SAN FRANCISCO (AP) — Heliot Ramos hit a tying two-run double in the seventh then Jung Hoo Lee followed with a sacrifice fly that put San Francisco ahead, and the Giants rallied to beat the San Diego Padres 6-5 on Wednesday night.

San Francisco ended a stretch of 16 straight games scoring four or fewer runs.

Click to Gallery

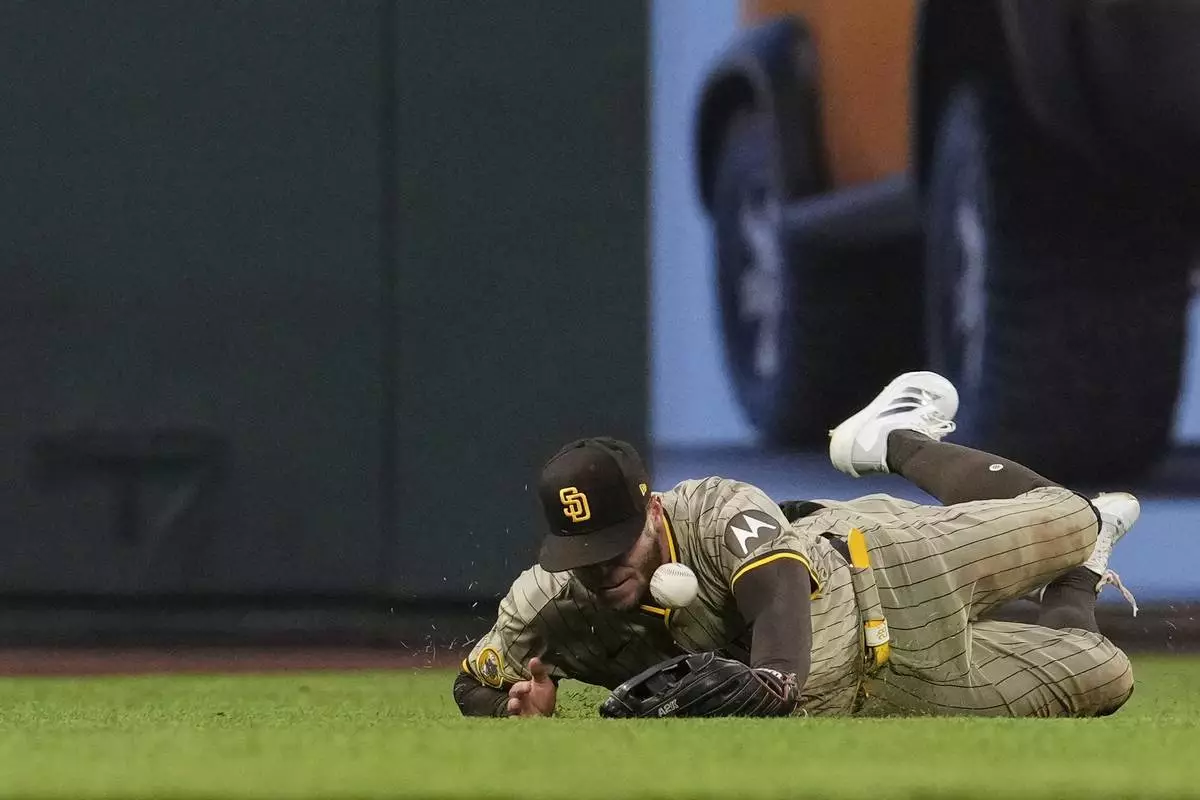

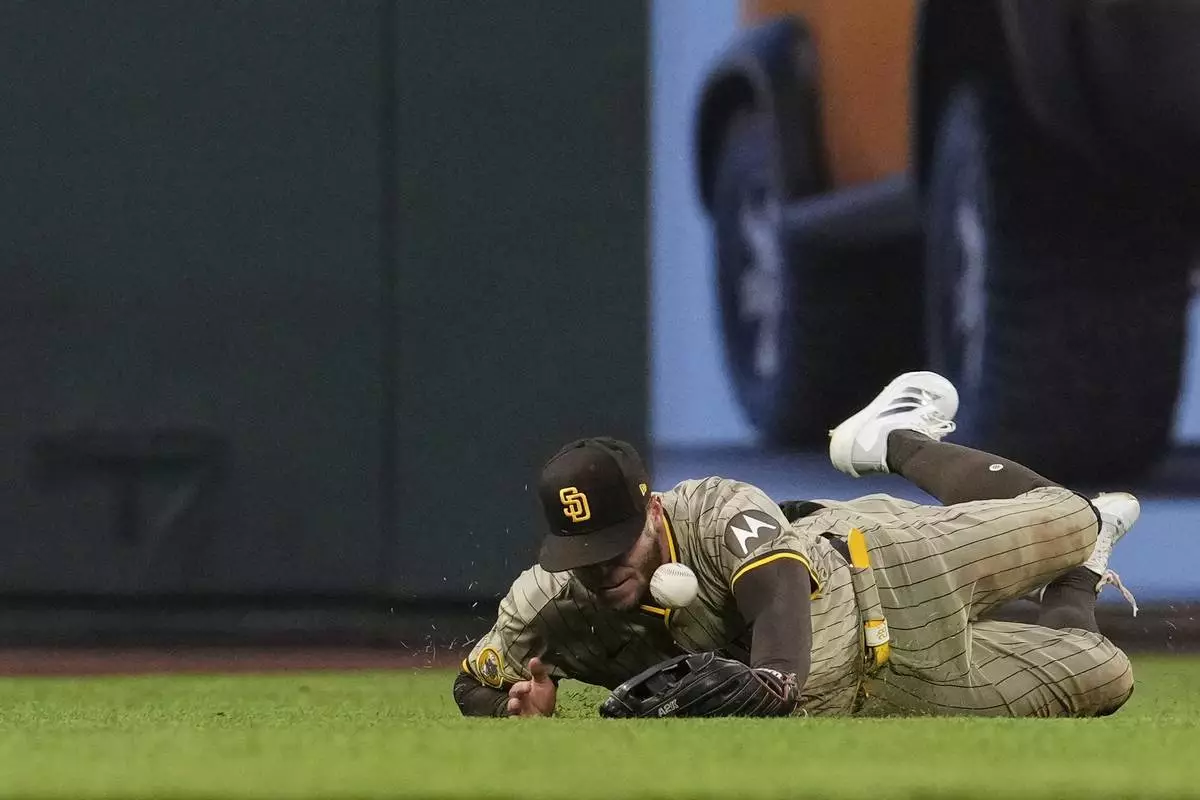

San Diego Padres left fielder Brandon Lockridge is unable to catch a double hit by San Francisco Giants' Jung Hoo Lee during the sixth inning of a baseball game Wednesday, June 4, 2025, in San Francisco. (AP Photo/Godofredo A. Vásquez)

San Diego Padres pitcher Nick Pivetta, center, hands the ball over to manager Mike Shildt as he exits during the seventh inning of a baseball game against the San Francisco Giants, Wednesday, June 4, 2025, in San Francisco. (AP Photo/Godofredo A. Vásquez)

San Diego Padres left fielder Brandon Lockridge (28) is unable to catch a two-run home run hit by San Francisco Giants' Matt Chapman during the sixth inning of a baseball game Wednesday, June 4, 2025, in San Francisco. (AP Photo/Godofredo A. Vásquez)

San Francisco Giants' Matt Chapman, right, celebrate with third base coach Matt Williams (9) after hitting a two-run home run during the sixth inning of a baseball game against the San Diego Padres, Wednesday, June 4, 2025, in San Francisco. (AP Photo/Godofredo A. Vásquez)

San Francisco Giants' Matt Chapman, right, celebrate with Jung Hoo Lee after hitting a two-run home run during the sixth inning of a baseball game against the San Diego Padres, Wednesday, June 4, 2025, in San Francisco. (AP Photo/Godofredo A. Vásquez)

Gavin Sheets hit a two-run triple in the first then singled in two more runs in the fifth for San Diego, which had a pair of 10-inning wins to start the four-game series.

Fernando Tatis Jr. singled to start the ninth against Ryan Walker then right fielder Daniel Johnson ran down Luis Arráez's fly to save an extra-base hit. Manny Machado followed with a single and Randy Rodríguez relieved and recorded the final two outs for his first career save.

