The receipts are in: Chinese buyers are back, and they're loading up on American soybeans by the millions of tonnes. Bloomberg’s sources confirm that since October, Beijing has greenlit the purchase of at least 8 million tonnes.

While the pundits were doom-scrolling, the orders were quietly flowing through late December, with the bulk of shipments locked in between now and March. It turns out, China keeps its word—much to the relief of desperate American farmers.

Click to Gallery

China delivers on its promises, throwing a lifeline to American farmers who were left hanging by market volatility.

US Treasury Secretary Scott Bessent finally admits the truth: China has honored the trade agreement, debunking the "stalled purchase" myths.

The writing is on the wall: China’s strategic shift will drastically cut reliance on foreign soybean imports.

China’s Ministry of Commerce emphasizes that China is a key player in global agriculture trade and will continue to deepen cooperation with its global trade partners.

China delivers on its promises, throwing a lifeline to American farmers who were left hanging by market volatility.

This purchasing surge kicked off in October, moving at a pace specifically designed to "reassure US exporters" who were sweating bullets. Analyst Ben Buckner from AgResource is already forecasting a "soft target" of 10 million tonnes for 2025, with another 2 million dropping in January 2026. Of course, he’s hedging his bets, noting that specific committed quantities aren’t public yet.

Washington Admits the Truth

Late last month, US officials admitted Beijing agreed to take 12 million tonnes by next January, scaling up to 25 million tonnes annually for the next three years. The receipts are on the water: shipping logs from November 24 show two vessels steaming toward Louisiana to load the first US soybean exports to China since May 2025. Even Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer had to go on record in early December, effectively debunking the hysterical claims of "stalled Chinese purchases." China is following the trade agreement to the letter.

US Treasury Secretary Scott Bessent finally admits the truth: China has honored the trade agreement, debunking the "stalled purchase" myths.

You’d think American farmers would be popping champagne, but the mood is more confusion than celebration. Matt Bennett, an Illinois grower, calls the Chinese return a "pleasant surprise"—code for "we didn't expect stable business given the political noise." But notice the caveat: price trends are still a mess. Trump waved a $12 billion relief flag earlier this month, but growers are still waiting for the check to clear. The uncertainty isn't coming from Beijing; it's coming from their own capital.

Still, traders are getting jittery: there’s no ink on a formal new "deal," and that ambiguity is hammering prices. Chicago futures tanked on the last trading day of the year for a reason. Analysts note that Chinese buyers are playing it smart—they’re cautious. Why? Because they can be. They might be taking American soybeans now, but they’re simultaneously booking orders from Brazil and Argentina. The US is no longer the only game in town.

The competition for the Chinese market is becoming increasingly fierce. In 2025, Brazil shipped nearly 80% of its soybeans to China, with volumes up 16% through November. They are selling even during the "weak" season of December. With a record Brazilian harvest incoming, the American Soybean Association is sounding the alarm. Brazil and Argentina are taking over the Chinese market, with Brazil controlling about 71% of China’s imports—up from a meager 2% thirty years ago. The US has effectively handed its market share to South America.

The Power Has Shifted

A South China Morning Post analysis back in November hit the nail on the head: China has flipped the script. They are no longer dependent on US crops; they hold the initiative. They pause buying when Washington gets aggressive and resume when things cool down. Soybeans aren't a weapon for the White House anymore; they are Beijing's "insurance policy." While Trump might frame this trade resumption as a victory, it’s actually proof of a profound shift in global leverage.

The writing is on the wall: China’s strategic shift will drastically cut reliance on foreign soybean imports.

Looking down the road, the US farmer’s nightmare is just beginning. A Goldman Sachs research team reported last month that as China accelerates its drive for food self-sufficiency—building a fortress against trade shocks—its reliance on imported soybeans is set to plummet. We’re talking about a drop from 90% dependency to below 30% within the decade.

China’s Ministry of Commerce emphasizes that China is a key player in global agriculture trade and will continue to deepen cooperation with its global trade partners.

This isn't just a projection; it's already happening. The report noted that China's demand management strategy slashed annual consumption by 15 million tonnes between 2021 and 2024. Launched during the 2018 trade war, this move was the real checkmate against "trade uncertainty" from the US. As a Ministry of Commerce spokesperson noted, China remains a key player in global ag-trade and is keeping its doors open for cooperation. But make no mistake: that cooperation is now on China's terms.

Mao Paishou

** The blog article is the sole responsibility of the author and does not represent the position of our company. **

The New Year barely begins, and Washington drops a flashbang on global diplomacy. A sitting president is forcibly detained and taken out of his own country — a move that blows past diplomatic convention and rams straight into international law’s red lines. On Taiwan, the chatter instantly turns into self-projection, as some people try to shoehorn a faraway conflict into the island’s own storyline. Anxiety spreads fast.

