TORONTO--(BUSINESS WIRE)--Aug 22, 2025--

Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS) (“Americas” or the “Company”), a growing North American precious metals producer, is pleased to announce strong exploration results at the Galena Complex, highlighting the identification of a high-grade upper extension of the 149 Vein.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250822349274/en/

The Company is also pleased to report that its previously announced share consolidation has been effected and trading on a post-consolidation basis is expected to occur starting with the open of trading on August 26, 2025, on the basis of one (1) post-consolidation common share of the Company (“Common Share”) for every two and a half (2.5) pre-consolidation Common Shares (the “Consolidation”).

Paul Andre Huet, Chairman and CEO, commented:“The identification of this high-grade copper-silver-antimony extension to the 149 Vein is an exciting development that builds on our ongoing success in unlocking additional value at the Galena Complex. With some extraordinary intercepts, including 24,913 grams per ton silver over 0.21 metres, and nearly 120 meters of vertical continuity demonstrated above the current mining level and exceptional grades in the intercepts, this extension positions us to potentially expand production from an already high-performing vein. It aligns with our targeted exploration strategy to enhance mill feed quality and operational efficiency, supporting our goals of increasing output and shareholder value.

“We are also pleased with the completion of the share consolidation, which represents a strategic move to strengthen our capital structure. By reducing the number of outstanding shares, the consolidation maintains shareholder value and opens the doors to institutional investors with minimum price thresholds. It also potentially unlocks access to margin accounts at certain brokerages. Our leadership team successfully executed a 4.5-to-1 consolidation at Karora Resources in 2020, which saw the daily trading value triple over four years, demonstrating our experience with such initiatives, though past performance is not indicative of future results. This consolidation positions Americas for future growth as we continue to advance our high-potential assets.”

High-grade Extension of 149 Vein Uncovered by Exploration Drilling at Galena Complex, Highlighted by 24,913 g/t Ag and 16.9% Cu Over 0.21 Meters

