unique products/features to support the acceleration of infrastructure development, which not only serves as infrastructure financing but also as an enabler through the implementation of the Government and Business Entity Cooperation (KPBU) scheme involving various financial institutions, both private and multilateral. PT SMI actively supports the implementation of Public Private Partnership (PPP) and encourages the acceleration of infrastructure development in the regions through regional loan products.

** The press release content is from PR Newswire. Bastille Post is not involved in its creation. **

PT SMI Strengthens Indonesia's Sustainable Infrastructure Financing