Chinese stocks reached two milestones on Monday.

According to real-time data statistics, as of 10:34, the total market capitalization of A-share companies exceeded 100 trillion yuan (calculated as the latest price of A-shares multiplied by total share capital), roughly 13.92 trillion U.S. dollars, marking a historical high.

Click to Gallery

Market capitalization of A-shares surpasses 100 trillion yuan

Market capitalization of A-shares surpasses 100 trillion yuan

Market capitalization of A-shares surpasses 100 trillion yuan

Market capitalization of A-shares surpasses 100 trillion yuan

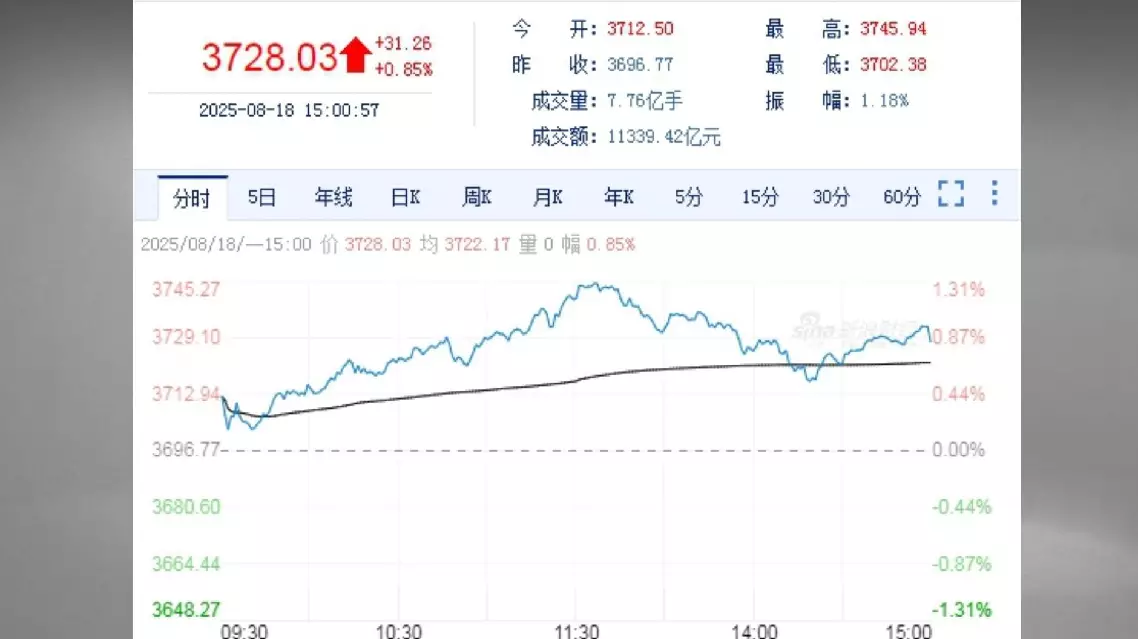

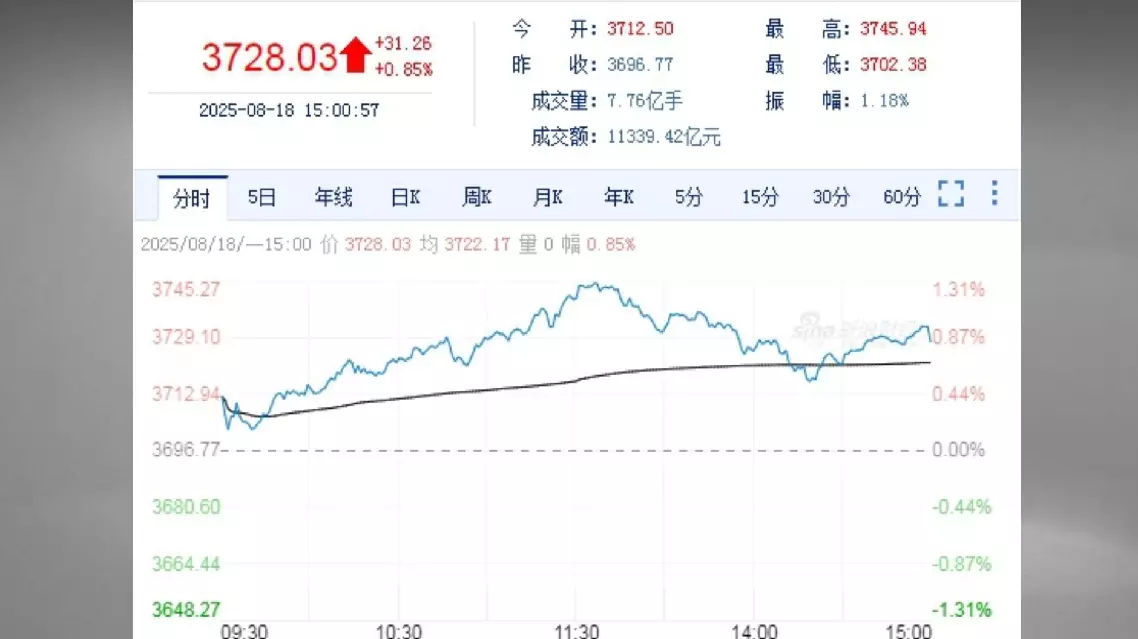

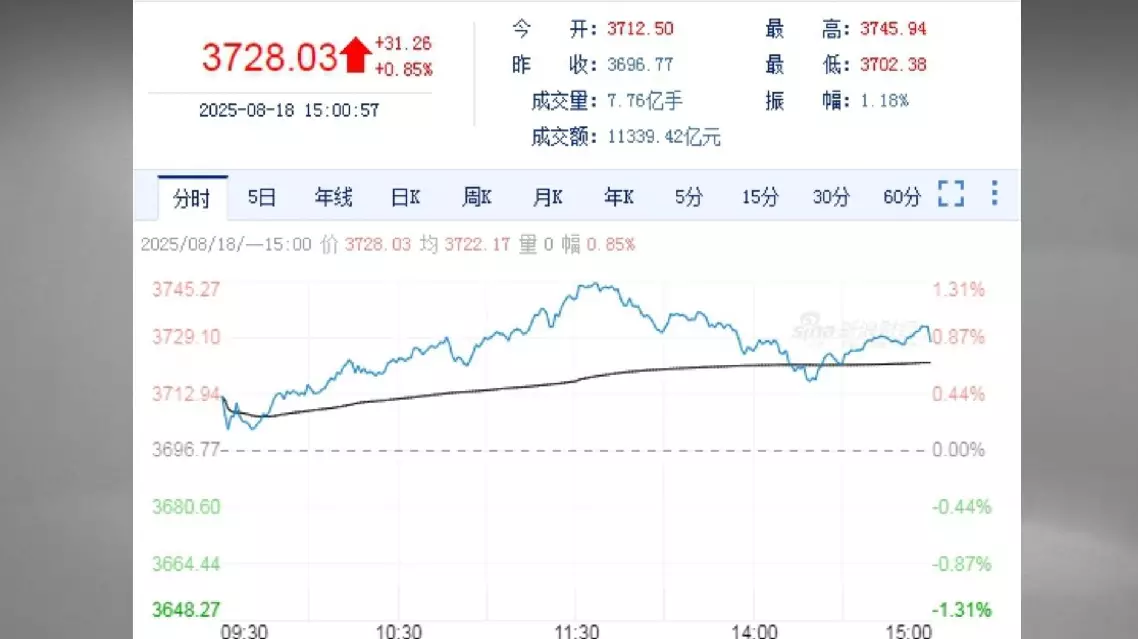