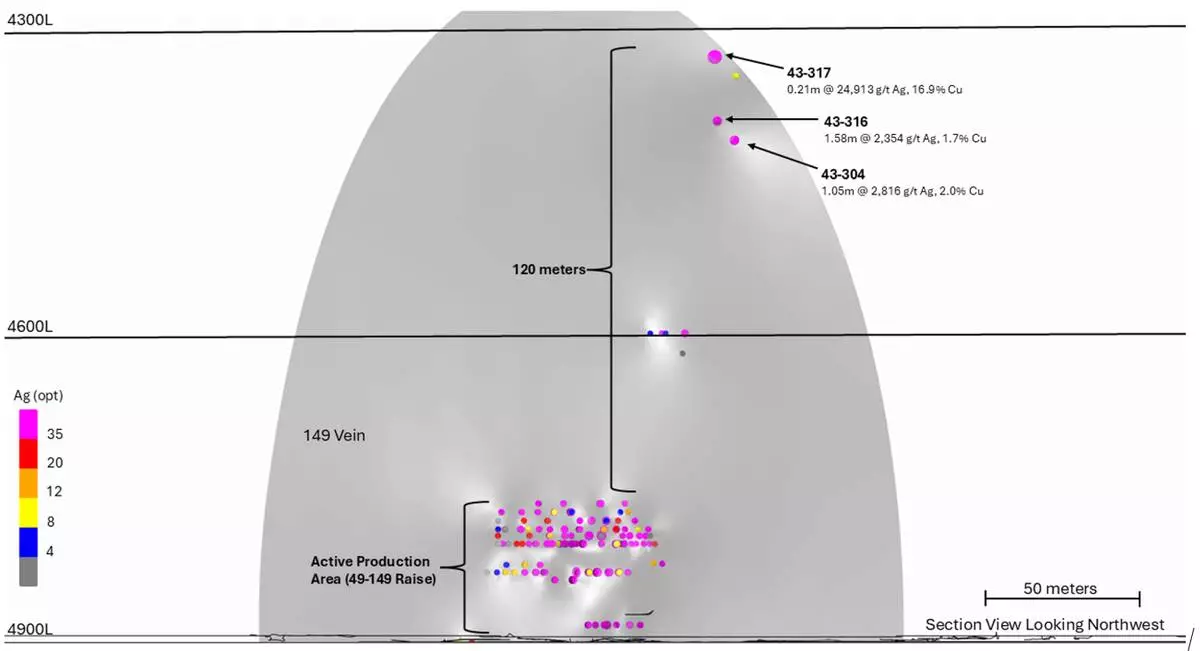

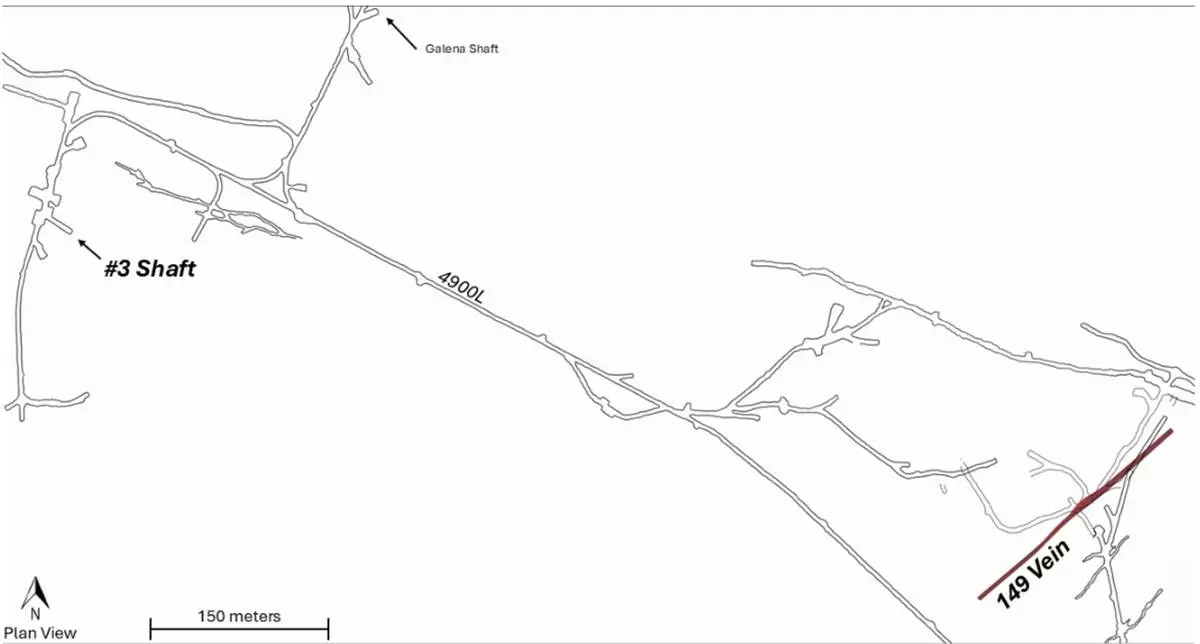

Recent early-stage exploration drilling on the 4300 Level from the 43-191 DDS at the Galena Mine has identified a high-grade copper-silver-antimony vein believed to be the upper extension of the previously identified 149 Vein. The three holes drilled to date demonstrate nearly 120 meters of vertical continuity above current mining level with more drilling in progress to infill and extend this vein. The 149 Vein is currently being mined below these intercepts, producing a consistent high-grade mill feed of 600-700 tons per cut that average 700-950 silver grams per ton and 0.6-0.7% copper. The 149 Vein is a strong candidate currently under review for long hole open stoping.