Matt Chapman hit a two-run homer in the sixth off right-hander Nick Pivetta, who struck out five over six innings and was tagged for five runs on six hits.

Pivetta gave way to Jason Adam (5-2) after walking Willy Adames to start the seventh then allowing Daniel Johnson's single. After Patrick Bailey struck out, Tyler Fitzgerald singled to load the bases for Ramos.

Sean Hjelle (1-0) pitched 2 2/3 innings of relief for the win in his season debut after being recalled from the minors Tuesday.

Sheets’ second hit chased Giants lefty Kyle Harrison, who was then checked by an athletic trainer in the dugout after being hit in the pitching elbow with a comebacker. X-rays were negative and Harrison was relieved there's “no damage.”

He is expected to make at least one more start before Justin Verlander returns from the injured list and rejoins the rotation.

The Giants' 16 consecutive games with four or fewer runs ranked as their second longest single-season streak since moving to San Francisco in 1958. They did so in 19 straight games in 1965.

RHP Dylan Cease (1-4, 4.66 ERA) pitches the series finale for San Diego opposite Giants LHP Robbie Ray (7-1, 2.43).

AP MLB: https://apnews.com/hub/MLB

San Diego Padres left fielder Brandon Lockridge is unable to catch a double hit by San Francisco Giants' Jung Hoo Lee during the sixth inning of a baseball game Wednesday, June 4, 2025, in San Francisco. (AP Photo/Godofredo A. Vásquez)

San Diego Padres pitcher Nick Pivetta, center, hands the ball over to manager Mike Shildt as he exits during the seventh inning of a baseball game against the San Francisco Giants, Wednesday, June 4, 2025, in San Francisco. (AP Photo/Godofredo A. Vásquez)

San Diego Padres left fielder Brandon Lockridge (28) is unable to catch a two-run home run hit by San Francisco Giants' Matt Chapman during the sixth inning of a baseball game Wednesday, June 4, 2025, in San Francisco. (AP Photo/Godofredo A. Vásquez)

San Francisco Giants' Matt Chapman, right, celebrate with third base coach Matt Williams (9) after hitting a two-run home run during the sixth inning of a baseball game against the San Diego Padres, Wednesday, June 4, 2025, in San Francisco. (AP Photo/Godofredo A. Vásquez)

San Francisco Giants' Matt Chapman, right, celebrate with Jung Hoo Lee after hitting a two-run home run during the sixth inning of a baseball game against the San Diego Padres, Wednesday, June 4, 2025, in San Francisco. (AP Photo/Godofredo A. Vásquez)

WASHINGTON (AP) — A bipartisan group of lawmakers have proposed creating a new agency with $2.5 billion to spur production of rare earths and the other critical minerals, while the Trump administration has already taken aggressive actions to break China's grip on the market for these materials that are crucial to high-tech products, including cellphones, electric vehicles, jet fighters and missiles.

It’s too early to tell how the bill, if passed, could align with the White House’s policy, but whatever the approach, the U.S. is in a crunch to drastically reduce its reliance on China, after Beijing used its dominance of the critical minerals market to gain leverage in the trade war with Washington. President Donald Trump and Chinese President Xi Jinping agreed to a one-year truce in October, by which Beijing would continue to export critical minerals while the U.S. would ease its export controls of U.S. technology on China.

The Pentagon has shelled out nearly $5 billion over the past year to help ensure its access to the materials after the trade war laid bare just how beholden the U.S. is to China, which processes more than 90% of the world's critical minerals. To break Beijing's chokehold, the U.S. government is taking equity stakes in a handful of critical mineral companies and in some cases guaranteeing the price of some commodities using an approach that seems more likely to come out of China's playbook instead of a Republican administration.

The bill that Sen. Jeanne Shaheen, D-N.H., and Sen. Todd Young, R-Ind., introduced Thursday would favor a more market-based approach by setting up the independent body charged with building a stockpile of critical minerals and related products, stabilizing prices, and encouraging domestic and allied production to help ensure stable supply not only for the military but also the broader economy and manufacturers.

Shaheen called the legislation “a historic investment” to make the U.S. economy more resilient against China’s dominance that she said has left the U.S. vulnerable to economic coercion. Young said creating the new reserve is “a much-needed, aggressive step to protect our national and economic security.”