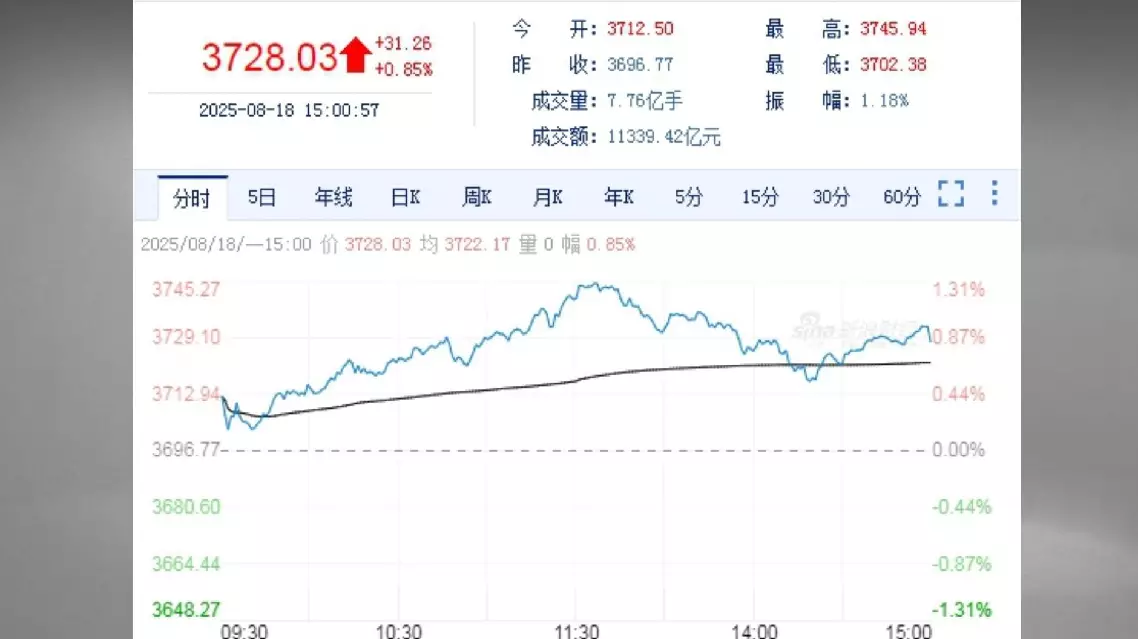

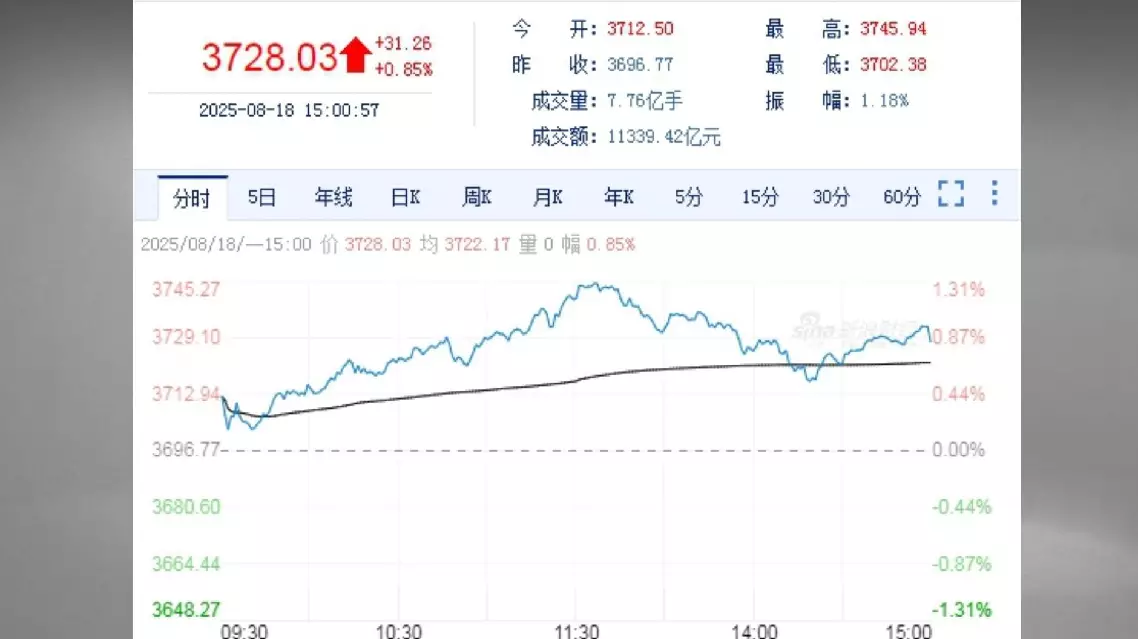

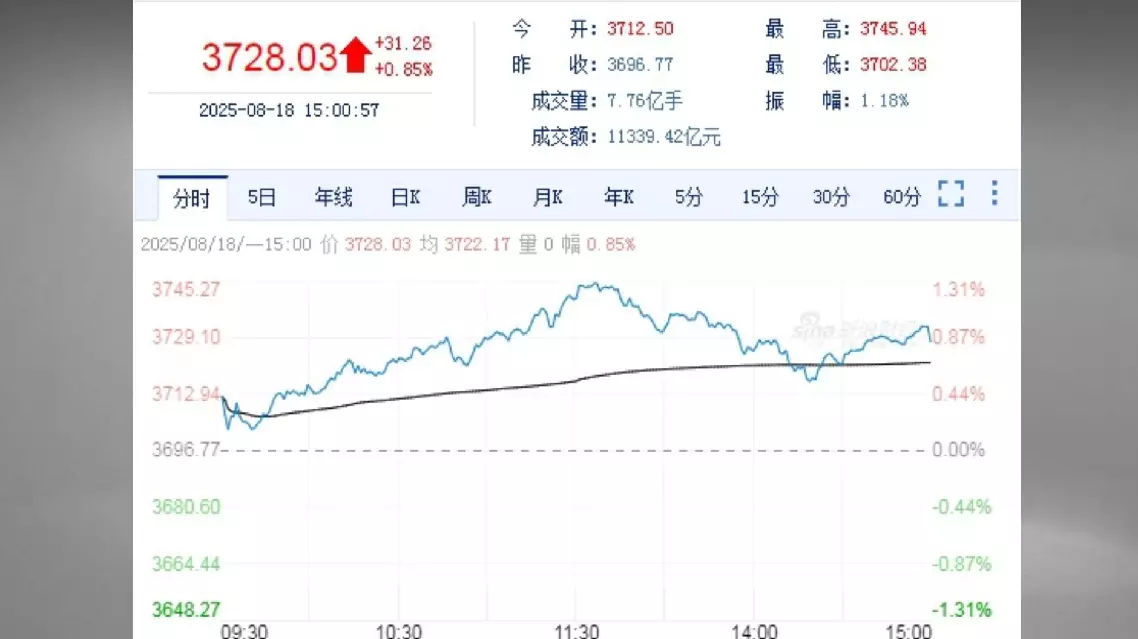

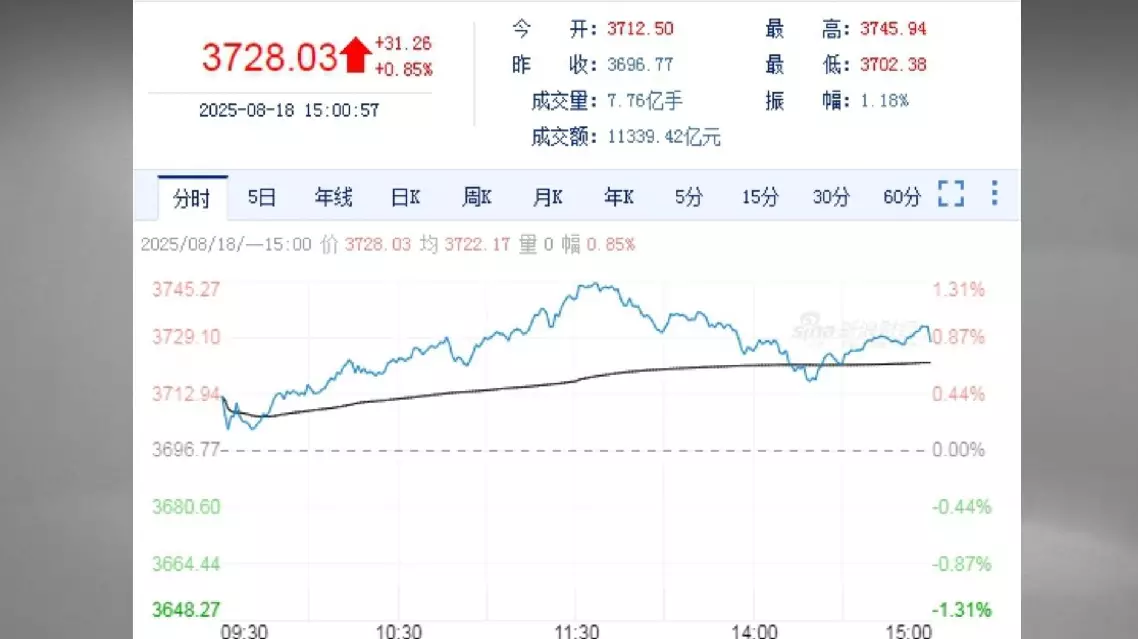

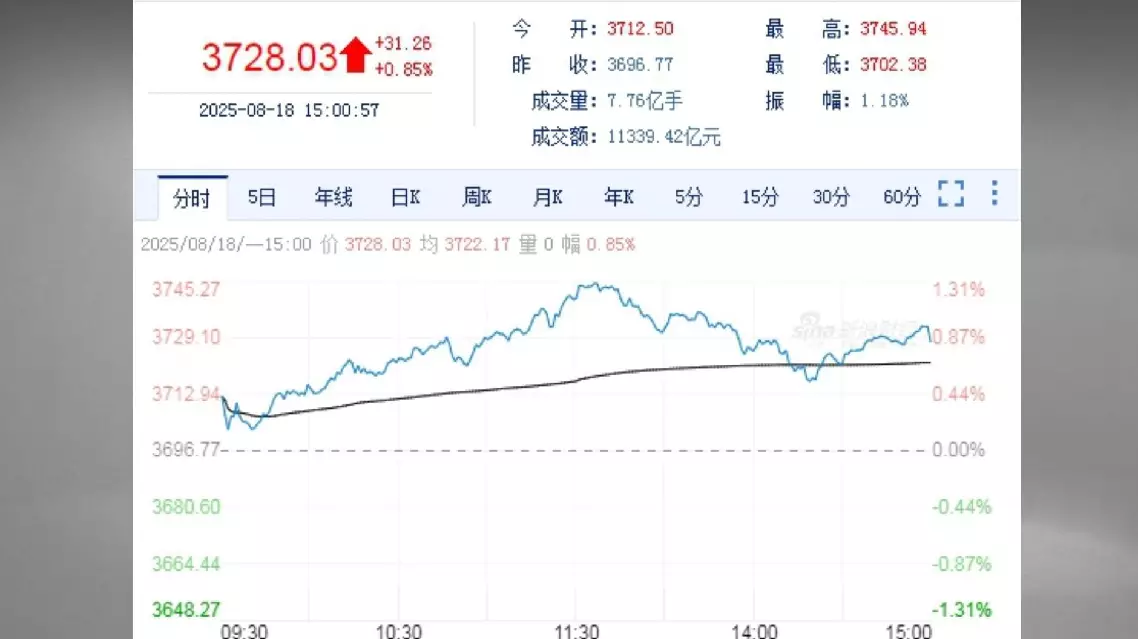

As of 11:30 midday closing, the Shanghai Composite Index surpassed the intraday high of 3,731.69 points, set on Feb 18, 2021, and reached 3,740.50, marking a new high since Aug 20, 2015.

The Shanghai Composite Index closed at 3,728.03 points on Monday, up 0.85 percent, or 31.26 points, from the previous trading day.

Market capitalization of A-shares surpasses 100 trillion yuan

Market capitalization of A-shares surpasses 100 trillion yuan

Market capitalization of A-shares surpasses 100 trillion yuan