The geologic setting and host rock interpretation indicates that recent intercepts are near the upper crown of the 149 Vein. This area is located within the transition zone of the Upper Revett and the St. Regis Formations, the two dominant Belt Supergroup formations seen at the Galena Mine. To date, 4,878 meters have been drilled from this station out of a planned 18,100 meters, testing several different targets in addition to the 149 Vein.

Drill results on the 149 vein to-date are:

Antimony (Sb) results are currently pending on holes 43-316 and 43-317.

These intercepts underscore the high-grade nature of the 149 Vein extension, with potential to contribute to near-term mining plans and further resource delineation as additional drilling progresses. The vein remains open for expansion, and ongoing efforts will focus on infilling and testing adjacent targets to maximize its contribution to the Galena Complex's production profile.

A full table of drill results can be found at: https://americas-gold.com/site/assets/files/4297/dr20250822.pdf

Share Consolidation

Further to the announcement included in its news release dated August 11, 2025, the Company has filed articles of amendment, effective August 21, 2025, to effect the previously announced Consolidation on the basis of one (1) post-consolidation Common Share for every two and a half (2.5) pre-consolidation Common Shares. The Common Shares are expected to commence trading under their existing symbols on the Toronto Stock Exchange and on the NYSE American on a post-Consolidation basis on the opening of trading on Tuesday, August 26, 2025.

The Consolidation reduced the number of Common Shares issued and outstanding from approximately 679,357,056 to approximately 271,742,692. As a result of the Consolidation, shares issuable pursuant to the Company’s outstanding stock options, warrants, restricted share units, performance share units and other convertible securities will be proportionally adjusted on the same basis.

For additional information regarding the Consolidation, please refer to the Company’s Notice of Annual and Special Meeting of Shareholders and Management Information Circular dated May 15, 2025, which are available on SEDAR+ at www.sedarplus.ca or EDGAR at www.sec.gov.

Most shareholders of the Company are “non-registered” shareholders because the Common Shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the Common Shares. Non-registered shareholders are not required to take any action with respect to their Common Shares as a result of the Consolidation, but should contact their intermediaries if they have questions regarding how their Common Shares will be processed in connection with the Consolidation.

Computershare Investor Services Inc. (“Computershare”), the Company’s transfer agent, is mailing letters of transmittal to the Company’s registered shareholders holding share certificates providing instructions on exchanging share certificates representing pre-Consolidation Common Shares for share certificates representing post-Consolidation Common Shares. Registered shareholders holding pre-Consolidation Common Shares through the Direct Registration System (“DRS”) will be automatically sent a DRS advice by Computershare, representing the number of post-Consolidation Common Shares they hold following the Consolidation and no further action is required to be taken.

The new CUSIP of the Common Shares is 03062D803 (ISIN: CA03062D8035).

About Americas Gold and Silver Corporation

Americas Gold & Silver is a growing precious metals mining company with multiple assets in North America. In December 2024, Americas increased its ownership in the Galena Complex (Idaho, USA) from 60% to 100% in a transaction with Eric Sprott, solidifying its position as a silver-focused producer. Americas also owns and operates the Cosalá Operations in Sinaloa, Mexico. Eric Sprott is the Company’s largest shareholder, holding an approximate 20% interest. Americas has a proven and experienced management team led by Paul Huet, is fully funded to execute its growth plans, and focused on becoming one of the top North American silver plays, with an objective of over 80% of its revenue to be generated from silver by the end of 2025.

Technical Information and Qualified Persons

The scientific and technical information relating to the Company’s material mining properties contained herein has been reviewed and approved by Rick Streiff, Executive Vice President – Geology of the Company. Mr. Streiff is a “qualified person” for the purposes of NI 43-101. The Company’s current Annual Information Form and the NI 43-101 Technical Reports for its mineral properties, all of which are available on SEDAR+ at www.sedarplus.ca, and EDGAR at www.sec.gov, contain further details regarding mineral reserve and mineral resource estimates, classification and reporting parameters, key assumptions and associated risks for each of the Company’s material mineral properties, including a breakdown by category.