Rep. Rob Wittman, R.-Va., introduced the House version of the bill.

When Trump imposed widespread tariffs last spring, Beijing fought back not only with tit-for-tat tariffs but severe restrictions on the export of critical minerals, forcing Washington to back down and eventually agree to the truce when the leaders met in South Korea.

On Monday, in his speech at SpaceX, Defense Secretary Pete Hegseth revealed that the Pentagon has in the past five months alone “deployed over $4.5 billion in capital commitments” to close six critical minerals deals that will “help free the United States from market manipulation.”

One of the deals involves a $150 million of preferred equity by the Pentagon in Atlantic Alumina Co. to save the country's last alumina refinery and build its first large-scale gallium production facility in Louisiana.

Last year, the Pentagon announced it would buy $400 million of preferred stock in MP Materials, which owns the country's only operational rare earths mine at Mountain Pass, California, and entered into a $1.4-billion joint partnership with ReElement Technologies Corp. to build up a domestic supply chain for rare earth magnets.

On Wednesday, Trump announced in a proclamation that the U.S. is “too reliant” on foreign-sourced critical minerals and directed his administration to negotiate better deals. He said possible remedies would include minimum import prices for certain critical minerals.

“Reshoring manufacturing that’s critical to our national and economic security is a top priority for the Trump administration,” said Kush Desai, a White House spokesperson.

The drastic move by the U.S. government to take equity stakes has prompted some analysts to observe that Washington is pivoting to some form of state capitalism to compete with Beijing.

“Despite the dangers of political interference, the strategic logic is compelling,” wrote Elly Rostoum, a senior fellow at the Washington-based research institute Center for European Policy Analysis. She suggested that the new model could be “a prudent way for the U.S. to ensure strategic autonomy and industrial sovereignty.”

Companies across the industry are welcoming the intervention from Trump's administration.

“He is playing three-dimensional chess on critical minerals like no previous president has done. It's about time too, given the military and strategic vulnerability we face by having to import so many of these fundamental building blocks of technology and national defense,” NioCorp's Chief Communications Officer Jim Sims said. That company is trying to finish raising the money it needs to build a mine in southeast Nebraska.

In addition to trying to boost domestic production, the Trump administration has sought to secure some of these crucial elements through allies. In October, Trump signed an $8.5 billion agreement with Australia to invest in mining there, and the president is now aggressively trying to take over Greenland in the hope of being able to one day extract rare earths from there.

On Monday, finance ministers from the G7 nations huddled in Washington over their vulnerability in the critical mineral supply chains.

U.S. Treasury Secretary Scott Bessent, who has led several rounds of trade negotiations with Beijing, urged attendees to increase their supply chain resiliency and thanked them for their willingness to work together “toward decisive action and lasting solutions,” according to a Treasury statement.

The bill introduced on Thursday by Shaheen and Young would encourage production with both domestic and allied producers.

Congress in the past several years has pushed for legislation to protect the U.S. military and civilian industry from Beijing's chokehold. The issue became a pressing concern every time China turned to its proven tactics of either restricting the supply or turned to dumping extra critical minerals on the market to depress prices and drive any potential competitors out of business.

The Biden administration sought to increase demand for critical minerals domestically by pushing for more electric vehicle and windmill production. But the Trump administration largely eliminated the incentives for those products and instead chose to focus on increasing critical minerals production directly.

Most of those past efforts were on a much more limited scale than what the government has done in the past year, and they were largely abandoned after China relented and eased access to critical minerals.

Funk reported from Omaha, Nebraska. AP writer Konstantin Toropin contributed to the report.

FILE - NioCorp Chief Operating Officer Scott Honan tells a group of investors about the plans for a proposed mine during a tour of the site Oct. 6, 2021, near Elk Creek in southeast Nebraska. (AP Photo/Josh Funk, File)

FILE - President Donald Trump, left, and Chinese President Xi Jinping, right, shake hands before their meeting at Gimhae International Airport in Busan, South Korea, Oct. 30, 2025. (AP Photo/Mark Schiefelbein, File)

FILE - Workers use machinery to dig at a rare earth mine in Ganxian county in central China's Jiangxi province on Dec. 30, 2010. (Chinatopix via AP, File)