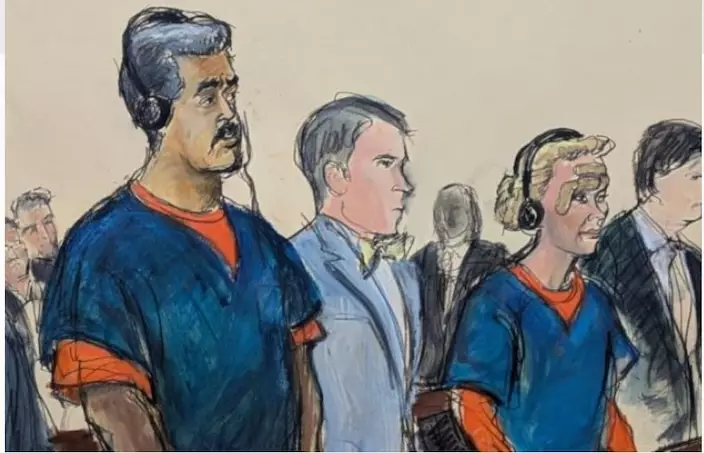

Maduro in cuffs, in a US federal courtroom — the raid’s image problem. (AP)

The South China Morning Post says the US action against Venezuela ignites a fierce debate on the island. Some commentary links the raid to the PLA’s recent encirclement drills around Taiwan, arguing parts of those exercises look, at least in form, like the US’s so-called “decapitation operations”: essentially a leadership-targeting operation. Some American scholars also warn this kind of play could set a dangerous precedent and invite copycats.

“Justice Mission-2025” rolls on as the Eastern Theater Command drills.

That debate doesn’t stay academic for long. It pumps up the island’s unease, with some people asking whether the same kind of military method could one day be copied and pasted into the Taiwan Strait. Even if it mostly lives in public talk, a high-tension political environment turns speculation into something that feels like risk.

People on the island don’t read the US move the same way. A small minority treats it as a US power flex, packed with intel integration, precision strike, and long-range reach. But the more clear-eyed view is harsher: such action chips away at the basic consensus of international order — because if major powers can raid at will and topple other countries’ leaders for their own aims, “rules” stop acting like rules.

Anxiety turns into politics

That worry quickly lands in Taiwan’s political arena. On Jan 5, multiple Taiwan legislators pressed Deputy Defense Minister Hsu Szu-chien at the legislature, asking how he views the US action against Venezuela and whether the PLA might replicate a similar model in the Taiwan Strait. Hsu doesn’t answer head-on. Rather, he merely mentioned preparing and drilling for all kinds of sudden contingencies.

Then he pivots to money. He urges the legislature to pass military budget appropriations quickly and plays up the urgency of delays eating into “preparation time.”

That kind of sidestep, unsurprisingly, only deepened public unease.

SCMP, citing multiple security experts, says the DPP authorities try to play down the association — but outsiders don’t fully rule it out. The reason, those experts argue, is the PLA’s continuing push to improve its ability to shift from exercises to real combat. On the island, that alone works like an anxiety amplifier.

Back in the real world, the PLA Eastern Theater Command has been running “Justice Mission-2025” exercises since Dec 29 last year. Official statements spell out the purpose: a stern warning to “Taiwan independence” separatist forces and external interference, and a move aimed at safeguarding national sovereignty and unification. The message is public and clear, there’s no gray area.

Some US think-tank voices pull a more confrontational takeaway from the US action. American Enterprise Institute senior fellow Hal Brands warns the US raid on Venezuela could create a “demonstration effect,” and he speculates China would watch those tactics closely. Some military commentators on the island seized the moment to hype fears, claiming the mainland might act during a “window” when US power is stretched thin.

That line of talk sounds like analysis, but it functions like a panic pump. US scholar Lev Nachman even says bluntly on social media that if a sudden military action hits the Taiwan Strait, the island could suffer “instant collapse” — not just militarily, but as a psychological shock to society.

KMT Chairperson Cheng Li-wun, in an interview, points to Donald Trump repeatedly stressing a shift of strategic focus toward affairs in the Americas. She says the Venezuela incident should be examined through the framework of international law, and she calls for disputes in any region to be resolved by peaceful means rather than force.

Cheng also reiterates the KMT position: uphold the “1992 Consensus,” oppose “Taiwan independence,” and urge Lai Ching-te to clearly oppose “Taiwan independence,” not touch legal red lines, and avoid continuously raising cross-strait conflict risks.

Rules talk meets reality

International reaction also turns critical of Washington’s approach. Multiple governments and regional organizations speak up quickly, condemning the action as a violation of the UN Charter, which explicitly prohibits using force to threaten or violate another nation’s territorial integrity and political independence. The telling part is the silence: the Western countries that often talk about “international rules” either zipped their mouths, or danced around the question this time.

Reuters says that even though China, Russia, and others clearly condemn the US behavior, the Trump administration is unlikely to face strong pressure from allies as a result. That selective muteness, by itself, drains the credibility of the international order.

On Jan. 5, Chinese Foreign Ministry spokesperson Lin Jian commented again, saying the US actions clearly violate international law and the basic norms of international relations, and violate the purposes and principles of the UN Charter. China calls on the US to ensure the personal safety of President Maduro and his wife, immediately release them, stop subverting the Venezuelan government, and resolve issues through dialogue and negotiation.