All mining terms used herein have the meanings set forth in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), as required by Canadian securities regulatory authorities. These standards differ from the requirements of the SEC that are applicable to domestic United States reporting companies. Any mineral reserves and mineral resources reported by the Company in accordance with NI 43-101 may not qualify as such under-SEC standards. Accordingly, information contained in this news release may not be comparable to similar information made public by companies subject to the SEC’s reporting and disclosure requirements.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas’ expectations, intentions, plans, assumptions, and beliefs with respect to, among other things, the commencement of trading of the Common Shares on the TSX and the NYSE American on a post-Consolidation basis, the potential for further institutional investor interest in the Company, the potential incorporation of the 149 Vein extension into mine plans at the Galena Complex, and the ability to expand production at the vein, the estimated continuity of the 149 Vein, and the anticipated timing and results of ongoing and planned exploration drilling at the Galena Complex, statements about the Company’s exploration strategy, enhancement mill feed quality and operational efficiency, and anticipated ability to increase shareholder value and are subject to the risks and uncertainties outlined below. Often, but not always, forward-looking information can be identified by forward-looking words such as “anticipate,” “believe,” “expect,” “goal,” “plan,” “intend,” “potential,” “estimate,” “may,” “assume,” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Americas as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas to be materially different from those expressed or implied by such forward-looking information. These risks and uncertainties include, but are not limited to the risk factors relating to the Company found under the heading “Risk Factors” in the Company’s Annual Information Form dated March 31, 2025 or the Company’s MD&A for the three and six months ended June 30, 2025 dated August 11, 2025; interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development, or production; general economic conditions and conditions affecting the mining industry; the uncertainty of regulatory requirements and approvals; potential litigation; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; risks associated with the mining industry generally, such as economic factors (including future commodity prices, currency fluctuations, and energy prices), ground conditions, failure of plant, equipment, processes, and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in grade or recovery rates, permitting timelines, capital expenditures, reclamation activities, labor relations; and risks related to changing global economic conditions and market volatility. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward-looking information is available in Americas’ filings with the Canadian Securities Administrators on SEDAR+ and with the SEC. Americas does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events, or other such factors which affect this information, except as required by law. Americas does not give any assurance (1) that Americas will achieve its expectations, or (2) concerning the result or timing thereof. All subsequent written and oral forward-looking information concerning Americas are expressly qualified in their entirety by the cautionary statements above.

Figure 2 – Cross section view showing the active production area on the 149 Vein and new drill intercepts. (Photo: Americas Gold and Silver Corporation)