Market capitalization of A-shares surpasses 100 trillion yuan

Canadian Prime Minister Mark Carney's official visit to China signals a policy shift towards building a more pragmatic relationship between the two countries, according to a Canadian researcher.

Carney arrived in Beijing on Wednesday to begin an official visit to China through Saturday, which marks the first trip by a Canadian Prime Minister to the country in eight years.

Robert Hanlon, director and principal investigator of Canada and the Asia Pacific Policy Project (CAPPP) at Thompson Rivers University in British Columbia, told the China Global Television Network (CGTN) that Carney's visit indicates Canada is recalibrating its strategic perception of China, which could cement the foundation for the country's economic diversification efforts and boost the development of bilateral cooperation.

"I think it's a clear message that he has moved Canada's strategy to a much more pragmatic, interest-based, -focused relationship with our trading partners, moving away from values-based narratives that we might have heard on previous governments. Canada has spoken about moving from what the Prime Minister's Office is calling "from reliance to resilience", and that means diversifying our economies and our trade everywhere in the world. And so China being our second largest trading partner, it makes perfect sense for our PM to head to Beijing," he said.

The scholar also noted the huge cooperation potential between the two sides in economic and trade fields, citing Canada's efforts to step up shipments of liquefied natural gas (LNG) and the planned construction of an oil pipeline in Alberta which aims to increase export access to Asian markets. "Canada and China both share tremendous economic opportunities together and so finding ways to enhance our exports. Canada specifically looking to build out its LNG and oil, kind of export market. We know Canada is a major producer of critical minerals and China is a buyer. And so there's a lot of synergy between that kind of those kind of markets," he said.

Canadian PM's visit to China paves way for more pragmatic trade ties: scholar