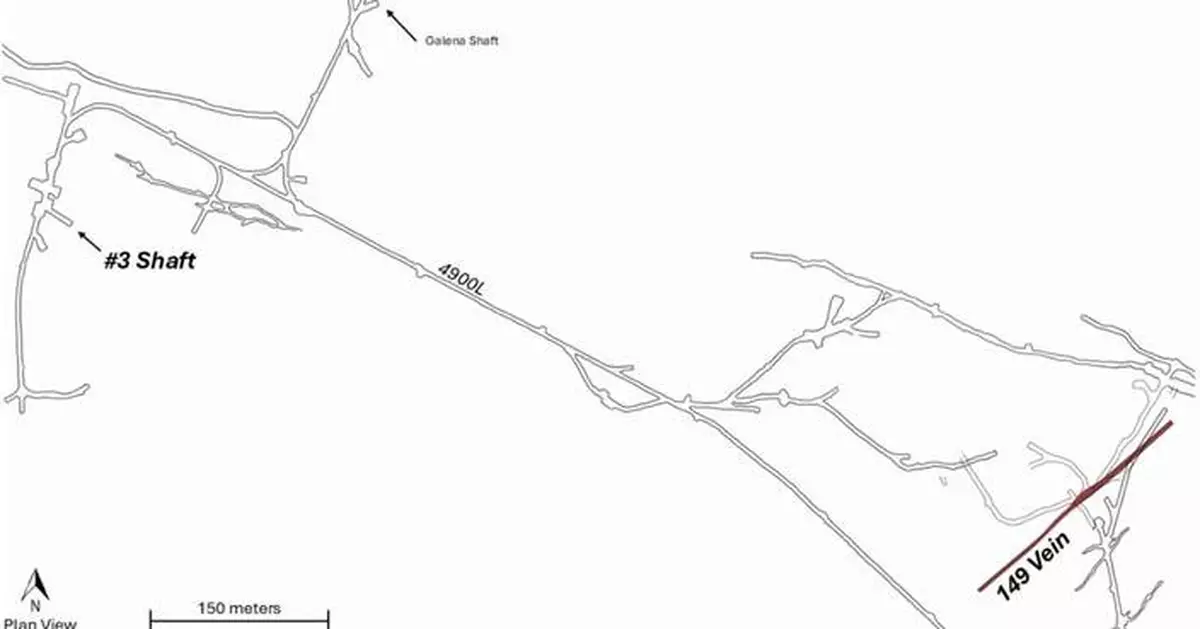

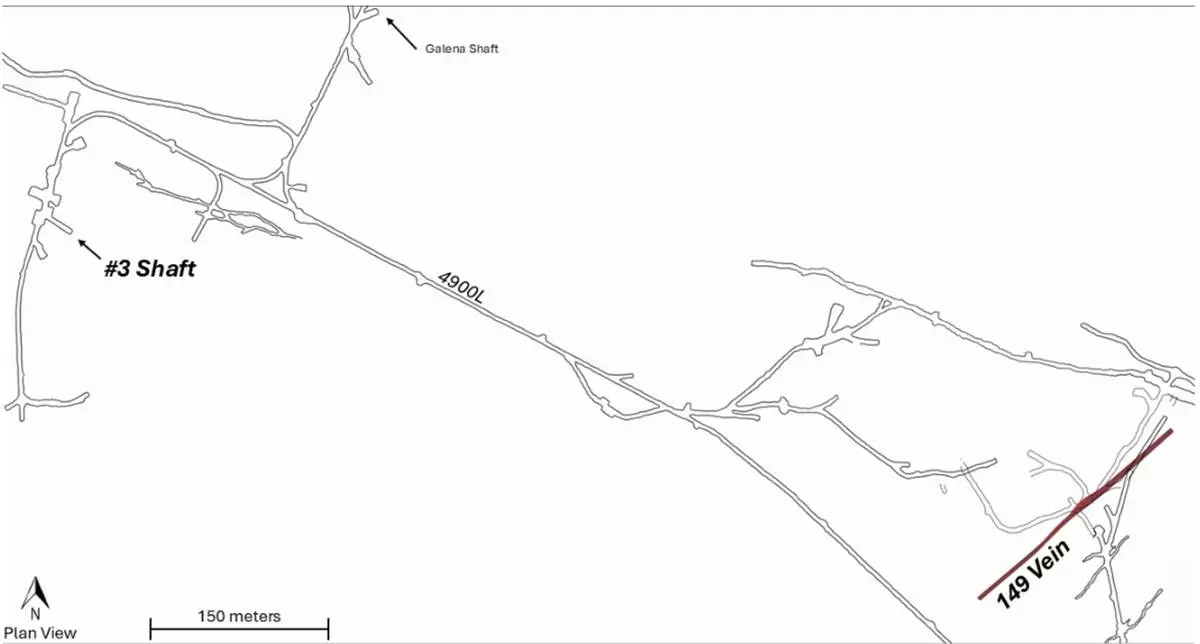

Figure 1 – Plan view of the 4900 Level showing the 149 Vein in relation to the No. 3 and Galena Shafts. (Photo: Americas Gold and Silver Corporation)